Trading forecast for June 14

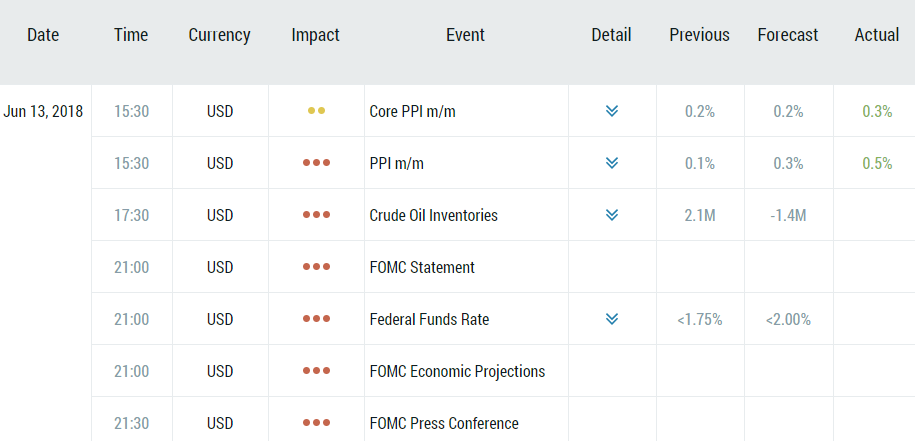

- The US dollar index can’t break the psychological level at $94. Even positive economic data couldn’t support the USD. PPI and core PPI figures were higher than expected. But the index is moving down.

Traders are waiting for the Fed’s meeting that will take place at 21:00 MT time on Wednesday. A rate hike is anticipated. However, if you remember the last time when the US central bank increased the interest rate, the US dollar fell as the hike was priced in. As a result, the USD may fall further. The support is at $93.50. If the Fed gives a more hawkish speech on the future rate hikes, the USD will have chances to increase. The resistance is still at $94.

On Thursday, more US economic data will be released. Retail sales and core retail sales figures will be out at 15:30 MT time. The forecast is positive, so the USD may find a support.

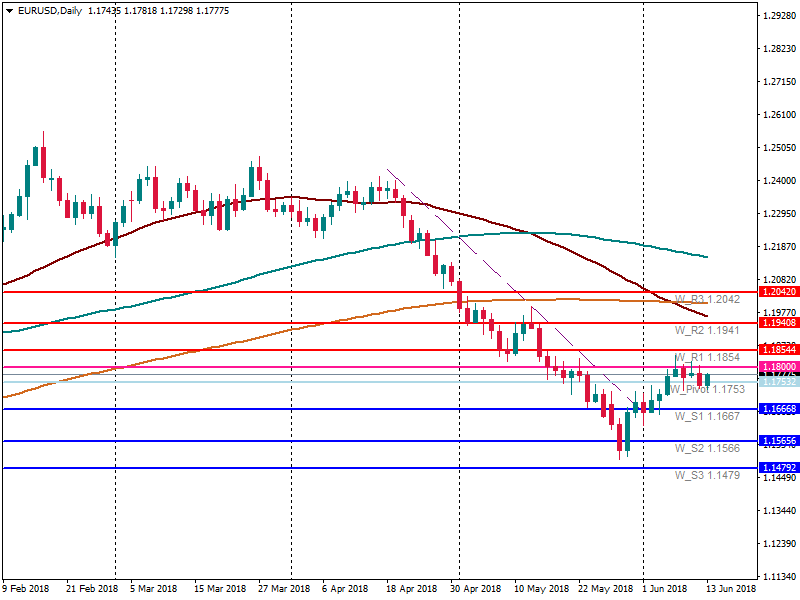

- Thursday will be an important day for the euro. Although the European Central Bank isn’t anticipated to raise the interest rate, traders are waiting for clues on the tapering of the quantitative easing. If the central bank declares its soon exit, the euro will be able to go up. Up to now, EUR/USD is trading above the support at 1.1750 (the pivot point). If the ECB is hawkish, the EUR/USD pair will be able to break the strong resistance at 1.18 and will move further to 1.1850. If traders don’t hear clues on the soon tapering, the euro will appear below the pivot point (1.1750).

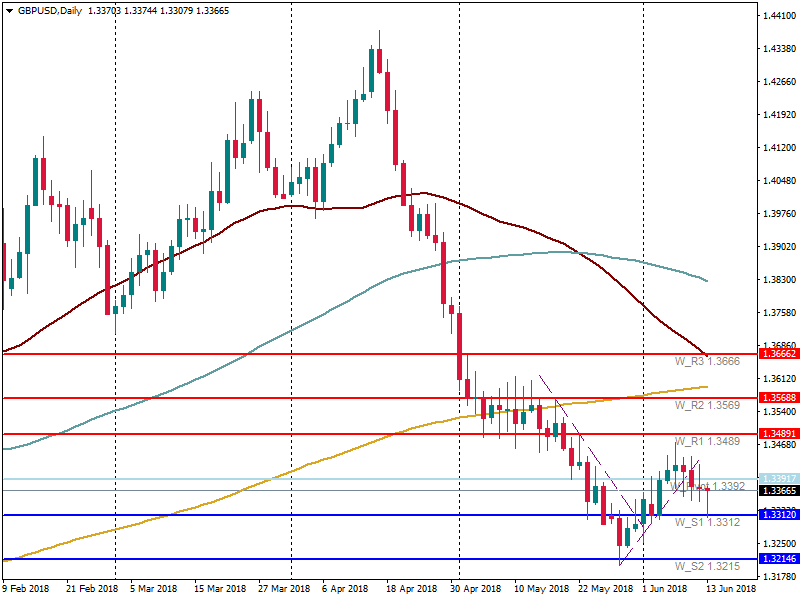

- Although Wednesday’s economic data were not negative for the pound, GBP/USD has tested the support at 1.33. On Thursday, traders will look at retail sales data. The forecast is negative; it means that GBP/USD may stick to the support at 1.33. If the actual data is greater than the forecast one, the pair will be able to reach the resistance at 1.34.