Weak data put US dollar under pressure

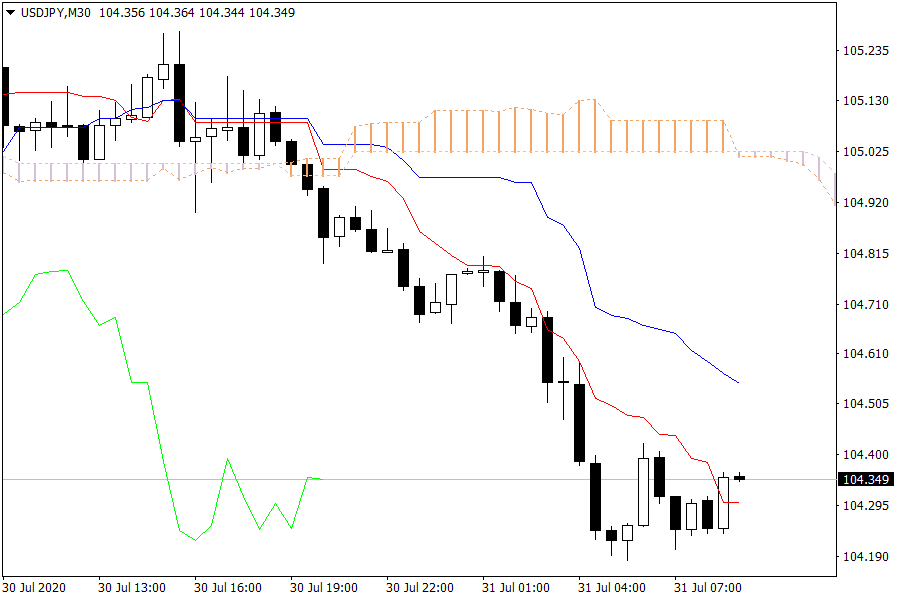

Ichimoku Kinko Hyo

USD/JPY: The pair has just surpassed the Tenkan-sen level. Further increase of the market will lead USD/JPY towards the Kijun-sen level. A failed attempt to move higher will push the pair below the Tenkan-sen, with further bearish implications.

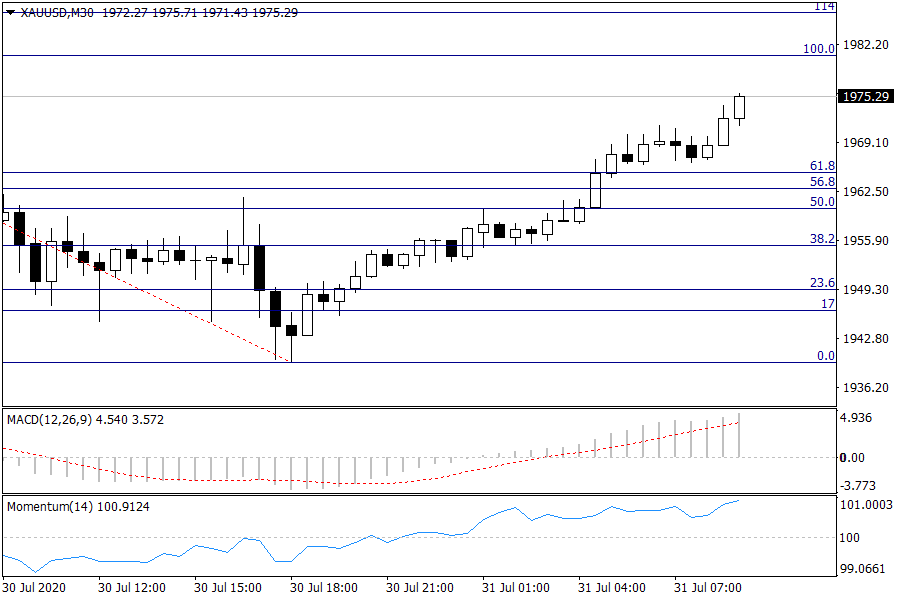

Fibonacci Levels

XAU/USD: Gold is heading towards the previous top and continues to be a bullish bet.

European Market View

The risk of a second wave of coronavirus is more likely to put pressure on rates. Risky assets are supported by fiscal and monetary stimulus.

The US dollar will most likely stay under pressure provided the weak data as well as the political uncertainty (yesterday’s comments from the President regarding postponing the US presidential elections).

GDP data for France, Spain, Italy and Canada are about to be released today. A significant slowdown is expected, as we saw in Germany and US yesterday.

The preliminary EU inflation data for July are expected as well to decline. The US PCE data (for July) are expected to rebound modestly.

Moody’s may update its view on the German sovereign rating. However, we do not expect to see a change to either the outlook or the rating.

European Key Point

- The risk of a COVID-19 second wave

- Weak data put US dollar under pressure

- GDP data for France, Spain, Italy and Canada

- The preliminary EU inflation data for July

- Moody’s may update its view on the German sovereign rating