USD bulls try to resist

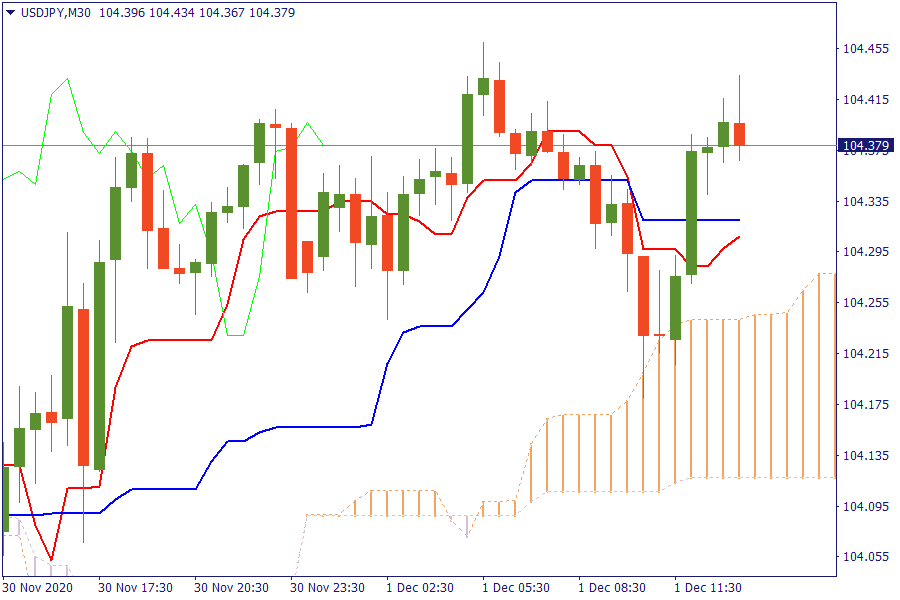

Ichimoku Kinko Hyo

USD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a new bullish outlook.

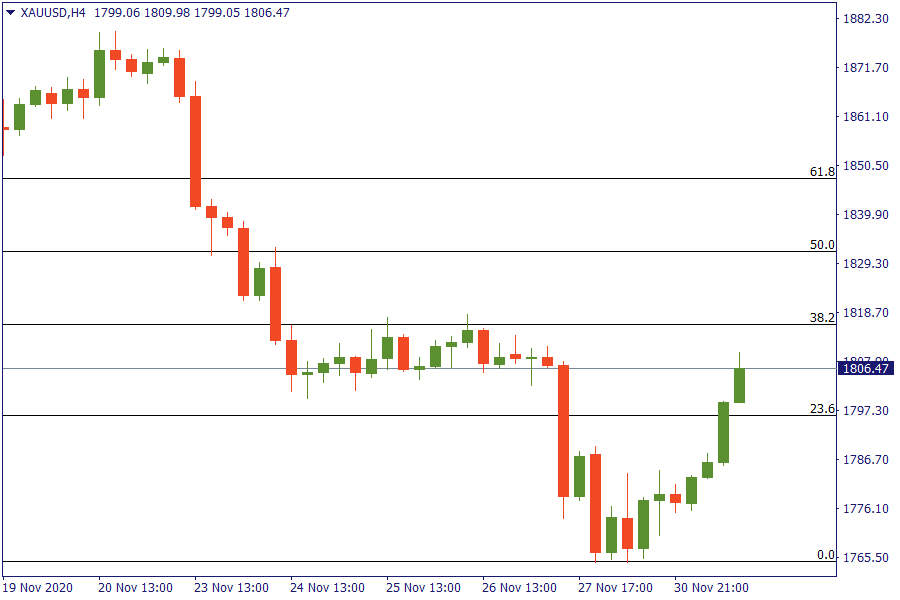

Fibonacci Levels

XAU/USD: Gold gains after a period of the significant selloff. Gold remains below the key 38.2% retracement area while bulls resist further selloff.

US Market View

World shares edged up to just below record peaks on Tuesday after robust China data boosted expectations of a recovery from the COVID-19 downturn and as drugmakers seek fast approval for their vaccines and authorities look set to keep stimulus support.

Bets of more easing from the Fed in the United States to help the pandemic-hit economy through the winter weighed on the dollar, as riskier currencies rose, while crude prices missed out on the bounce after OPEC+ countries delayed a decision on output cuts. In foreign exchange markets, the dollar was under pressure after closing out its worst month since July with a little bounce and as investors reckon on even more US monetary easing. In a speech released late on Monday, Fed chair Jerome Powell said a slowing recovery and a surging pandemic meant the US was entering a "challenging" few months, with the potential deployment of a vaccine still facing hurdles.

Elsewhere sterling hit a three-month high as traders clung to hopes for a Brexit trade deal before the year's end, while risk-related currencies such as the Canadian and Australian dollar rose against the greenback.

USA Key Point

- Cable eases back to key near-term levels on the pullback after testing 1.3400

- UK November final manufacturing PMI 55.6 vs 55.2 prelim

- Eurozone November final manufacturing PMI 53.8 vs 53.6 prelim

- Germany November unemployment change -39.0k vs 8.0k expected

- France November final manufacturing PMI 49.6 vs 49.1 prelim