Oil is looking for a base

Trade ideas

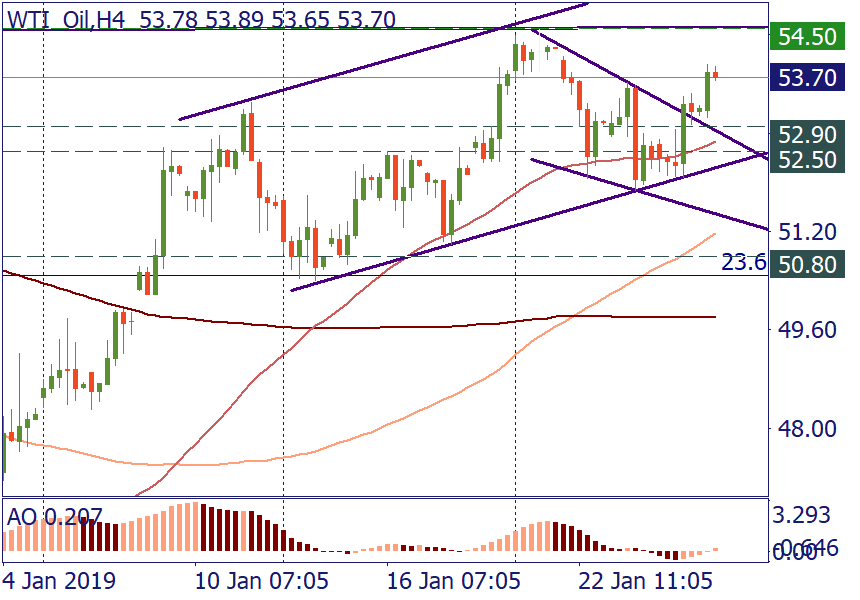

BUY 55.70; TP 58.00; SL 54.50

BUY 52.90; TP 54.50; SL 52.50

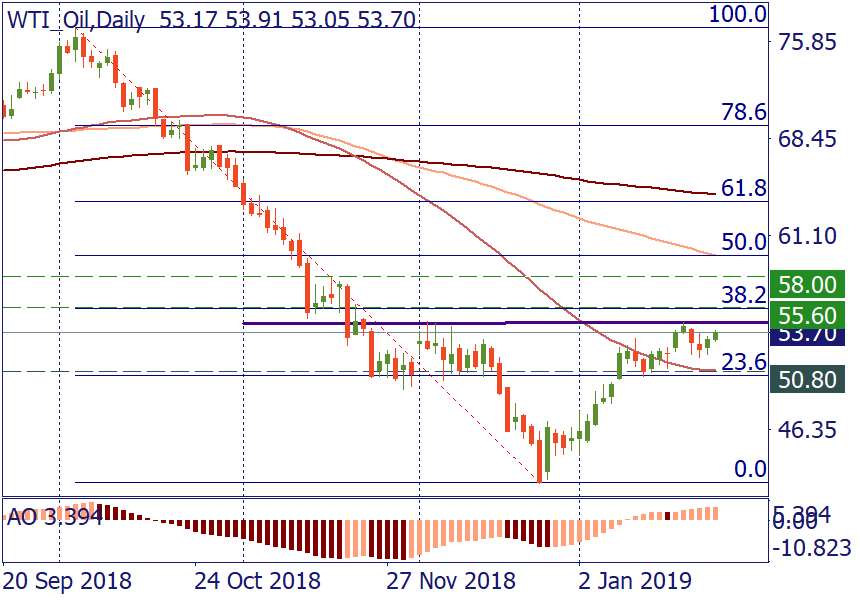

Let’s analyze oil. Since the end of December, the price of WTI has substantially recovered. It managed to rise above 50-day MA at 50.80. The price action resembles an inverted ‘Head and shoulders’. However, the pattern will be confirmed only above 55.60 (38.2% Fibo of the October-December decline). The targets will be at 58.00 (100-week MA) and 59.55 (50% Fibo). We’ll keep an eye on the chart to see if such a recovery actually takes place.

In the near term, there’s a positive position of MAs on H4. A return to the 53.00 area will likely attract new demand and let the price recover to 54.50.

The downside scenario will become possible if the price slides below 52.00. In this case, it will test support at 50.80.

Notice that if you want to trade WTI, choose WTI-19H, WTI-19J or WTI-19K in your MetaTrader (File - CFD Futures).