Trading plan for July 6

Friday is full of economic events.

- On Friday, the USD will be under pressure because of the big amount of the economic data. Average hourly earnings, nonfarm employment change, and the unemployment rate will be released at 15:30 MT time. The main data that will affect the US dollar is nonfarm payrolls. The forecast is weaker than the previous data. However, if the actual one will be greater than the forecast, it will pull the US dollar index up.

On Thursday, the US dollar index has been falling. The economic data were weak and as a result, the index tested the support at $94.20. If Friday economic data are greater than the forecast, the US dollar index will be able to recover. Resistances are at the psychological levels of $94.50 and $95. If the data are weak, especially the NFP, the index will continue falling.

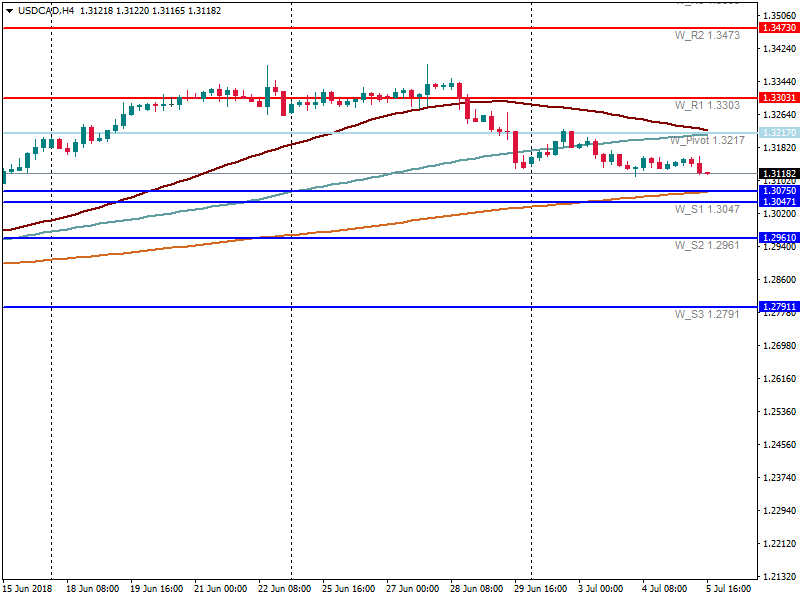

- On Thursday, the Canadian dollar has been appreciating against the USD. The end of the Thursday trading will depend on crude oil inventories data. If there is a greater decline in the number of inventories than anticipated, the oil market will rise and the CAD will strengthen as well. So the pair will close down. Otherwise, the CAD won’t get additional support. And there are risks of the reversal. Remember that the CAD is correlated with the oil market.

Friday is an important day for the Canadian dollar as well. Employment change, trade balance, and unemployment rate data will be out at 15:30 MT time. The forecast is mixed. The Friday direction of the CAD will depend on the actual data. If they are greater than the forecast ones, the Canadian currency will appreciate. Otherwise, the CAD will depreciate.

The key levels are the support – 1.3075 (200-hour MA), the resistance – 1.3215 (the pivot point, 50-hour and 100-hour MAs).

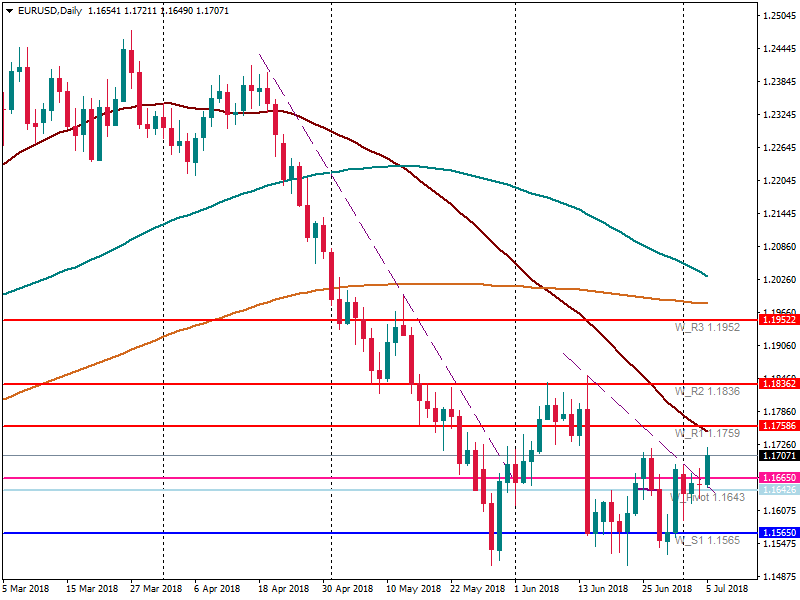

- The USD has been weakening, as a result, other currencies managed to recover.

On Thursday, EUR/USD rebounded from the support at 1.1645 (the pivot point) and tested the resistance at 1.1665 reaching levels near 1.17. Friday direction will depend on the strength of the USD as no important European economic data will be released. If the USD is weak, the EUR/USD will reach the resistance at 1.1760 (50-day MA). Otherwise, there are risks of the reversal to the support at 1.1645.

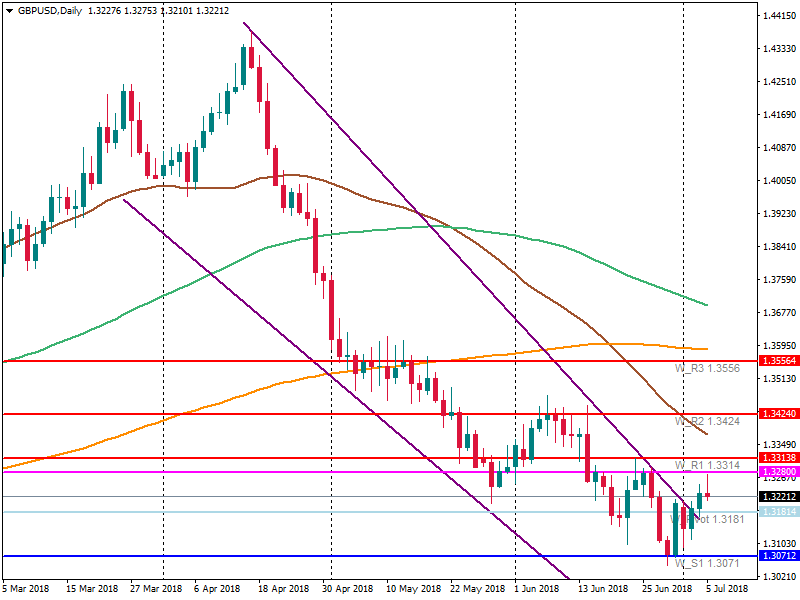

- On Thursday, the speech of the BOE Governor Mr. Carney supported the pound. After the speech, BOE rate hike expectations for August in the money market jumped to about 62% from 57% prior to his speech. However, the Central Bank needs additional support from the economic data.

The GBP/USD pair has been moving up. It reached the resistance at 1.3280. However, couldn’t break it. No important economic data will be released on Friday. As a result, there are risks of the fall to the support at 1.3180.

Moreover, the Brexit deal weighs on the pound’s rate. The Prime Minister’s Cabinet will meet on Friday to finalize the Government’s Brexit trade policy and desired customs arrangement with the EU prior to publishing the official White Paper.

If there are positive comments on the meeting, the pound will appreciate, otherwise, it will fall.