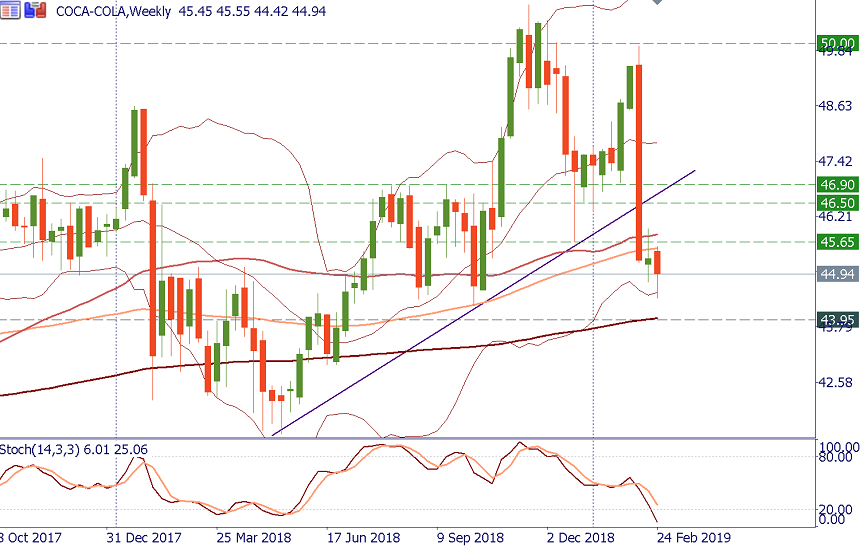

Will Coca-Cola fill the gap?

The stock has been extremely volatile so far: it had the worst trading day in decades on February 14. The selloff was caused by the company’s announcement of the gloomy projection for its 2019 earnings.

When such a fall happens, a natural question is whether it’s time to buy the fallen asset at a cheap price. The answer is that it may indeed be the case as by now the negative news is mostly priced in. The news that the company increased the dividend and will continue buying back its shares can also help. Yet, better safe than sorry: a confirmation of the upside momentum is surely needed before buying.

Smaller timeframes (D1, H4) clearly show that Coca-Cola is oversold. The weekly chart makes it visible that the return above 45.65 (December low, 100-week MA) will give the stock a chance to retest the breached support line at 46.50. If the price manages to push above 47, it will be possible to make a big trade targeting 50.00 as the price fills the gap.

Support lies at 44.25 and 43.95. There’s also a rising 50-month MA at 43.78. If the decline continues from the current levels to that zone, it would be wise to reassess buying opportunities given the overall long-term bullish trend since 2009.

Trade ideas

BUY 45.75; TP 46.50; SL 45.50

BUY 47.15; TP 49.80; SL 46.80