Massive Cryptocurrency Technical Outlook

The time for cryptocurrency has come! Bitcoin is once again looking interesting enough to analyze it. But digital gold is not the only one to watch after. In this article, we would like to give you some interesting crypto ideas for mid-term trades.

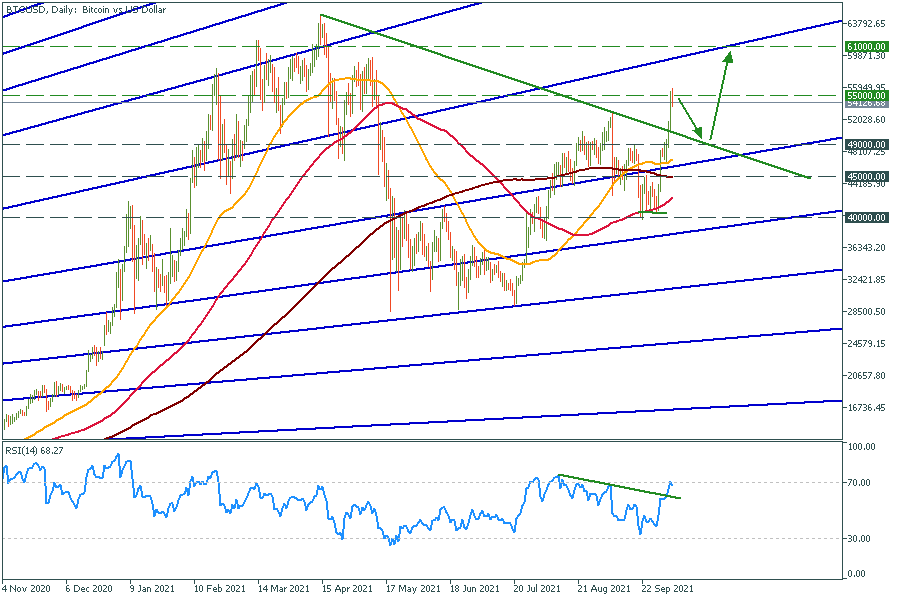

Bitcoin

That’s right, Bitcoin's weird moves are over! The price skyrocketed through the main resistance line, and we have gained enough momentum to continue the uptrend. The resistance at the RSI has been cleared as well. Now we expect the price to retest $49 000 and to soar higher. In the long-term, we believe the main crypto will renew its all-time highs.

BTC/USD daily chart

Resistance: 55 000; 61 000; 65 000

Support: 49 000; 45 000; 40 000

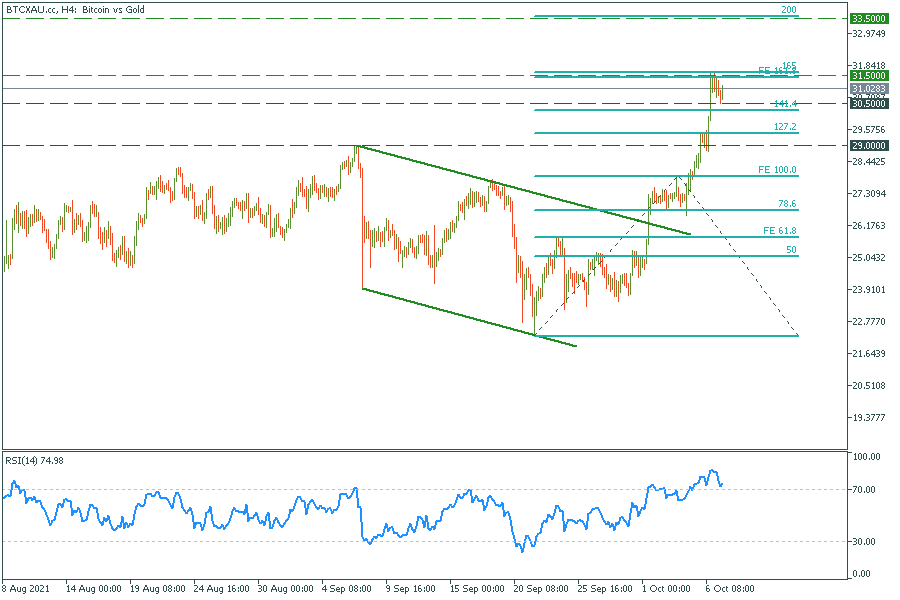

Bitcoin to gold chart is also interesting. Due to the inverse correlation of gold and USD, you may consider buying BTC/XAU pair when the dollar is especially strong.

