AUD/USD is driven by the news

The Australian dollar will be quite volatile in the upcoming sessions. The near-term pressure on the Australian currency is related to worse-than-expected retail sales and trade balance figures released in Australia on Thursday. Earlier this week, comments of country’s central bank, on the contrary, had pushed AUD/USD up from the 2019 lows. The RBA Governor Lowe will speak on Friday. In addition, volatility will come from the US side of things, as America will publish Nonfarm Payrolls (NFP). Finally, don’t forget the market’s changeable attitude towards the threat of coronavirus which is also driving the AUD.

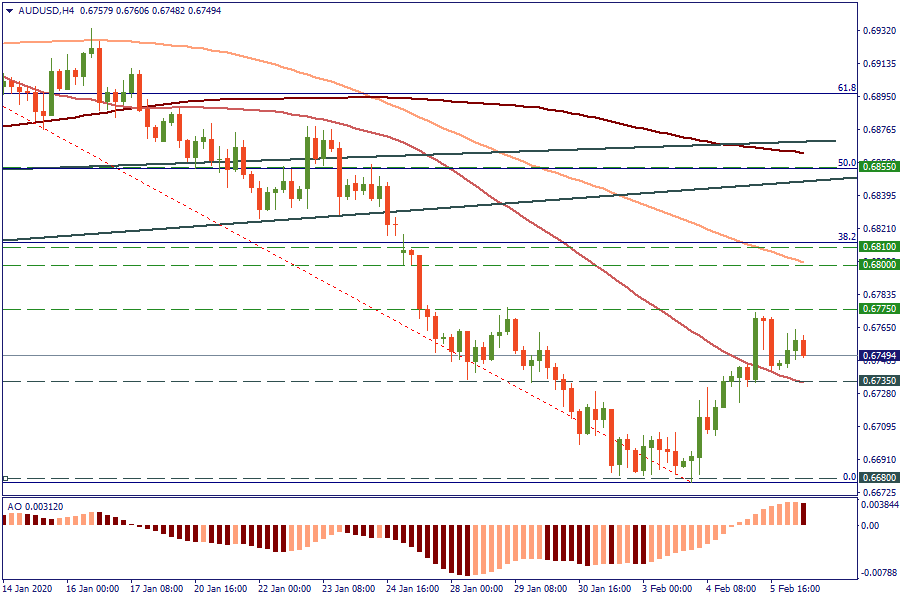

So far, AUD/USD met resistance around 0.6775. Still, as long as the pair is above the 50-period MA at 0.6735, it is safe from the decline to 0.6680 (previous minimums). On the upside, the next resistance is in the 0.6800/10 area ahead of 0.6850.

Trade ideas for AUD/USD

SELL 0.6730; TP 0.6690; SL 0.6745

BUY 0.6780; TP 0.6810; SL 0.6765