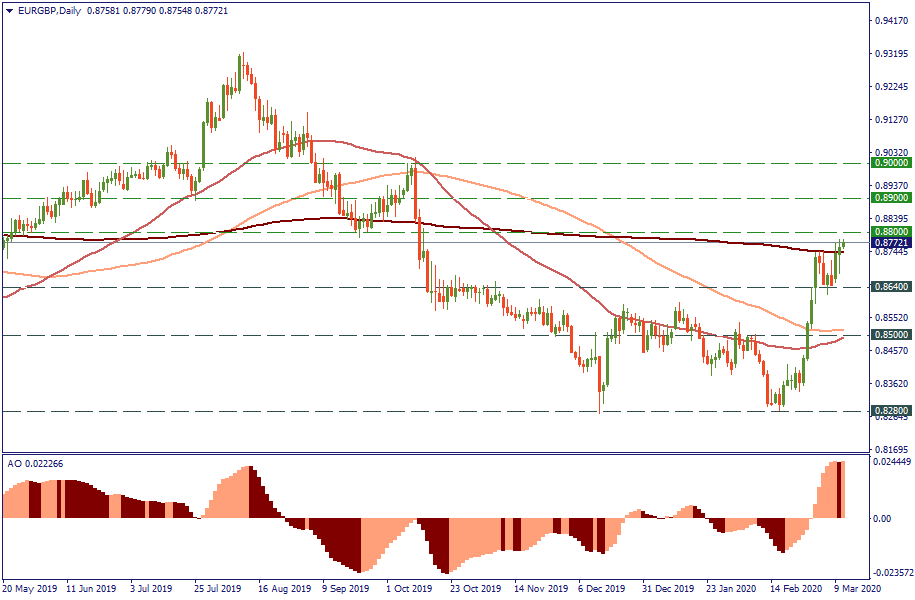

EUR/GBP: testing the 200-MA

Key indicators

Performance in 2020: +3.8%

Last day range: 0.8752 – 0.8780

52-week range: 0.8280 – 0.9326

Observing the limits

While the UK’s response to virus with precautionary measures has been minimal so far, the British businesses do suffer from the coronavirus global consequences. And although Europe faces more significant economic damage altogether, its currency doesn’t seem to lose the battle against the British pound this time. In the middle of February, EUR/GBP came to observe the strategic 2-year low of 0.8280 but chose not to cross it. Since then, it has been rising and currently trades at 0.8775. That’s where it tests the 200-day Moving Average, being above it for the third day in a row. The Awesome Oscillator hints that a correction downwards is possible before the next move upwards. In the latter, psychological resistance levels at 0.8800, 0.8900 and 0.9000 may be the possible targets in the mid-term.

Technical levels

Resistance 0.8800

Support 0.8640