US ISM manufacturing: impact on the USD

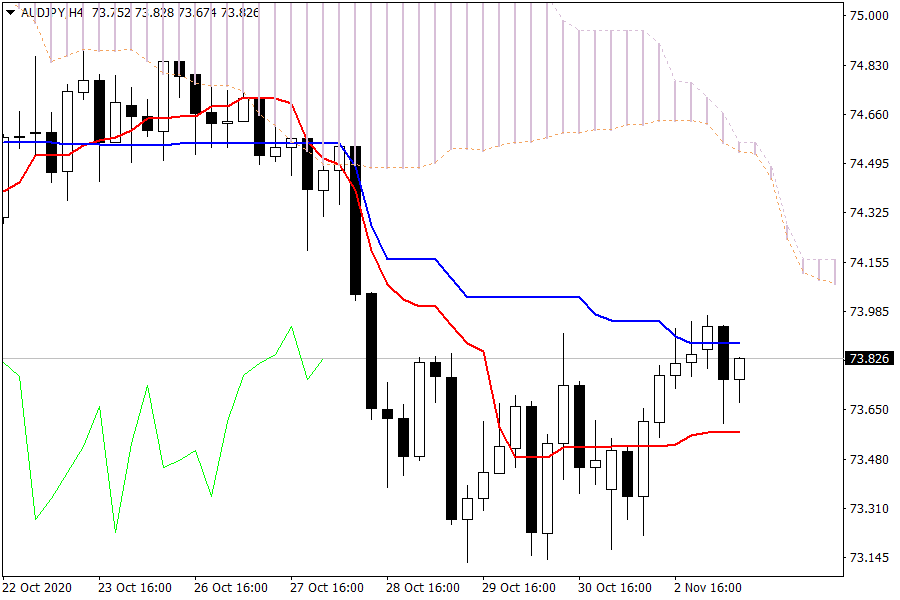

Ichimoku Kinko Hyo

AUD/JPY: The AUD/JPY pair is trading between the Tenkan sen and the Kijun sen levels. A failed attempt to move higher will push prices to violate the Tenkan sen level, pushing the market to retest the previous lows.

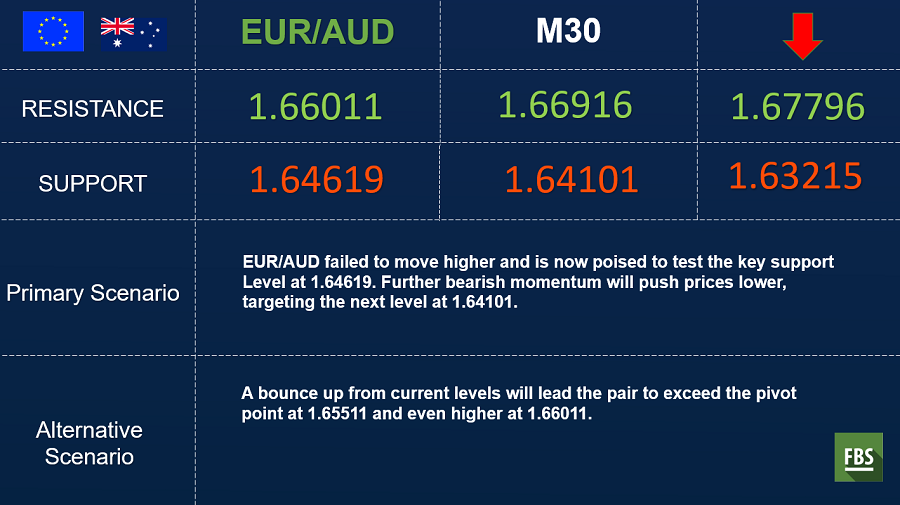

European Market View

Today's key event is the US election, where the Democratic party leads according to some polls. Joe Biden, the Democratic presidential candidate, has a 61% chance of winning the presidential election tonight according to the latest update from prediction markets. One of the key states to follow is Florida that is expected to deliver a result early Wednesday morning as it has already started to count mail votes. Trump cannot win without Florida but Biden can still pull it off without it, so a Trump victory in Florida may imply that we won't know the election result for a couple of days.

Despite a strong session for risk, FX moves were very limited in the start of the week. EURUSD grinded a little lower towards the low 1.16s while currently is trading in the mid 1.16 area.

US ISM manufacturing rose to 59.3 in October from 55.4, higher than the consensus expectation of 56.0, signaling that the pace of recovery in the manufacturing sector is accelerating.

Oil rebounded to USD39/bbl yesterday on positive risk sentiment and the news that OPEC could be mulling delaying planned output hikes by three months. Russian producers yesterday met with the Russian oil minister to discuss this option. OPEC is planning to meet on 30 November-1 December.