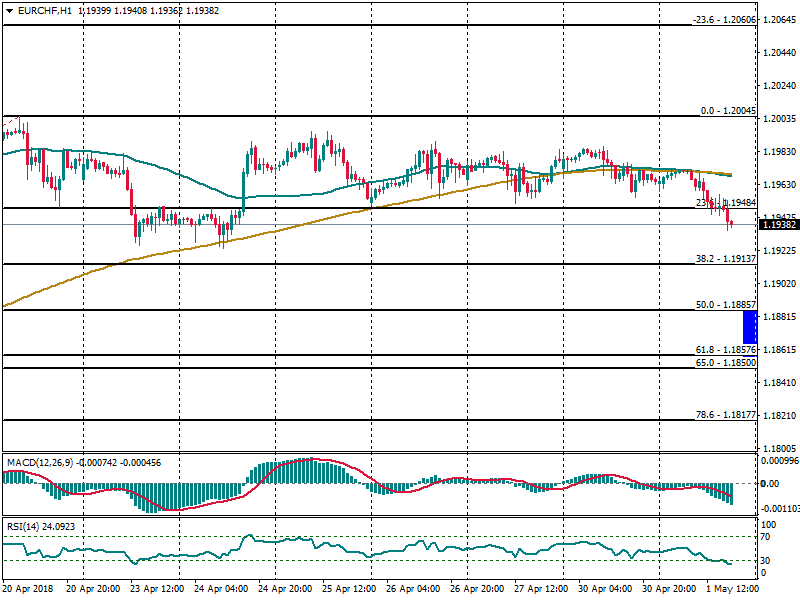

EUR/CHF on its way to extend the corrective move

The pair is looking to make a lower extension below the 200 SMA at H1 chart and now it’s challenging the lows from April 25th. If such levels give up in favor of the bears, the pressure on the pair would help to make a testing of the Fibonacci zone of 50% at 1.1885, where bulls could gather momentum. The overall target remains in place at 1.2060, where is located the Fibonacci level of -23.6%. However, we cannot discard a fall to test the 1.1850 area.

RSI indicator remains in the oversold territory, calling for a rebound in coming hours.