JPY: Forex reconquest - take two

Key indicators

Last day range: 107.36 – 108.37

52-week range: 104.43 – 112.40

What’s happening?

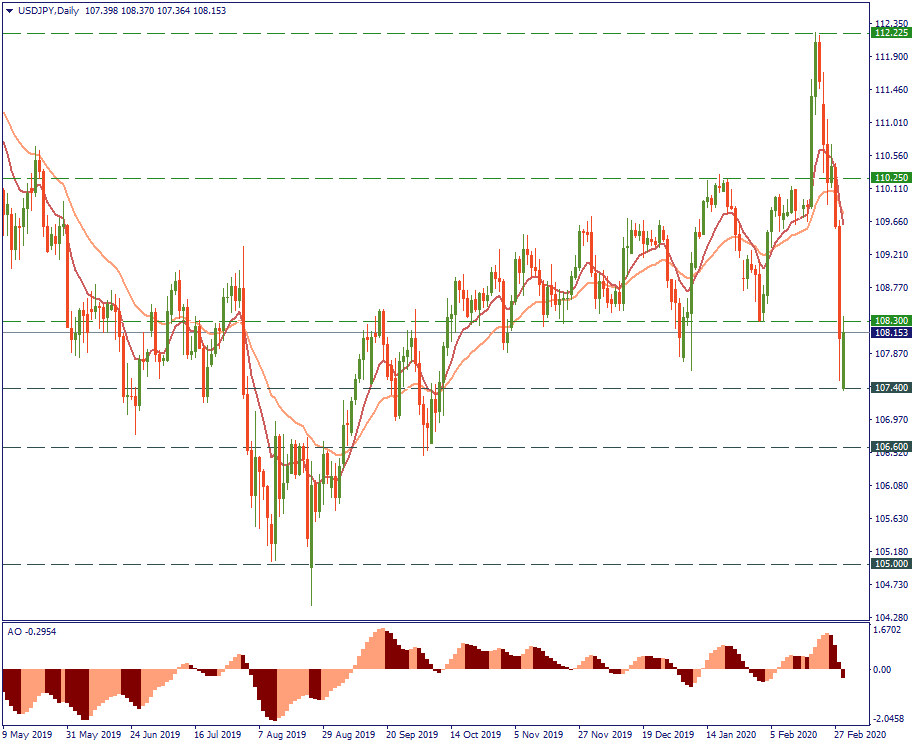

We have spoken about the JPY’s return already, and now we need to speak of it again. Why? Look at the chart.

There is hardly any other currency on the Forex market against which the USD lost so much value in the last weeks. The US Dollar was at 112.22 on February 20-21, and just touched 107.40 recently – that’s an almost 5% loss in just two weeks. By the way, current disposition may be a good chance to apply the 30-pips-a-day trading strategy, even though it normally is used on shorter timeframes - now may be a good moment to act on it. But let’s put things into the context and have a mid-term perspective.

Mid-term

On the daily chart below, the recent drop takes the currency pair to challenge the November-2019 lows next. The closest one lies at 106.60 and seems not that far away, especially in the current circumstances. If things go really bad for the USD, the August-2019 low of 105.00 will be waiting down there. Nothing the Fed’s readiness to react to the virus consequences by reducing the interest rate on March 18, keep your hand on the pulse and watch the dynamic: if there is no change in the global economic rhetoric, the pressure will keep dragging the USD down in the mid-term, and JPY will be its best counterpart to indicate where the market goes.

Technical levels

Support 107.40

Resistance 108.30