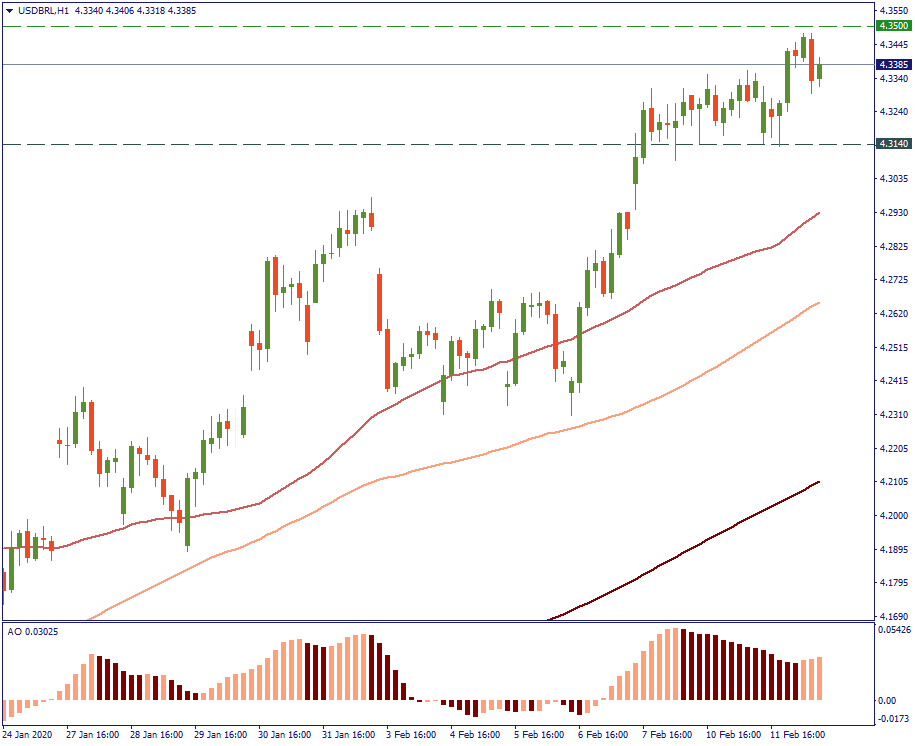

USD/BRL: higher and higher

Currency pair of the day: USD/BRL

Performance in 2020: +7.6%

Day range: 4.2986-4.3400

52-week range: 3.6922-4.3400

Technical levels

Resistance 4.3500

Support 4.3140

Brazil: what’s happening?

Internally

On February 5, the Central Bank of Brazil cut the interest rate to an all-time low of 4.25. In the short-term, that pushes the USD (even more) up against the BRL. In the long-term, that indicates economic weakness which the Brazilian central bank is trying to resolve through this monetary stimulus. Fundamentally, the domestic weakness will also eventually depreciate the national currency.

Externally

China takes 22% of Brazilian exports. Due to the Coronavirus, obviously, there will be shortages/lags in Chinese consumption, which in turn will lead to shortages in Brazilian sales. Currency investors know that and try to price-in the future drop accordingly. Hence, this also depreciates the BRL against the USD.

No surprise, the USD/BRL keeps rising. And so far, there is little reason to expect a different move in the nearest future – at least, until the negative effect of the Coronavirus exhausts itself. And that’s not going to happen until April, as per the most recent announcements. Trade accordingly.