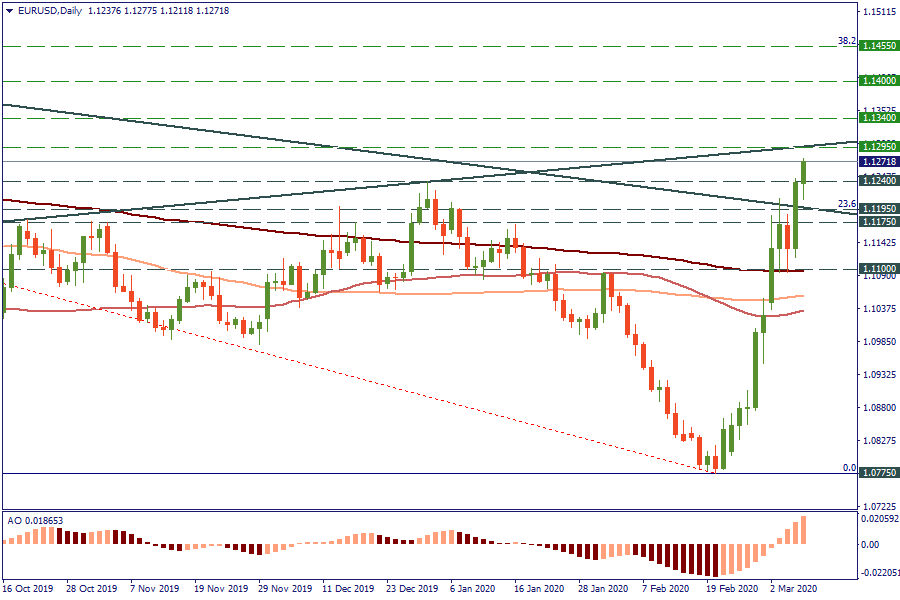

Key levels for EUR/USD ahead of NFP

EUR/USD has reached December high at 1.1240 and is actively testing levels above it. The picture at the chart changes very fast. Traders don’t really like the USD at the moment, so the pair will easily get to 1.1295 (the line connecting October and December highs). There it will likely meet some resistance ahead of the release of the Nonfarm Payrolls (NFP) in the United States.

If the US publishes weaker data, the advance above 1.1295 will bring the pair to 1.1340. The next resistance will be at 1.1400. Given the bearish divergence on the H4, you may look for reversal patterns around 1.1290 targeting a return down to 1.1240 and 1.1200 – this will be an option if NFP exceeds expectations. Selling the euro will also be an idea if EUR/USD slides below 1.1175. The target in this case will be at 1.1100.

Trade ideas for EUR/USD

BUY 1.1305; TP 1.1340; SL 1.1290

SELL 1.1170; TP 1.1100; SL 1.1190