Want to choose a currency pair? Consider EUR/JPY

If you don’t want to deal with the violent moves of the USD these days, consider crosses, for example, EUR/JPY. The currency pair has been moving down since the start of January as the yen strengthened on the rising demand for safe havens.

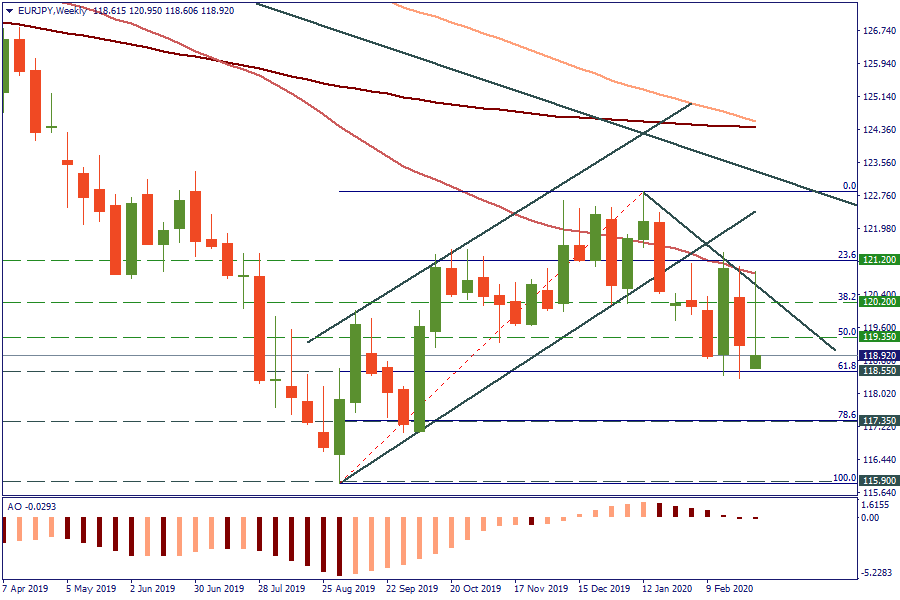

On the W1 chart, there are many negative signs: the 50-week MA limits EUR/JPY at 120.90, the 100-week MA is about to cross the 200-week line to the downside, the Awesome Oscillator is declining. We can see that the break below the 61.8% Fibonacci retracement at 118.55 will open the way down to 117.35 (78.6%).

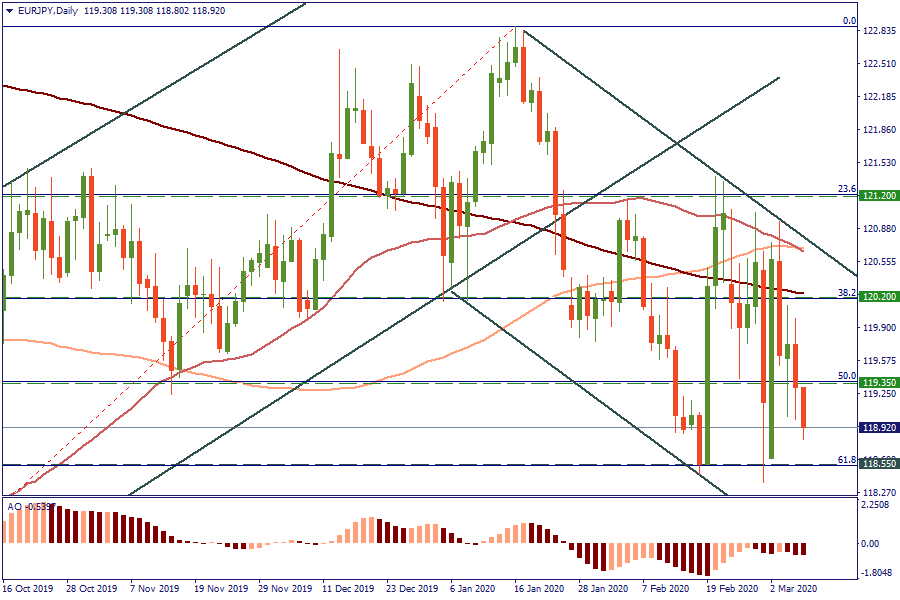

On the D1, there’s still room for consolidation between 118.55 and 120.20. If some positive news appear and EUR/JPY gets above 119.35, the targets will be at 119.80 and 120.20.

Trade ideas for EUR/JPY

SELL 118.30; TP 117.40; SL: 118.55

BUY 119.40; TP1 119.80; TP2 120.20; SL 119.25