Trading plan for July 27

It’s a forecast for July 27.

- The US dollar index has managed to recover after a significant fall. In early Thursday trading, the index fell to a 2-week low at $94.09. Later that day, the index has surged above $94.50. If it is able to close above this level, it will have more chances to rise further on Friday. The next resistance is at $95. Otherwise, it will be difficult for the index to reach $95. A lot of economic data will be out on Friday: advance GDP, advance GDP price index and revised UoM consumer sentiment. The forecast is encouraging. If the actual data are greater than the forecast ones, the index will have chances to stick at good levels.

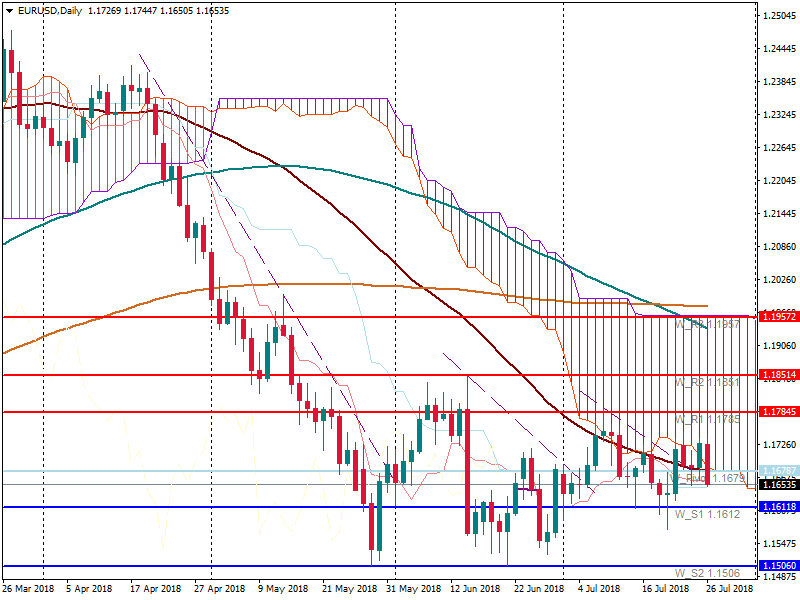

- On Tuesday, the euro showed mixed moves. EUR/USD was rising ahead of the ECB meeting. However, the results of the meeting pulled the pair below the pivot point (1.1680). Mr. Draghi didn’t discuss reinvestments and said that the exchange rate isn’t an ECB’s target. Moreover, there were not a lot of changes in the outlook on the economic growth and inflation and the monetary policy targets.

If on Thursday, the pair closes below the pivot point, risks of the further fall will increase. No important economic data will be released on Friday. The support is at 1.1610. However, if the USD weakens, the pair will have chances to be above 1.1680 again. However, rise to the resistance at 1.1785 is unlikely.

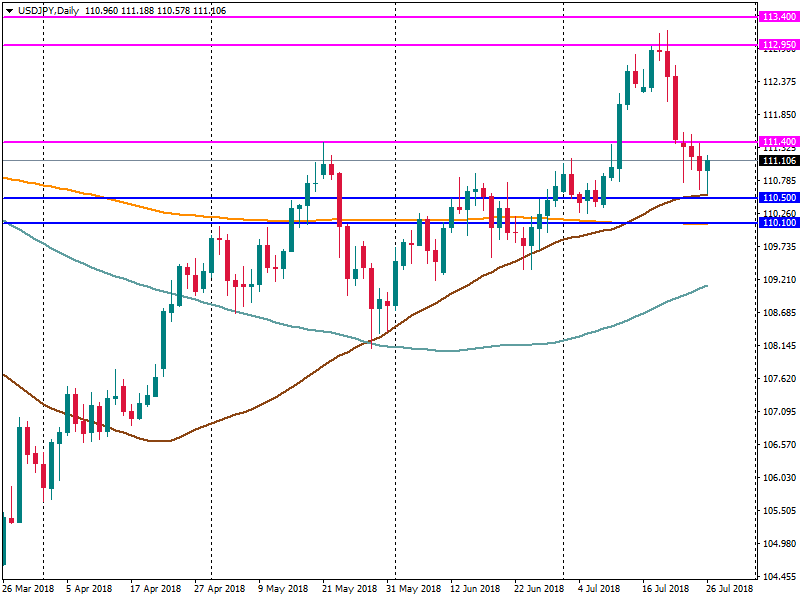

- The USD/JPY pair has been recovering. Trade wars tensions eased after the meeting of the US President and the President of the European Commission. Moreover, the US dollar index has been recovering.

In the early trading, the pair reached the support at 110.50 (50-day MA) and rebounded. The pair has been moving to the resistance at 111.40. If the USD is stronger on Friday, the pair will be able to break the resistance. Otherwise, the return to 110.50 is anticipated.