Trading plan for September 14

Thursday American CPI data pulled the US dollar index below the psychological level at 95.50. Traders are looking for Retail Sales figure that will be out at 15:30 MT time. The forecast is weak, but if the actual data is greater than the forecast, the USD will have chances to recover.

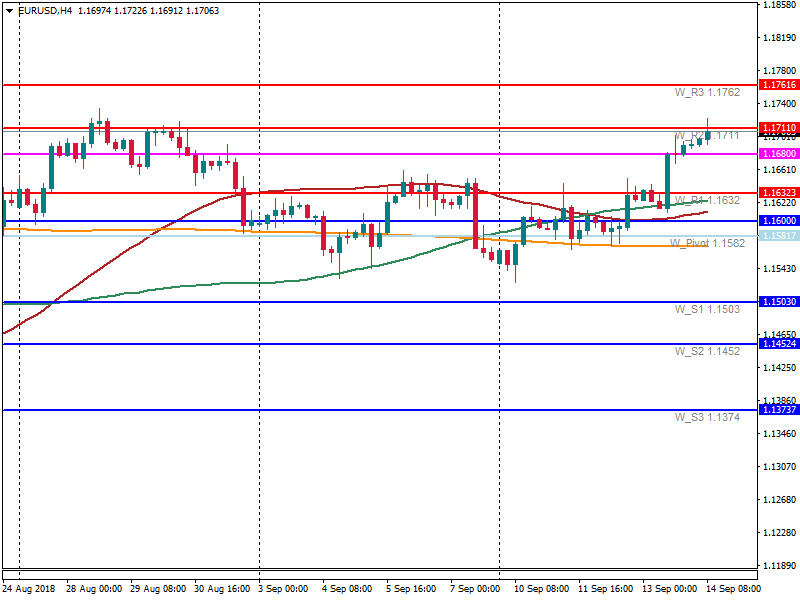

The weakness of the US dollar has been pulling the euro up. Moreover, yesterday the market evaluated the statement of the European central bank as optimistic. The President of the ECB didn’t mention risks related to the emerging markets that boosted the European currency a lot. In case of the weaker USD, the pair will be able to break the resistance at 1.1711 and continue its upward movement to 1.1760. However, as we can see on the H4 chart, the level is really strong. So the USD should fall much further to let EUR/USD appear above 1.1711. If the USD recovers, EUR/USD may appear below 1.1680. The next support is at 1.1632.

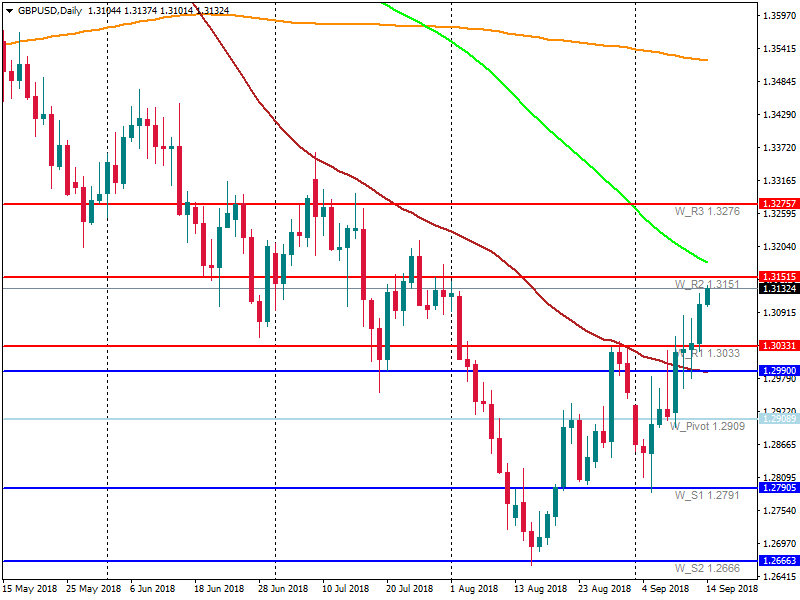

The governor of the Bank of England will give a speech at 13:00 MT time. The British pound needs additional support to stick at highs it reached yesterday. There are risks of the pound’s fall, as the Bank of England wasn’t hawkish yesterday during its statement. The central bank worries about growing Brexit uncertainties. If the governor sounds hawkish today, the pound will get additional support to test the resistance at 1.3151. The resistance is strong as 100-day MA has been moving to this level. It will put additional pressure on the pair. If the governor doesn’t give optimistic comments on the economic conditions, there are risks of the pound’s weakness. The support lies at 1.3033.