All eyes focusing on Fed

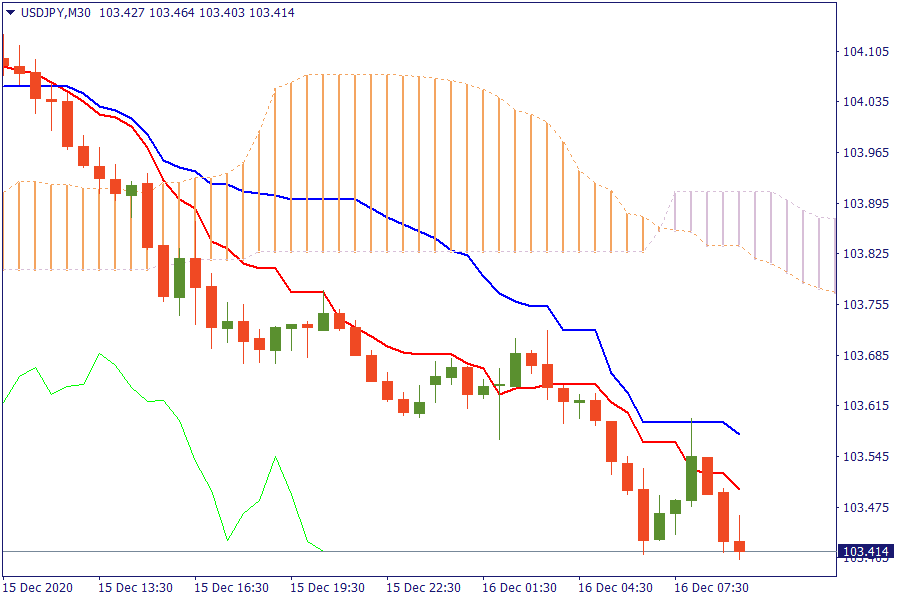

Ichimoku Kinko Hyo

USD/JPY: The pair is trading below the cloud. Further bearish pressure will lead the currency pair to retest the previous lows.

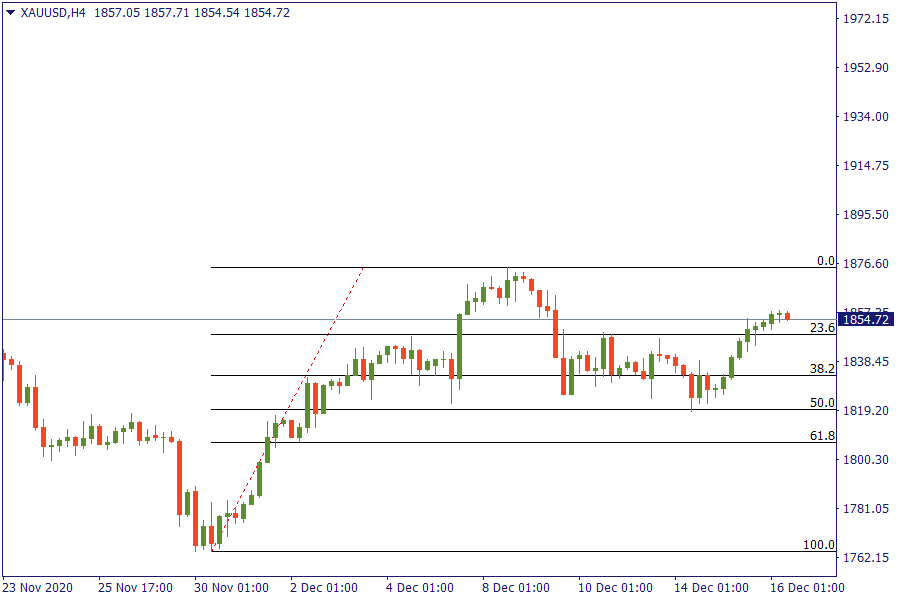

Fibonacci Levels

XAU/USD: Gold consolidates above the 23.6% retracement area the last day. Bullish trend gains momentum.

European Market View

Asian equity markets traded higher as the region received a tailwind from Wall Street where all major indices were lifted amid stimulus hopes. Looking ahead, highlights from macroeconomic calendar include UK and Canadian inflation, Eurozone, UK & US flash PMIs, US retail sales, DoEs, FOMC rate decision & press conference, ECB's de Guindos, Schnabel speeches. Optimism over a $1.4 trillion U.S. spending package increased after House of Representatives Speaker Nancy Pelosi invited other top congressional leaders to meet late on Tuesday to hammer out a deal to be enacted this week. Markets will now look to the U.S. Federal Reserve for new projections on whether the economy will suffer a double-dip recession or is on the cusp of a vaccine-inspired boom.

The central bank is to release a statement later in the day, with analysts expecting some guidance on when and how the Fed might change its bond purchases. Optimism for a trade deal on Brexit also boosted stocks, while contributing to a weaker dollar against the British pound and the euro.

EU Key Point

- Dollar holds a touch weaker to start the session

- China says that Australian government should take China's concerns seriously

- Gold set to launch higher on Fed's last meeting of the year