USD/TRY: calm before the storm?

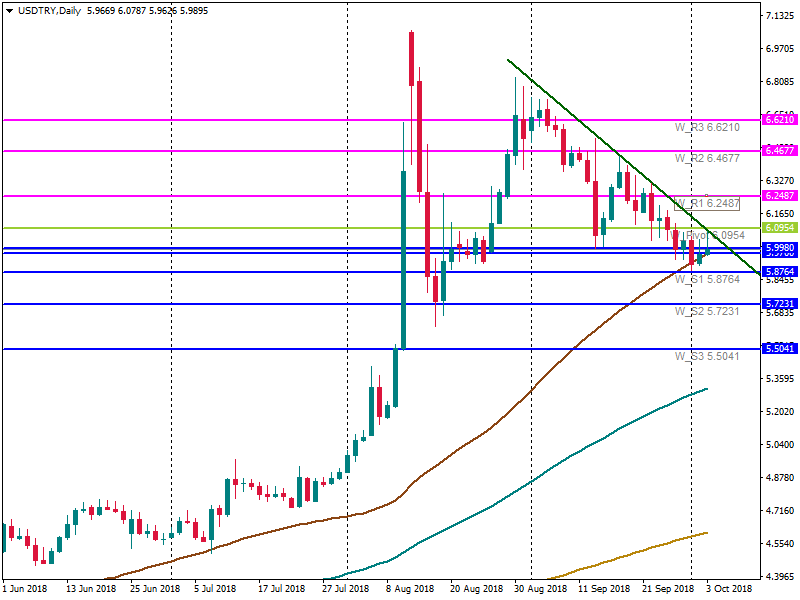

The consumer inflation in Turkey increased to 24.5% in September - the highest level since August 2003. Producer prices increased by 46.2% as well. The reason for it lies in existing currency crisis and the US sanctions against two Turkish diplomats. However, it seems like the Turkish lira has reacted to this data weakly. Since the release of the consumer inflation indicator USD/TRY has gained a little. It got support at 5.97 (50-day MA) and started moving towards the resistance at 6.0950.

If we look at the bigger picture, the Turkish lira was gaining against the US dollar in September. The latest tensions in the price of USD/TRY are connected with the central bank decision. The Central bank of Turkey (TCMB) decided to increase the interest rate from 17.75% to 24% on September 13, 2018. At the same time, Turkish president Tayyip Erdogan was calling for lower rates to create cheaper credit flowing. As a result, USD/TRY dropped from 6.3234 to 6.0591 in just one day. The recent discussion between Erdogan and German Chancellor Angela Merkel on the future relations between Turkey and the EU supported the lira as well during the last month.

Nevertheless, inflation is not the only indicator which signals about the contraction of Turkish economy. Manufacturing purchasing manager’s index decreased to 42.7% in September. To compare with, it was 55.7 in January. The possible solution to the current economic problems could be solved by the tight monetary policy of TCMB. Finance minister Berat Albayrak already said that discussions on fighting the inflation would begin on Thursday.

Can the next rate hike move the lira up against the US dollar? Well, hardly. Big increases of interest rates can lose their significance. For instance, despite Argentina raised its interest rate from 45% to 60%, the peso kept decreasing.

To sum up, the possible solution for USD/TRY traders is to wait until further comments by Turkish Central bank. To see more significant changes for the Turkish lira, it probably needs the changes in the country’s leadership, cancelation of the US sanctions and much better economic fundamentals.

For now, if the pair gains and break the resistance at 6.0954, it will resume to follow the uptrend.