Risk-on mood gains momentum before NFP

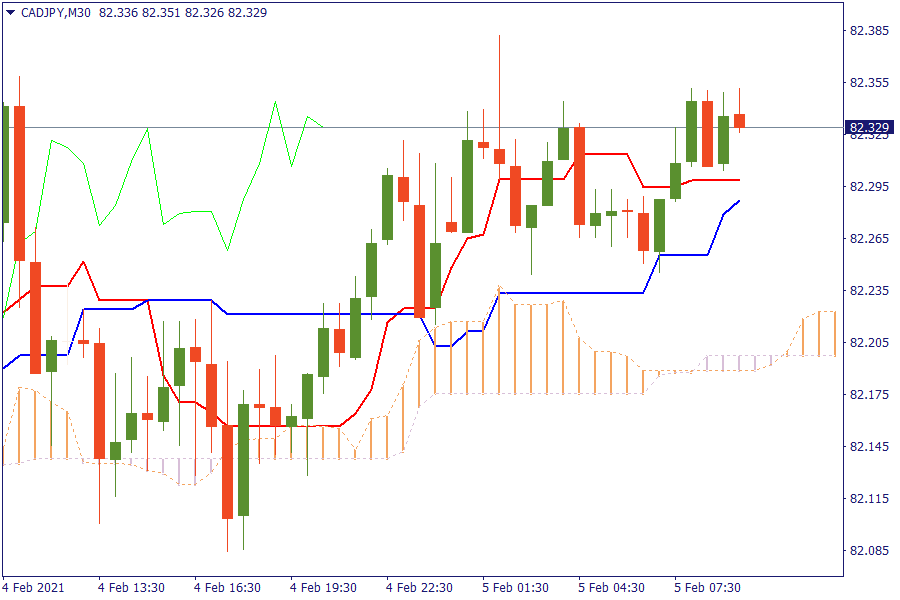

Ichimoku Kinko Hyo

CAD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

Fibonacci Levels

XAG/USD: Silver continuous to stand above 61.8% retracement area. Bears seems that losing control of the trend.

EU Market View

Asia-Pac stocks traded higher as regional bourses took their cues from the fresh all-time highs on Wall Street. European stock markets are seen edging higher at the open Friday, amid optimism that the ongoing global vaccination program will restore the region’s economy - notably in the U.K. - and speed the earnings recovery. The euro zone has been hard hit by the second wave of the Covid-19 pandemic, with the region’s GDP falling by 0.7% in the final quarter of 2020 as governments introduced new restrictions and lockdowns to try to curb the virus. Later today the focus will be on the official U.S. employment report later in Friday’s session, with job growth expected to have rebounded in January as authorities began easing restrictions on businesses.

US House Speaker Pelosi has been asked by swing-district members to break up the COVID-19 relief bill. Looking ahead, highlights from macroeconomic calendar include US and Canadian labour market reports, BoE's Broadbent, Bailey ECB's Schnabel speeches.

EU Key Point

- Germany December factory orders comes at -1.9% vs -1.0% m/m than

- Germany reports 12,908 new coronavirus cases, 855 deaths in latest update today.

- UK press says the government is planning 'Vaccine passports' for tourists.

- Fed's George supports US economic progress is encouraging, will pick up further.