Will the Fall of USD Bring Hope to the Crypto Markets?

Last week after rebounding off the "turncoat resistance" at 108.128, the US Dollar failed to create a new high, increasing the chances of a bearish continuation. It is also important to note that while we await the Feds' decision this Wednesday, bearish pressure continues to mount on the US Dollar from the Golden Fibonacci level at 61.8% of the most recent swing low.

BTCUSD

After bouncing off the previous Major trendline last month, Bitcoin seems to be retesting the support area again in hopes of catching a bullish momentum. BTCUSD's rise may, however, be short-lived.

USDJPY

USDJPY has broken below the trendline inside the Weekly resistance zone and seems to be heading to 141.555 as the first possible area of support. 139.272 seems to be the next area of support provided price breaks through the initial one at the 141 area.

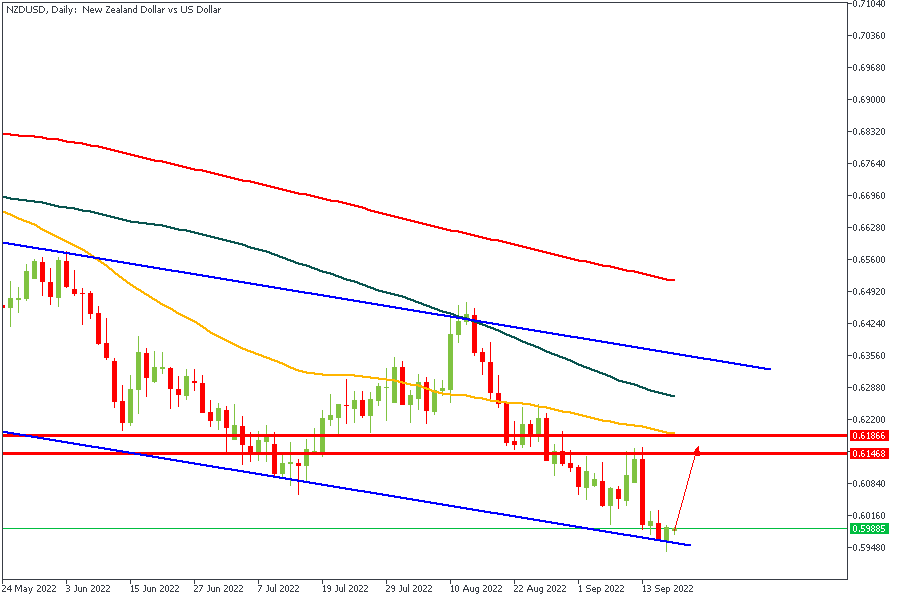

NZDUSD

Last week Friday, NZDUSD closed bullish on top of the major trendline from May 12, 2022, and seems to be getting ready for a bullish run all the way to the 50-MA at 0.61498 area. The major target in view is around the 0.61400 area.

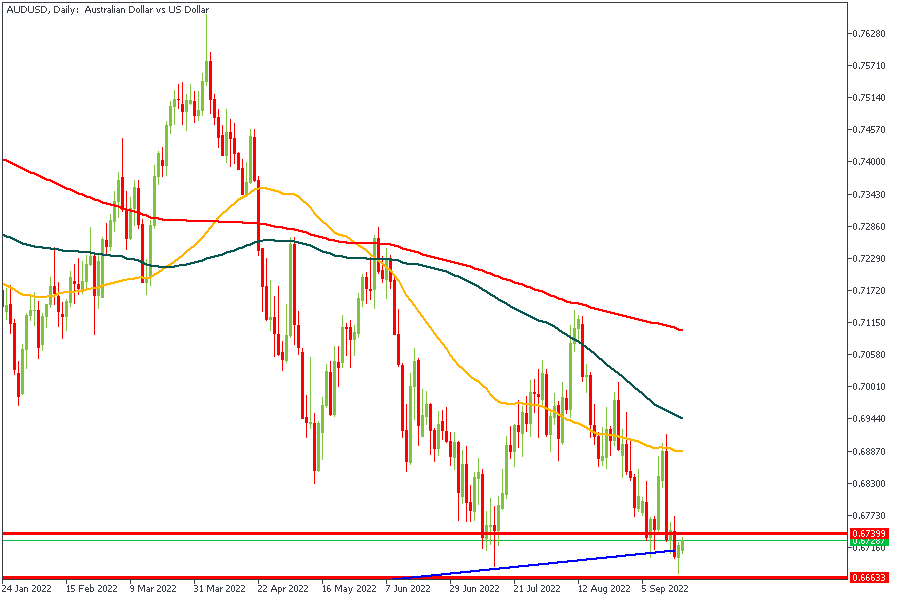

AUDUSD

Still within the Daily Support zone and with interest rates fundamentals incoming this week, The AUDUSD pair may be prepping for a change in the bearish momentum. So far, we saw Friday close with a Bullish rejection candle, thus, increasing the chances of a Bullish short-term rally.

USDCAD

USDCAD may face serious rejection from the upper trendline boundary of the wedge it is currently trading inside. The upper boundary of the wedge has the Daily resistance level as an added confluence, and we may see prices sink as far as the 1.30500 area.