Gold’s rally may be limited

XAU/USD is edging higher, but may meet soon the strong resistance. What is the forecast?

Fundamentals

House Speaker Nancy Pelosi set a 48-hour deadline to reach a deal over fiscal stimulus ahead of the US election. This announcement has improved the market sentiment and weighed on the US dollar, allowing gold to rally further.

Moreover, the earnings season is underway. Even though companies faced many difficulties amid the coronavirus restrictions, they have managed to beat market expectations. As you know, when earnings are better than the forecasts, stocks move up. These days, gold tends to rise in combination with stocks as investors want to hedge their risky investments.

Elsewhere, the uncertainty over Brexit and the US election process are among factors, which may underpin the yellow metal.

Technical tips

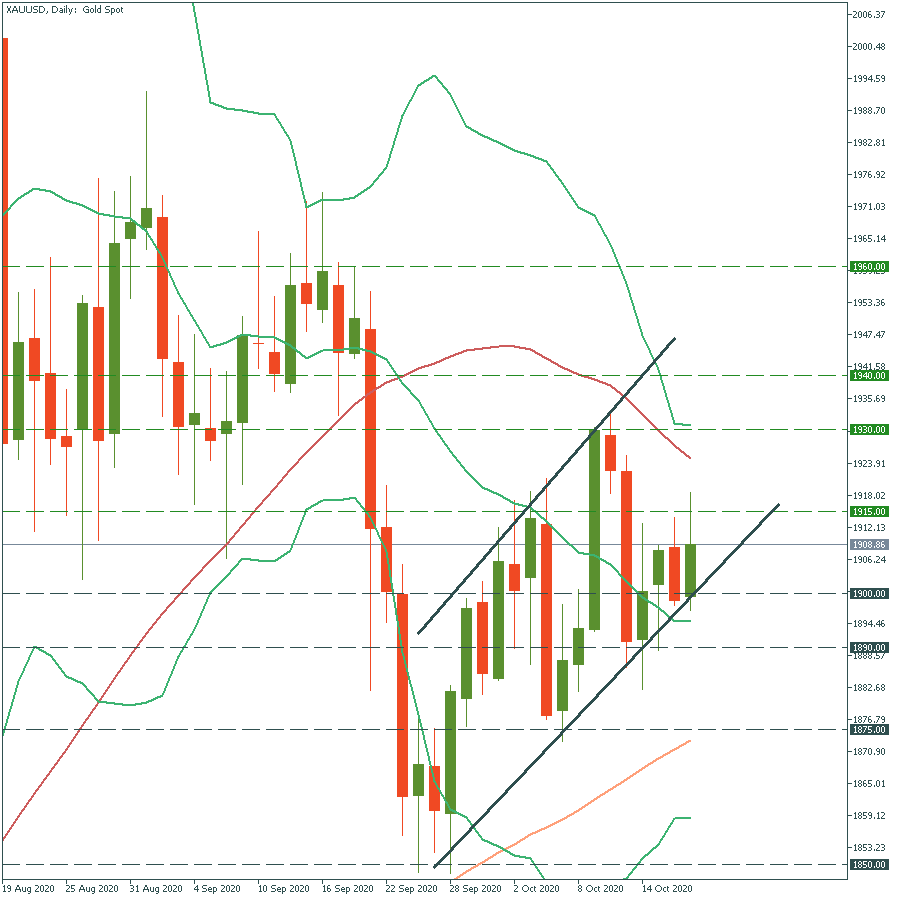

Gold is trading in an ascending channel near its lower trend line. That means it should continue its zig-zag movement and rise further. If it jumps above the high of October 5 at $1 915, the way to the next resistance of $1 930 will be open, but be cautious as there are 50-day moving average and the upper line of Bollinger Bands at this level, which gold is unlikely to break. Support levels are $1 900 and $1 890.