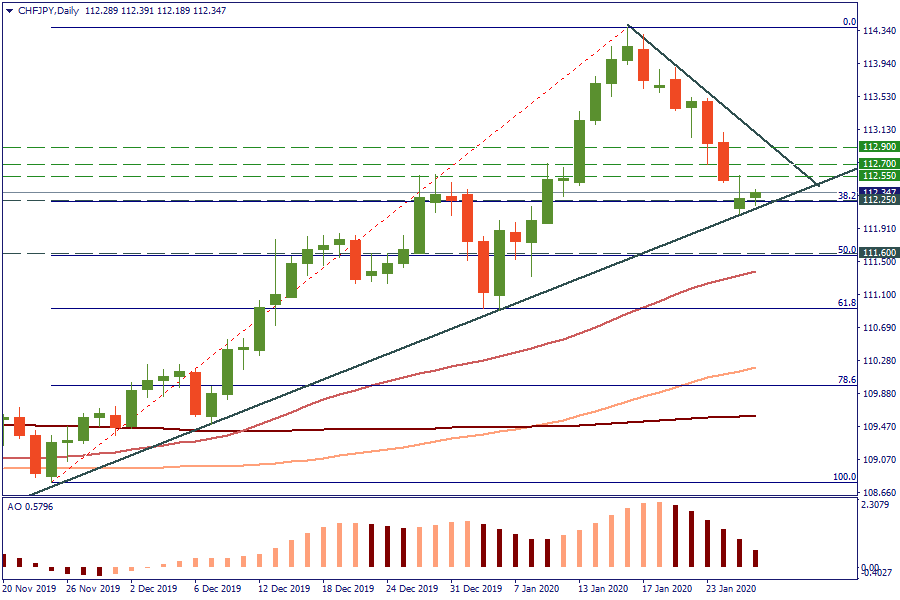

CHF/JPY tested support

CHF/JPY has been declining since the middle of January. It went down, as the yen was the number one safe haven after the outbreak of the coronavirus in China. The pair descended to the support line from November-December just above 112.00. In the short-term, we’ll likely see a pullback to the upside. An “inverted hammer” was formed on the D1 near the 31.8% Fibo retracement. Upside targets lie at 112.55 (Monday’s high), 112.70 (January 23 low) and 112.90 (100-period MA, short-term resistance line).

At the same time, the fundamental and bigger technical factors (weekly “inside bar” and the exchange rate going far away from the MAs) allow expecting that the recovery will be temporary and attract new sellers. The decline below 112.08 (the recent low) should also trigger selling.

Trade ideas

SELL 112.70; TP 112.25; SL 112.95

SELL 112.05; TP 111.60; SL 112.25