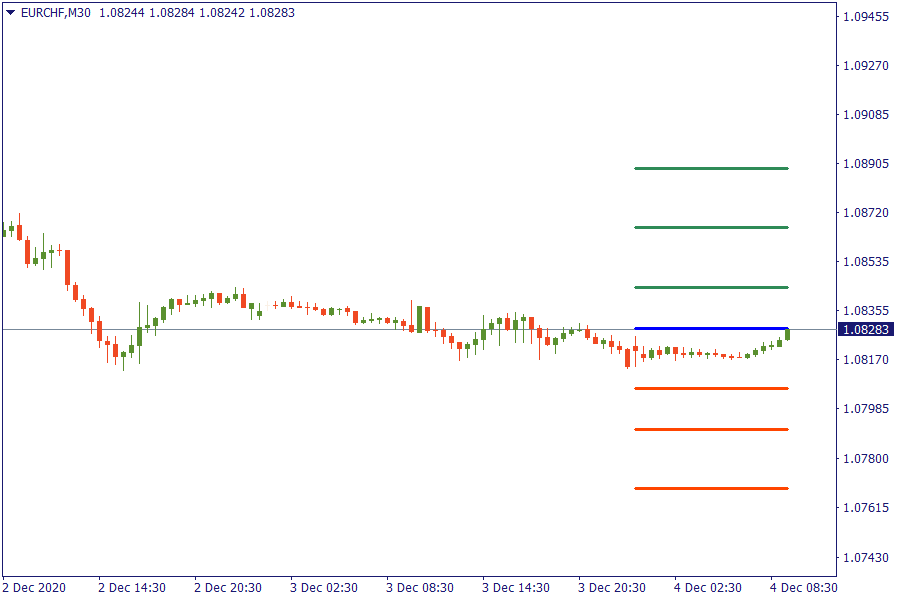

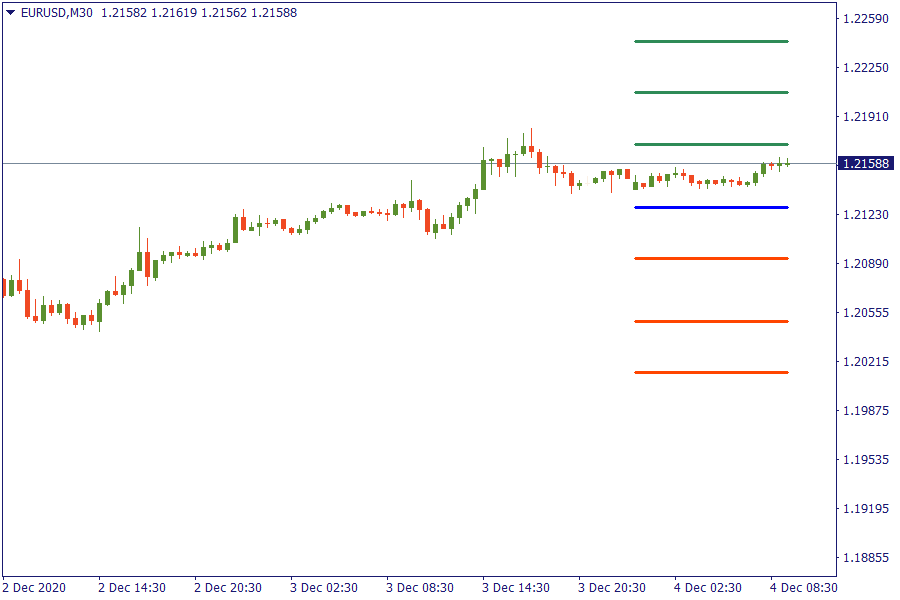

The big stategic picture remains bullish for euro against all currencies

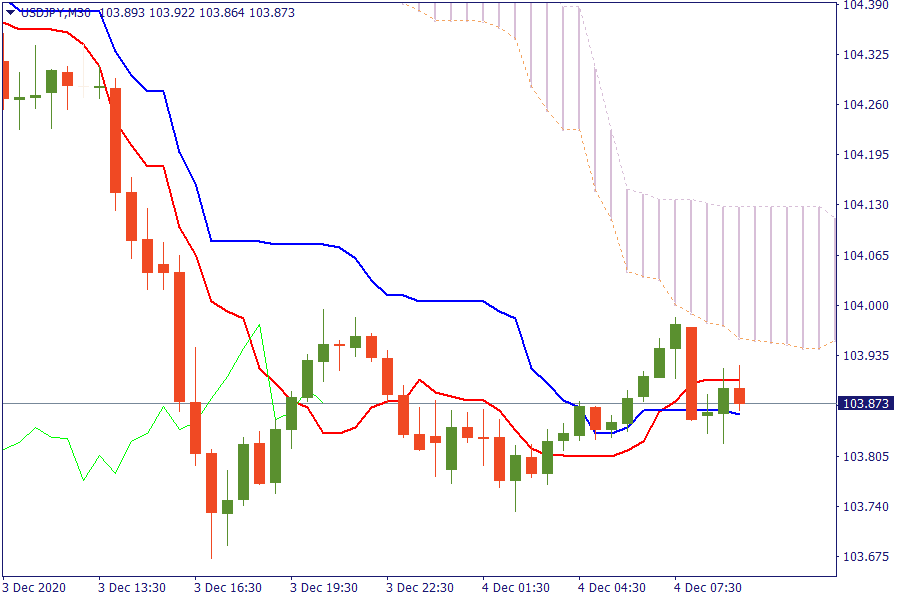

Ichimoku Kinko Hyo

USD/JPY: The pair is trading below the cloud. Further bearish pressure will lead the currency pair to retest the previous lows.

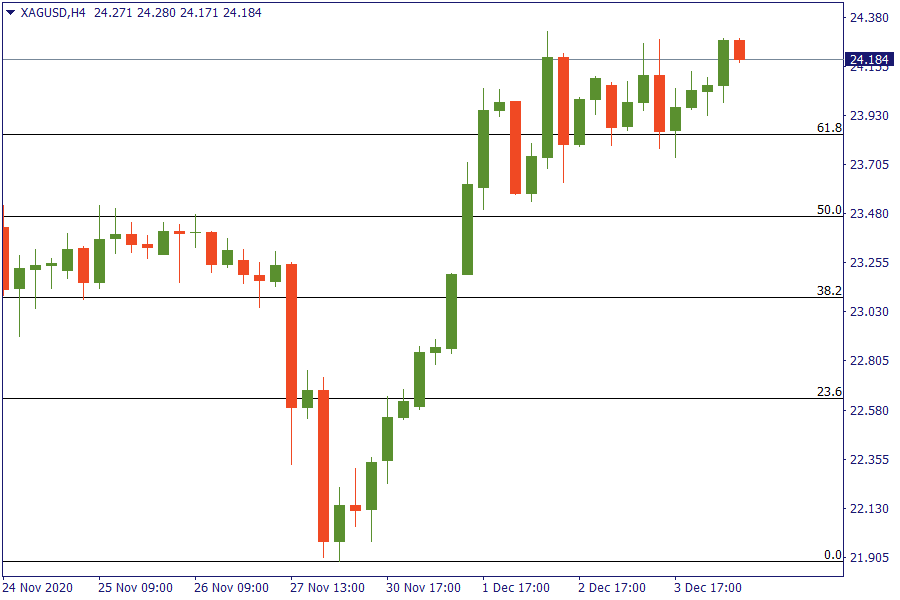

Fibonacci Levels

XAG/USD: Silver consolidates above 61.8% retracement area. Buyers have returned.

European Market View

Asian shares scaled a record high on Friday on growing prospects of a large U.S. economic stimulus package, while hopes that coronavirus vaccine rollouts will boost the global economy underpinned investor sentiment.

Looking ahead, highlights from macroeconomic calendar include EZ Construction PMI, US and Canadian Labour Market reports, US Durable Goods (R), Baker Hughes Rig Count, BoE's Saunders, Tenreyro, Fed's Evans, Bowman and Kashkari speeches.

In commodities, oil prices got an additional lift after OPEC and Russia agreed to slightly ease their deep oil output cuts from January by 500,000 barrels per day (bpd) even as they failed to find a compromise on a broader and longer term policy.

The United States topped 14 million known COVID-19 infections with over 100,000 patients hospitalized for the first time. California imposed stay-at-home orders to take effect when intensive care units approach capacity in the coming days.

EU Key Point

- France's Beaune supports that Europe would veto any Brexit deal that is deemed unsatisfactory

- Germany October factory orders +2.9% vs +1.5% m/m expected

- Germany reports 23,449 new coronavirus cases in latest update today

- Biden says coronavirus economic aid bill should be passed; he will ask for more once in office