Risk-on mood remains intact

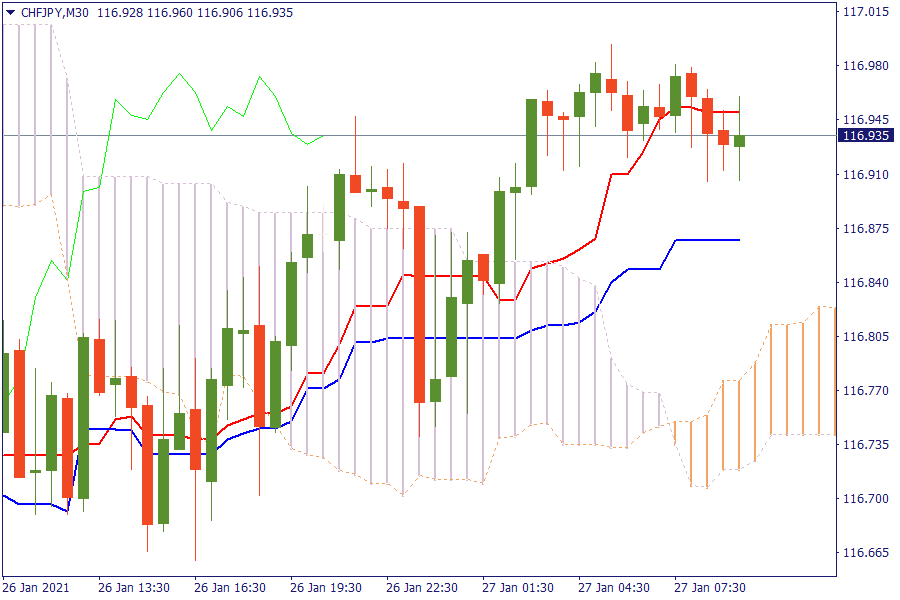

Ichimoku Kinko Hyo

CHF/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

Fibonacci Levels

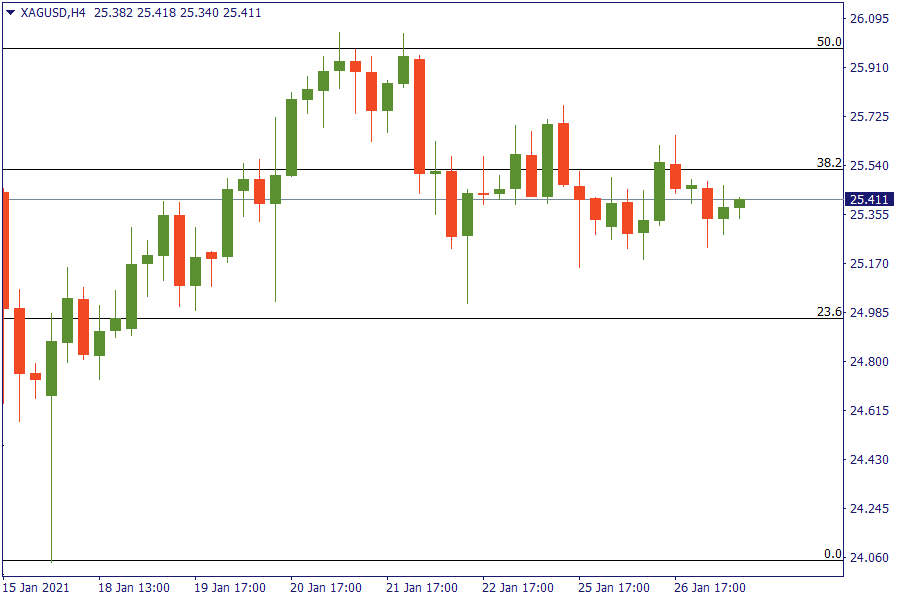

XAG/USD: Silver consolidates between 23.6% and 38.2% retracement areas.

EU Market View

Asian equities traded mixed and attempted to shrug off the weak handover from the US where there was a slight negative bias. The global economy appears to be losing momentum a bit and there is no clear sign yet that COVID-19 infections are slowing even after vaccinations have started in some places. S&P500 futures were mostly flat, capped by caution ahead of the Fed's policy meeting as well as profit-taking on cyclical shares after stellar gains this month. The S&P500 is now trading at 22.7 times its expected earnings, near its September peak of 23.1 times, which was its most inflated level since the dotcom bubble in 2000. Today we expect U.S. Federal Reserve to stick to its dovish tone to help speed the economic recovery when it concludes its two-day policy meeting on Wednesday.

Looking ahead, highlights from macroeconomic calendar include German GFK consumer sentiment, US durables, FOMC rate decision and Fed Chair Powell press conference, NZ trade, ECB's Hakkarainen, Lane, and US. Earnings from Apple, Facebook, Boeing, Tesla, Blackstone.

EU Key Point

- France January consumer confidence 92 vs 94 expected.

- Germany reports 13,202 new coronavirus cases, 982 deaths in latest update today.

- The White House will begin regular COVID-19 briefings again from Wednesday.

- New US Treasury Secretary Yellen highlighted coordination with the Fed.

- UK to require returnees to hotel quarantine from 30 countries.

- US to purchase another 200m doses of coronavirus vaccines.