MXN, RUB, TRY: uncharted potential

Intro

Currencies of developing countries such as the RUB, TRY, and MXN are by definition unstable. That’s why they fluctuate more than main ones, offering wider profit opportunities. At the same time, they are normally weaker than the USD. In the long run, therefore, you are likely to see USD/RUB, USD/TRY, and USD/MXN mostly rising. Hence, with exotic currencies, you have an almost guaranteed and predictable long-term trend coupled with wider profit opportunities – what can be more interesting for a trader?

USD/RUB

Few other currency pairs offer a richer environment for technical analysis than USD/RUB. The multitude of highs and lows far away from each other gives a lot of space to apply indicators and identify trends. In the long-term, the USD is winning over RUB but fierce battles make it shift from 50 to 80 and back over years. In the mid-term, further downside is imminent as the USD is still retracting from the shocking strike made at the RUB in March. Until the bottom of this uptrend is touched, any short-term upside as suggested by bullish divergence will likely disappear in a larger bearish move.

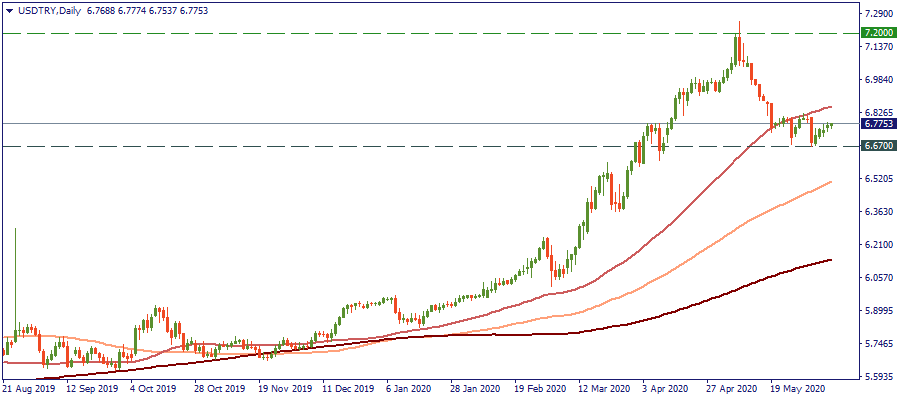

USD/TRY

It’s not the first time USD/TRY dives below the 50-MA to get back rising, and it’s not going to be the last. The Turkish financial authorities are trying what is in their hands to stabilize the Lira and bolster the economy - hence the current consolidation above the support of 6.67. That will not change the fundamental layout, though, so USD/TRY will eventually get back upwards. What can be more attractive than convenient regular downward corrections in a stable guaranteed large uptrend?

USD/MXN

Moves this big normally don’t happen with developed currencies – and that’s not only due to the virus. In one month, USD/MXN went from 18.50 to 25.35 making a 27% rise. Currently, it’s in a mid-term retrace testing the support of 100-MA at 21.50. We are likely to see it further below at 50-MA but the fundamental layout doesn’t change the weakness of the Peso. Although with battles, it will give way to the USD as the Mexican economy cannot compete with its northern neighbor.

Conclusion

Exotic currency pairs are as unknown as more attractive to trade. They offer more room for technical analysis and are more predictable fundamentally. In other words, clear trends, lots of moves, wider profit opportunities – that’s what you have with exotics.