EUR/USD eyes 50-day SMA after Monday's surge

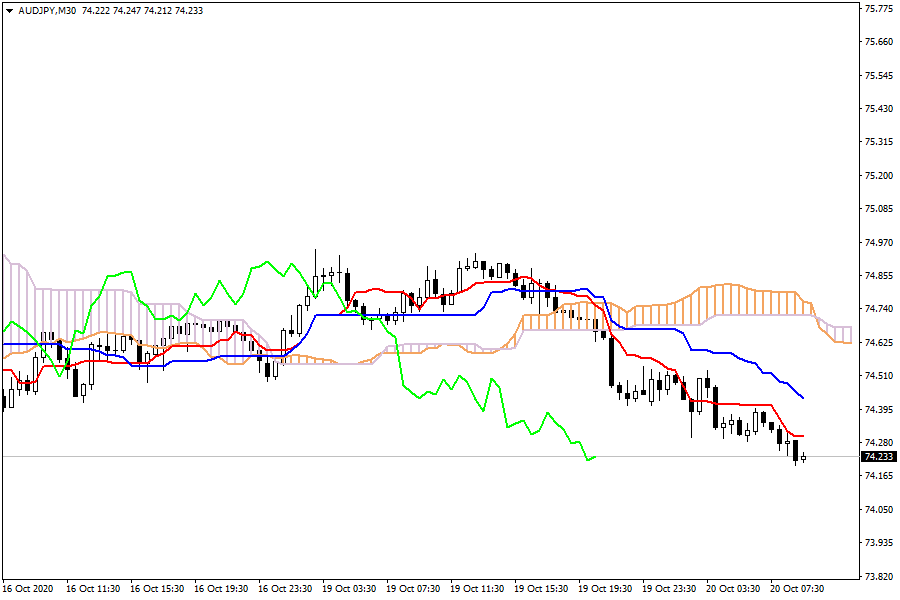

Ichimoku Kinko Hyo

AUD/JPY: The pair is trading in a bearish sentiment below the cloud. The currency pair has just surpassed the Kijun-sen and the Tenkan-sen, confirming a bearish momentum.