BTC/USD H4 chart

Resistance: 31.5; 33.5

Support: 30.5; 29.0

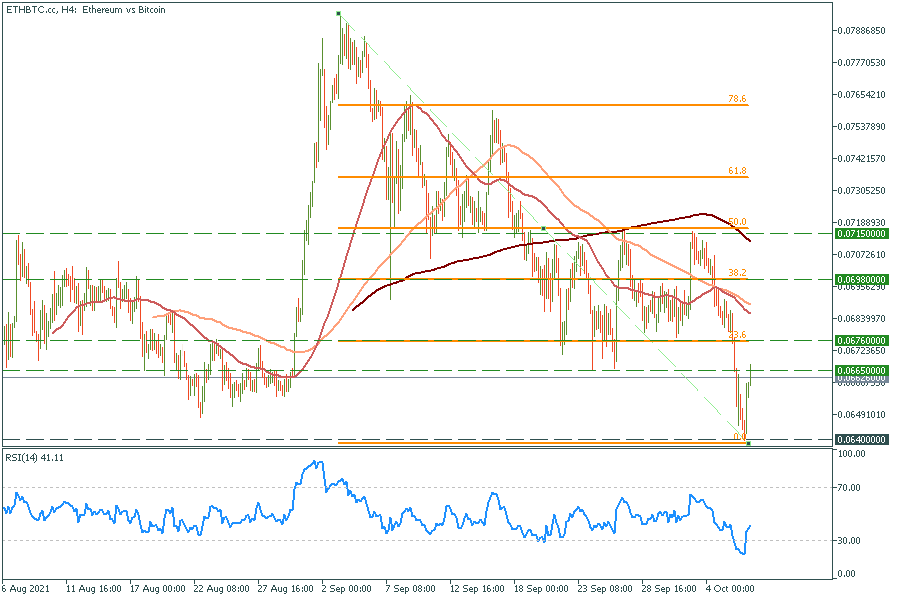

Ethereum

After bitcoin finishes its strong uptrend movement and gives the market some rest, the Bitcoin domination will surely fall, like it does every time. This event is called “altseason” because other cryptocurrencies start to grow apart from BTC. This is a perfect opportunity to invest in other fundamentally strong projects. Ethereum is one of them.

ETH/BTC H4 chart

Resistance: 0.0665; 0.0676; 0.0698; 0.0715

Support: 0.0640

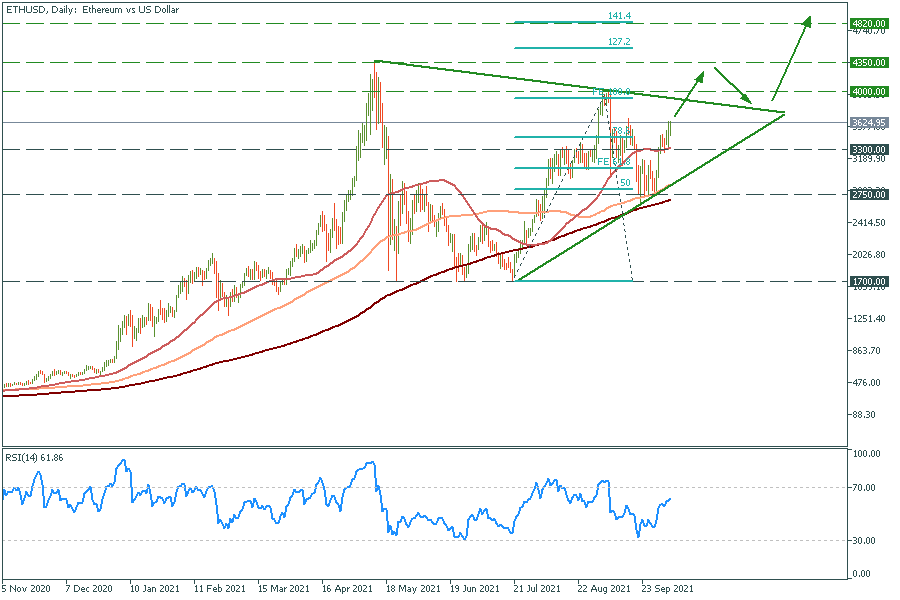

But if you are more into classic cryptocurrency trading (against the greenback), then ETH is still a thing for you to notice. Ethereum has formed a symmetrical triangle, and after some consolidation we expect it to soar. Mid-term targets are $5200 and $7400.

ETH/USD daily chart

Resistance: 4000; 4350; 4820; 5200

Support: 3300; 2750; 1700

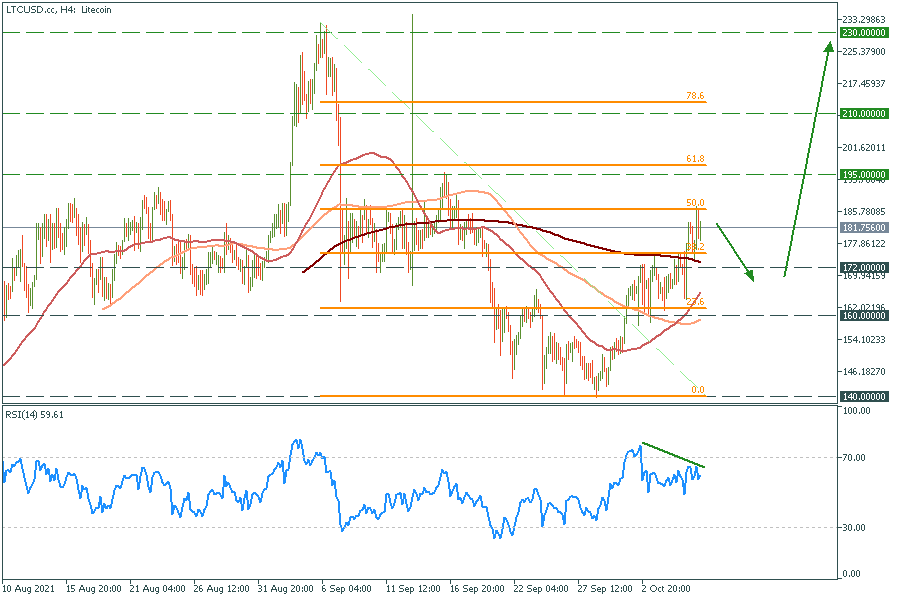

Litecoin

LTC has a divergence on the RSI, so while Bitcoin is making its moves, this coin may correct a little bit. Litecoin gets more and more use cases (it has started with PayPal, which accepted LTC as a payment method). In the short term $230 and $360 are the main targets.

LTC/USD H4 chart

Resistance: 195; 210; 230

Support: 172; 160; 140