New Beginning for the Canadian Dollar

Recently, the Bank of Canada hiked the interest rates by 50 basis points. It is now 1.5%, and it’s only the beginning. The policy rate may directly go to the top, or even above, what the Bank of Canada considers its “neutral range,” estimated at 2-3%. These measures can push the CAD higher against other currencies.

Moreover, Canada’s economy recorded a surge in trade with the rest of the world in March, as rising prices for commodities coupled with strong domestic demand and a smoother global supply chain drove imports and exports.

Imports jumped 7.7 per cent in March to $61.1 billion (US$47.7 billion), while exports were up 6.3 per cent to $63.6 billion, Statistics Canada reported on Wednesday. The nation’s surplus narrowed to $2.5 billion, from a revised $3.1 billion in February.

Technical analysis

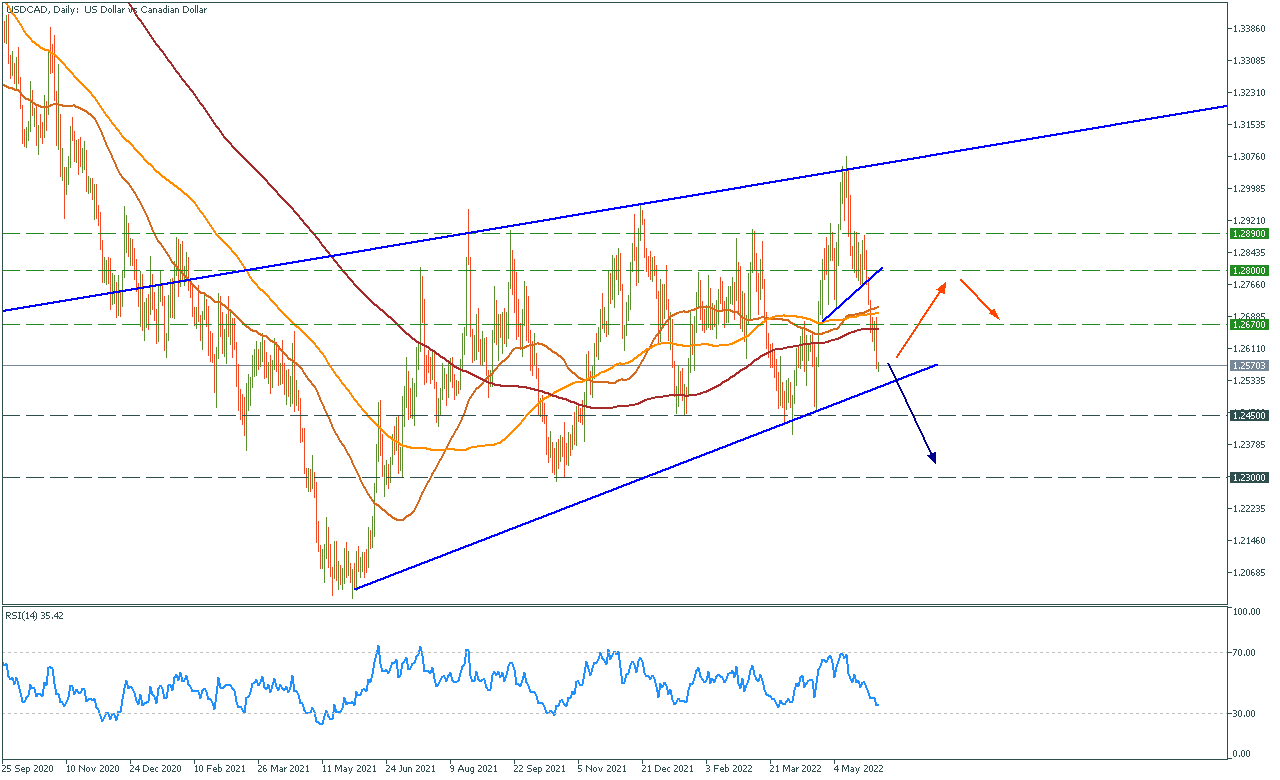

We’ll take a look at two pairs. First is USDCAD. The pair is near the support trendline, which prevents the USD from falling for more than a year. We can expect another touch of the line, but the breakout is not a must-have right now. The bounce from the trendline will probably result in the consolidation for another month or two. If the price breaks through the support, the downtrend for the USD will continue.

USDCAD daily chart

Resistance: 1.2370, 1.2800, 1.2890

Support: 1.2450, 1.2300

Another chart worth looking at is CADJPY. We can clearly see a fractal that happened in 2012; the movement seems similar, and we can expect the pair to move higher. CADJPY may reach 106.50 before the end of the uptrend. That aligns with our prospects for the Canadian dollar.

CADJPY Weekly chart

Resistance: 101.20, 104.00, 106.50

Support: 97.80, 93.20, 91.50

If you want to trade currencies with FBS, follow these simple steps:

- First of all, be sure you’ve downloaded the FBS Trader app or Metatrader 5.

- Open an account in FBS Trader or the MT5 account in your personal area.

- Start trading!