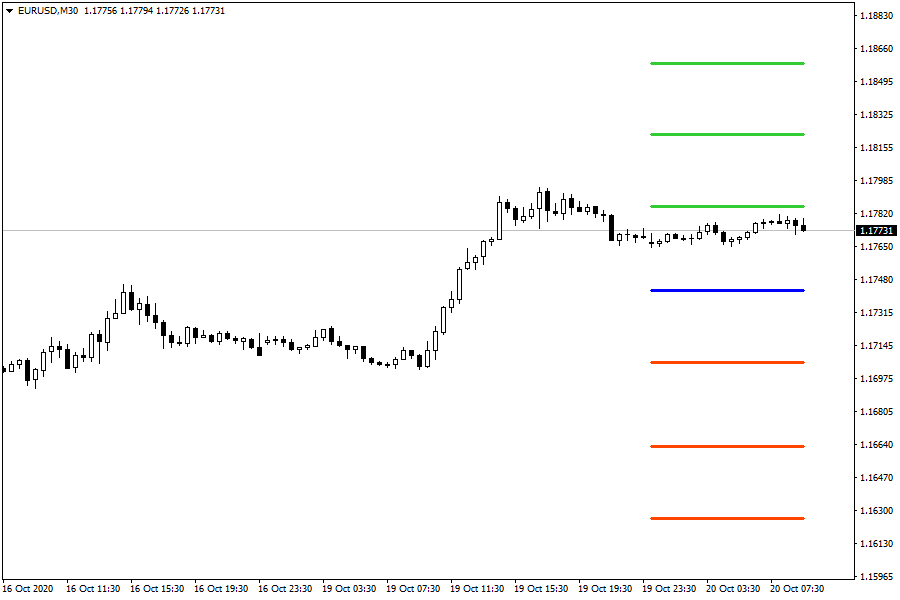

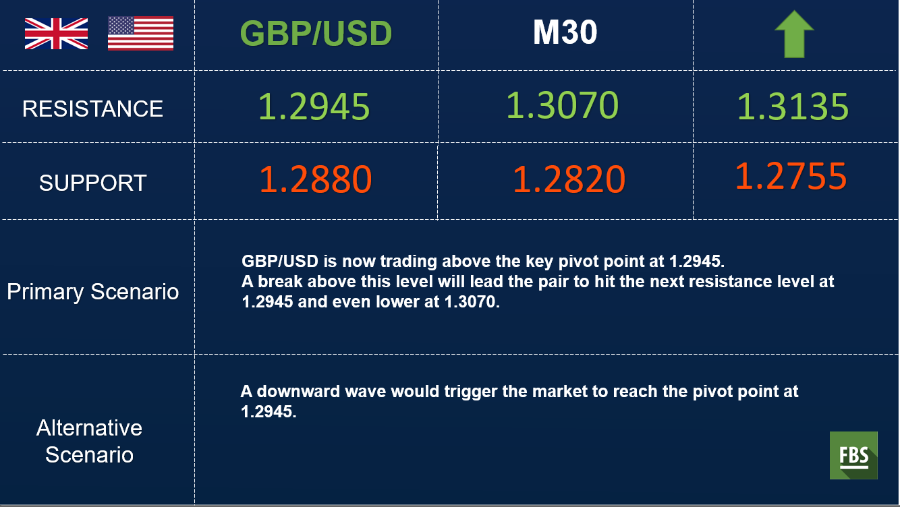

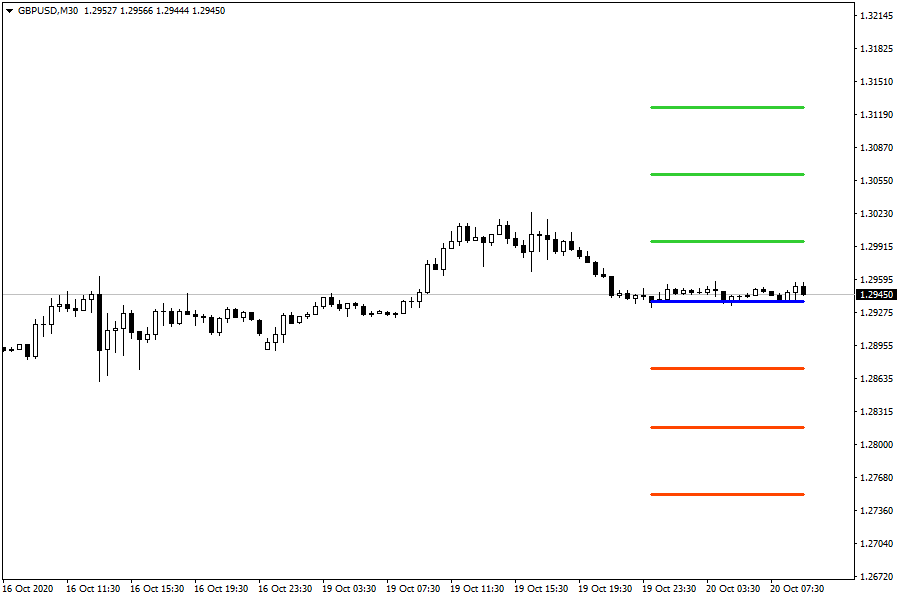

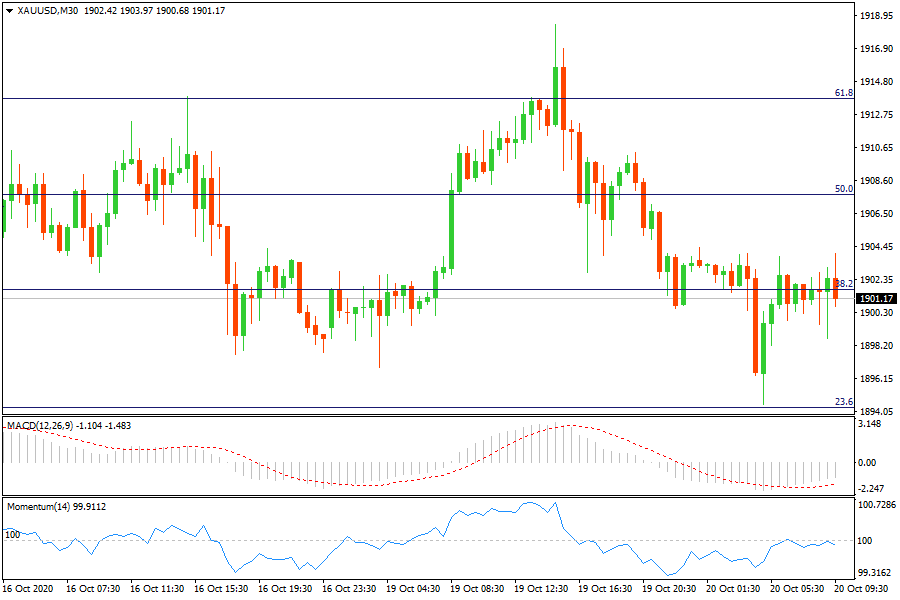

Fibonacci Levels

XAU/USD: Gold consolidates at 38.2% retracement area. The upcoming stimulus should help gold to move higher.

EU Market View

European stock markets are seen opening a little lower Tuesday, weighed by weakness on Wall Street as time begins to run out on a new U.S. stimulus package while European governments continue to tighten public health measures to stop the spread of Covid-19. Nancy Pelosi said a stimulus package must be agreed in the next 48 hours if it is to pass before the election, as the Democratic speaker of the House of Representatives turned up the heat on senior Republicans over coronavirus aid. Ms Pelosi will meet Steven Mnuchin, the Treasury secretary, on Monday as the two look to thrash out differences over proposed relief measures which could amount to about $2tn.

Looking ahead, highlights from the macroeconomic calendar include US Building Permits/Housing Starts, Fed’s Williams, Quarles and Evans and supply from Germany. Earnings include UBS, Bellway, Phillip Morris, P&G, Lockheed Martin, Netflix.

EU Key Point

- Germany September PPI comes at +0.4% vs -0.1% m/m than expected

- Germany reports 6,868 new daily coronavirus cases in latest update today