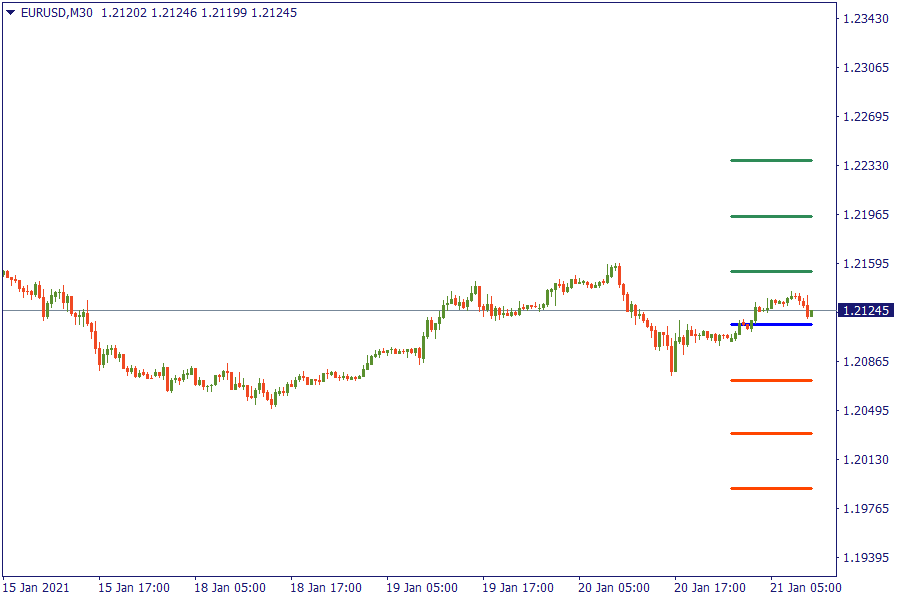

EUR/USD: will the ECB send it lower?

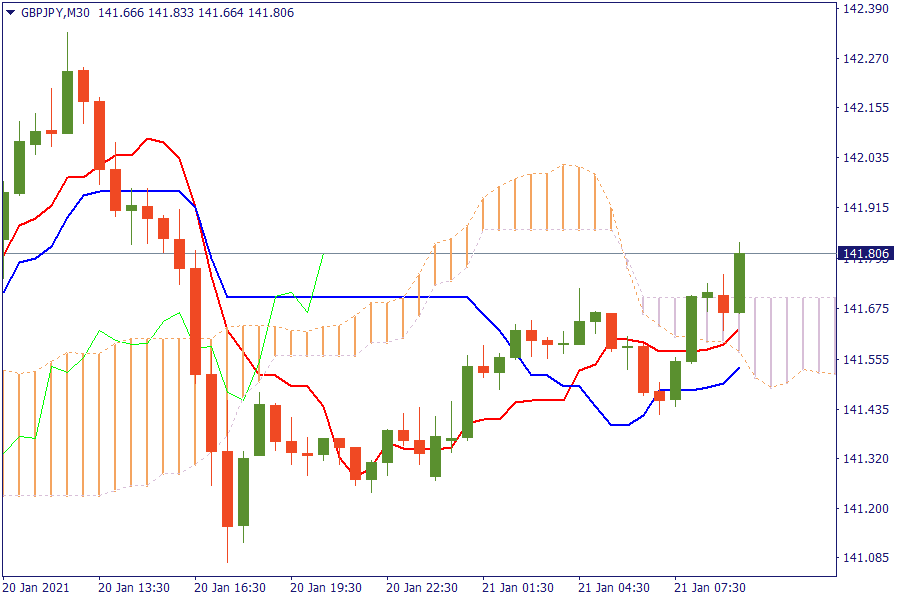

Ichimoku Kinko Hyo

GBP/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

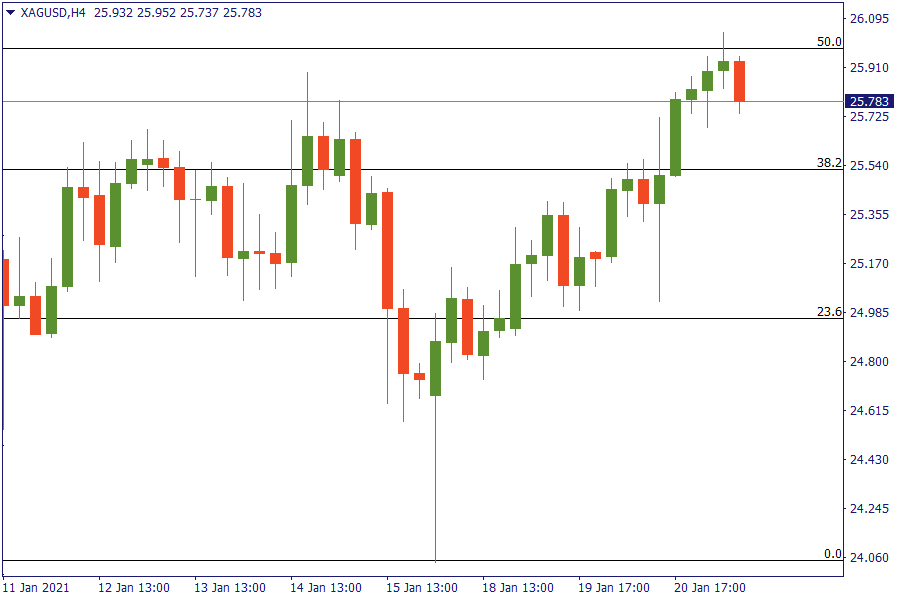

Fibonacci Levels

XAG/USD: Silver bulls return and send price below the critical level of 50% retracement.

EU Market View

Asia-Pac bourses took impetus from the gains on Wall Street where stocks rallied to all-time highs and the Nasdaq outperformed. US Republican Senator Romney said he is not looking for new stimulus in the immediate future. Joe Biden was sworn in as president of the United States on Wednesday, offering a message of unity and restoration to a deeply divided country reeling from a battered economy. "We must end this uncivil war that pits red against blue, rural versus urban, conservative versus liberal. We can do this - if we open our souls instead of hardening our hearts."

Today the ECB’s Governing Council, led by President Christine Lagarde, will now likely pause for the foreseeable future and use this week’s meeting to steer markets in a new direction, as well as discussing the strength of the euro.

Looking ahead, highlights from macroeconomic calendar include, ECB rate decisions & ECB press conference, US weekly jobs, EZ consumer confidence.

EU Key Point

- BOJ's Kuroda supports that it is too early to consider exit from powerful monetary stimulus.

- US coronavirus deaths rise by 4332 on Wednesday.

- German reports 20,398 new coronavirus cases.

- USD moves lower and is the weakest of the major currencies in early trading today.