Trading plan for July 19

It’s a forecast for July 19.

- The US dollar index managed to break the psychological level at $95. The index needs additional support to break the next resistance at $95.50. On Thursday, traders will take into consideration Philly Fed manufacturing index, unemployment claims (15:30 MT time) and FOMC member Quarles speaks (16:00 MT time). If the actual economic data are greater than the forecast, and the speech of the FOMC member is hawkish, the US dollar index will appreciate. Otherwise, there are risks of the fall. Targets are resistance at $95.50, supports at $95, $94.50.

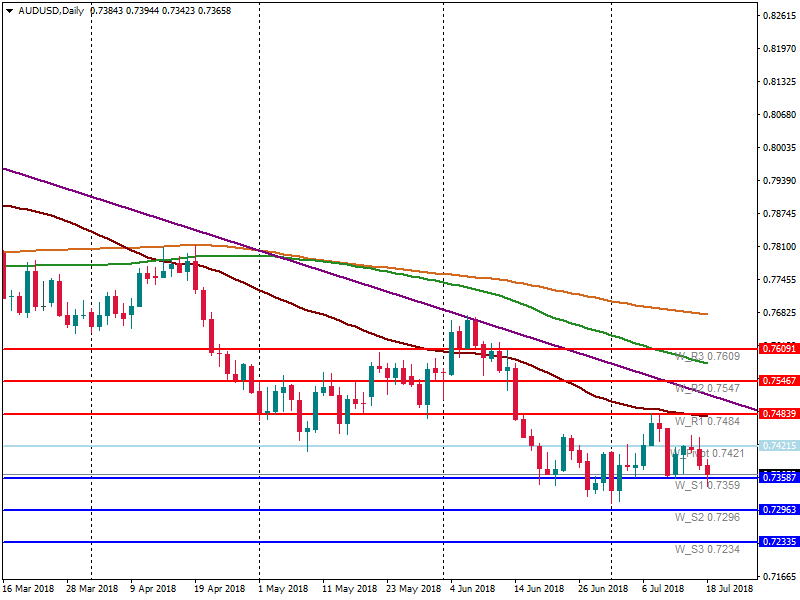

- Traders should pay attention to AUD/USD on Thursday. Australian job data will be out at 4:30 MT time. The forecast is optimistic, but the direction of the AUD will depend on the actual data. If the employment change figure is greater than the forecast and the unemployment rate figure is less than the forecast, the Australian dollar will be able to appreciate.

Up to now, the pair has been trading near the support at 0.7360. If the pair closes below the support, risks of the further fall will increase. The next support is at 0.73. MAs move down that is the negative signal for the pair. Moreover, on Monday the bearish shooting star was formed. It’s a signal of the bearish movement. If the economic data are positive, the pair will be able to trade above 0.7360. The resistance is at 0.7420.

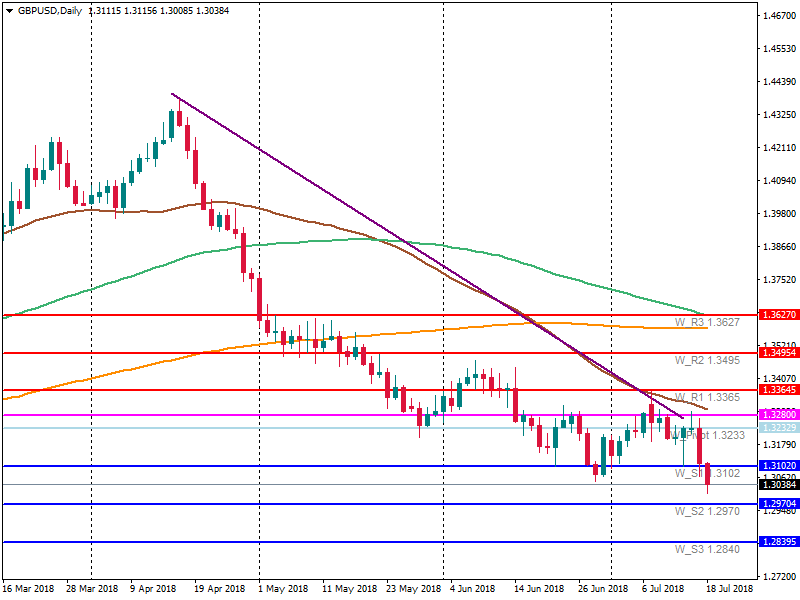

- Thursday will be an important day for the pound. Retails sales figure will be out at 11:30 MT time. The forecast is weak. However, if the actual data is greater than the forecast one, the pound will have chances to recover. Up to now, GBP/USD has been trading below the support at 1.31. Positive economic data will be able to pull the pair up to 1.31. Otherwise, the further fall to 1.2970 is anticipated.