EUR/JPY is preparing to move

Trade idea

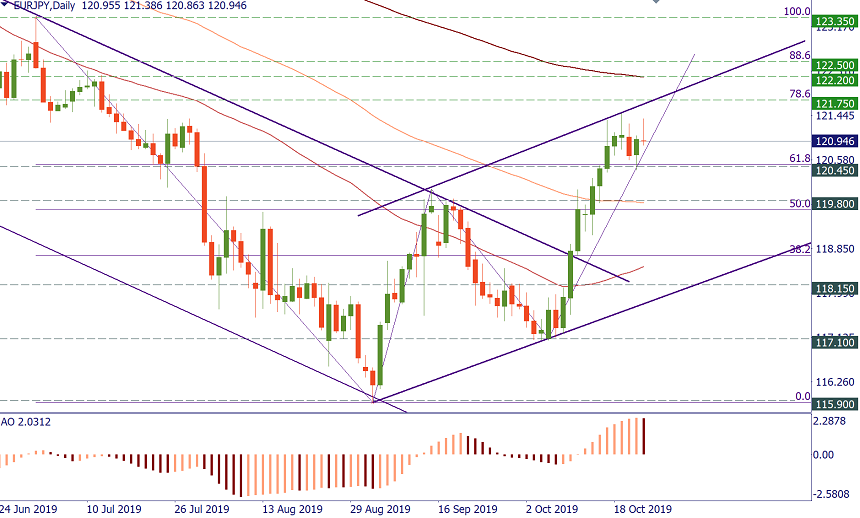

SELL 120.30; TP 119.80; SL 120.50

BUY 121.85; TP 122.20; SL 121.70

EUR/JPY has been moving up since the start of September. At the beginning of October, it formed a higher low. The pair is currently consolidating between 61.8% Fibo of the July-September decline at 120.45 and the 78.6% Fibo level at 121.75. All in all, EUR/JPY is at the upper edge of its channel. It looks like there’s a need for correction to the downside. The decline below 120.40 will open the way down to the support at 119.80 (100-day MA).

On the upside, the next obstacle above 121.75 is at 122.20 (200-day MA). So far, the price action in line with the bearish harmonic “Bat” pattern: that means that the pair may get to test levels around 122.20/50, but then turn lower. As a result, it may be possible to pursue higher levels on positive news from the euro area, though one will have to be careful with that.