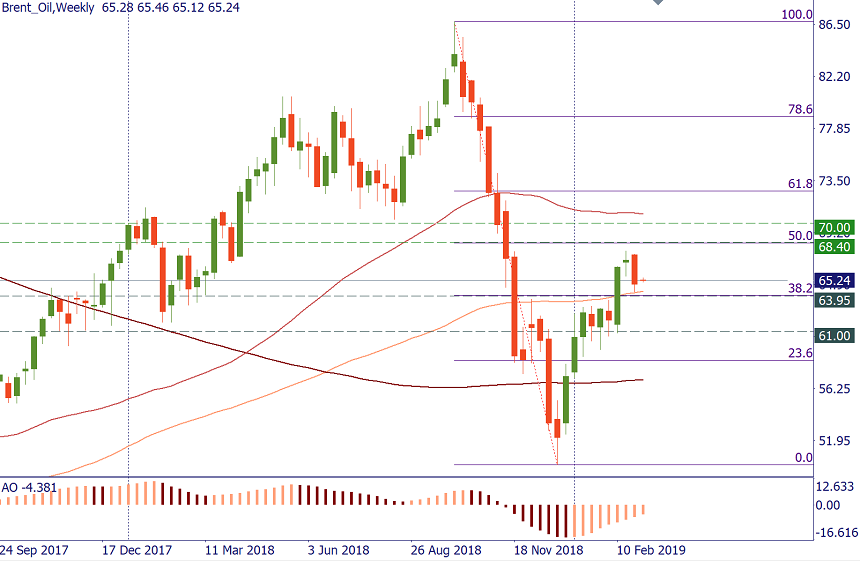

Brent oil: inverted H&S is still in place

It took Brent oil 3 months to form an inverted "Head and shoulders” pattern. The commodity broke above the neckline at 63.95 in the middle of February. Oil price then consolidated between 67.70 and the neckline.

The retracement to the neckline is quite natural for the inverted H&S. It may represent a chance for bulls to join the future rally at attractive levels. We can say that the prospect of upside is safe as long as Brent remains above 64.34 (100-week MA) and 63.95 (38.2% Fibo retracement of the September-December decline). If we look at the lower timeframes, support can actually be stretched to 63.30.

Given everything mentioned above, we can propose these ideas to swing traders:

BUY 64.50; TP 68.40; SL 63.20

SELL 62.90; TP 61.00; SL 63.50

Notice that if you want to trade Brent, choose BRN-19J or BRN-19K in your MetaTrader (File - CFD Futures).