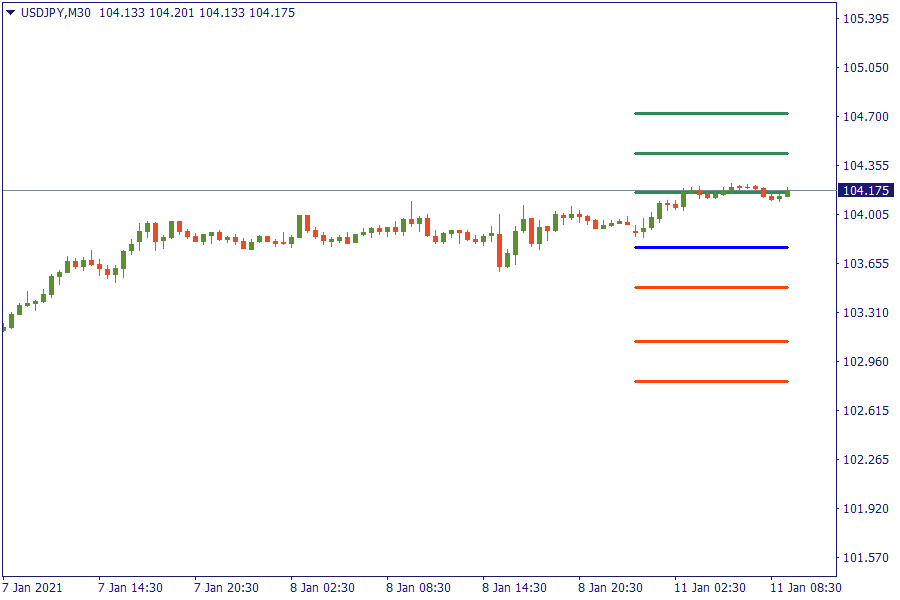

USD/JPY runs into key resistance trendline area

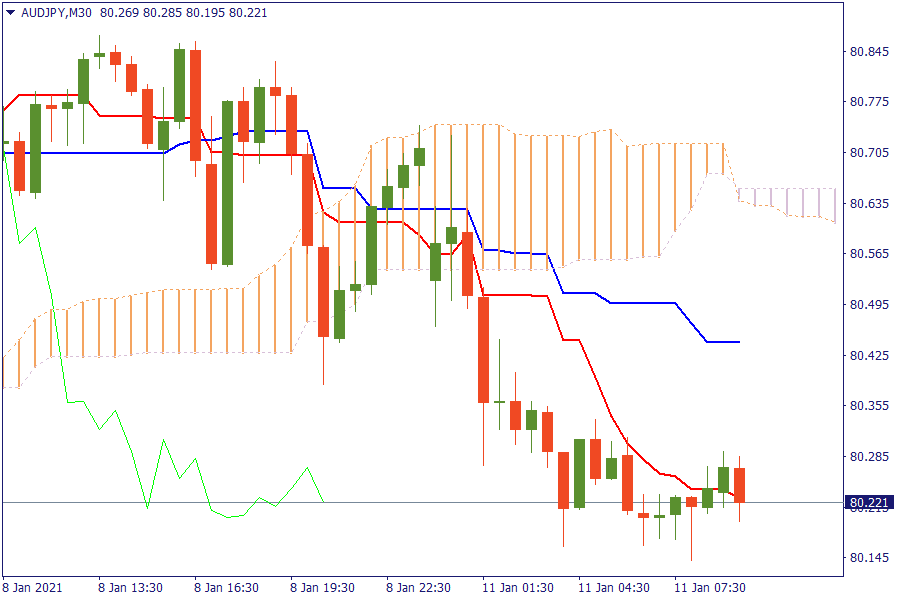

Ichimoku Kinko Hyo

AUD/JPY: The pair is trading below the cloud. Further bearish pressure will lead the currency pair to retest the previous lows.

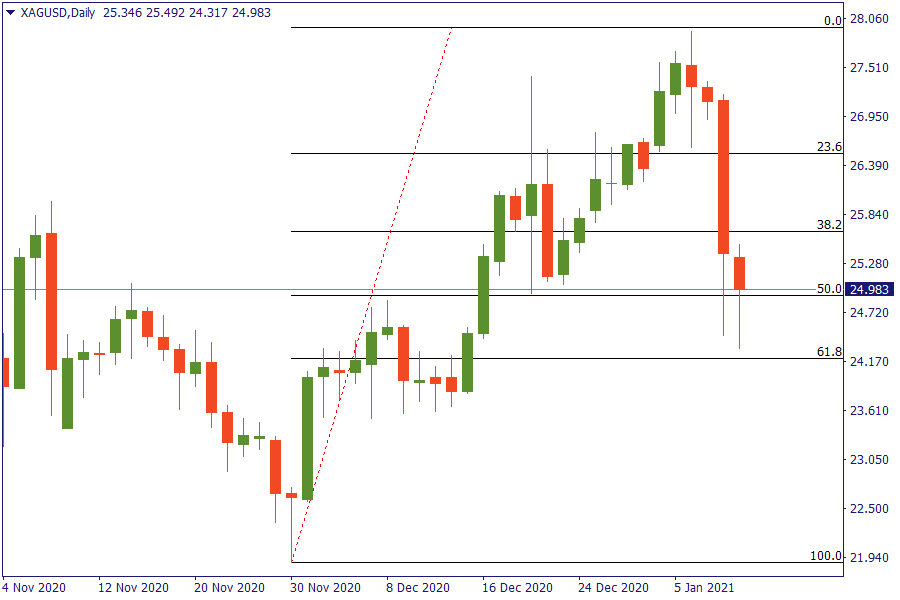

Fibonacci Levels

XAG/USD: Silver stands above 50% retracement level with an indecision between bulls and bears.

European Market View

Asian equity markets began the week indecisively as ongoing COVID-19 concerns and US-China tensions contributed to the cautious mood. US House Speaker Pelosi said the House will take up a resolution to impeach US President Trump unless VP Pence and the cabinet invoke the 25th amendment. Treasury yields were at a 10-month top as "trillions" in new U.S. fiscal stimulus plans were set to be unveiled this week, stoking a global reflation trade.

Oil prices fell on Monday, hit by renewed concerns about global fuel demand amid tough coronavirus lockdowns in Europe and new curbs on movement in China, the world's second-largest oil user, where infections jumped. Mainland China saw its biggest daily increase in virus infections in more than five months, authorities said on Monday, as new infections rose in Hebei, which surrounds the capital, Beijing. Looking ahead, highlights from macroeconomic calendar include Eurozone Sentix Index, BoE's Tenreyro, ECB's Lagarde, Fed's Bostic and Kaplan speeches.

EU Key Point

- Germany reports 12,497 new coronavirus cases in latest update today

- There are two Federal Reserve speakers on the docket for Monday

- Trump's 2nd impeachment will likely be this week, a conviction could take until mid-April

- Pakistan is in talks with the International Monetary Fund (IMF) to put the fiscal support program back on track