EUR/NZD: where to sell?

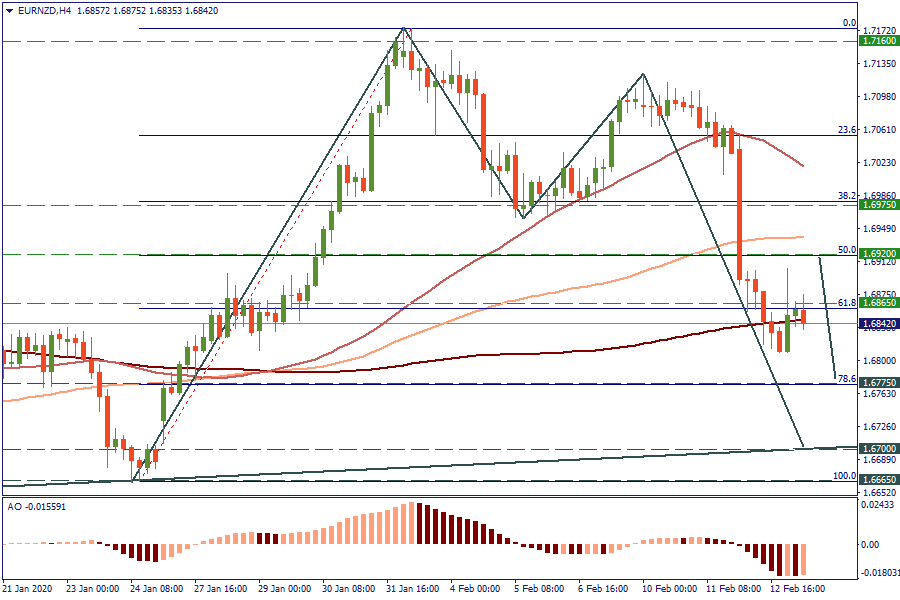

EUR/NZD formed a “hanging man” pattern on the W1 and went down to trade below the 100- and 50-week MAs. The decline of the pair was caused by the weakness of the EUR because of the euro area’s low economic figures and the strength of the NZD after the policy meeting of the Reserve Bank of New Zealand. Technically the pair has potential to slide lower in line with the harmonic pattern.

On the H4, EUR/NZD formed an “Inside bar”. If the current candlestick at this timeframe closes below 1.6835, the pair will likely fall to 1.6775 (78.6% Fibonacci of the January-February advance). A break below the latter will open the way down to 1.6665 (January lows).

The near-term outlook will remain bearish as long as the pair remains below 1.6920 (50% Fibo).

Trade ideas for EUR/NZD

SELL 1.6770; TP 1.6700; SL 1.6790

SELL 1.6920; TP 1.6945; SL 1.6775