Treacherous bull traps

A bull trap is a real pain in the neck as it causes substantial financial losses leaving the market participants penniless. The bull traps occur when prices start heading upwards, but then, out of nowhere, reverse and decline. This counter price move produces a trap and often leads to substantial sell-offs. You may face with such traps in a major resistance zone.

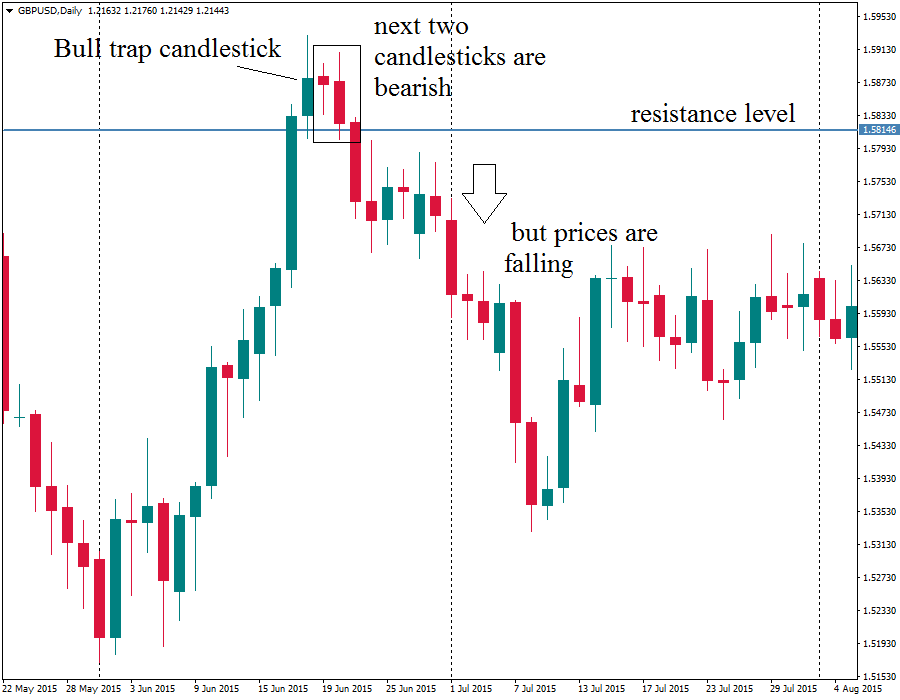

So, let us straighten out, how to predict the occurrence such traps; how to recognize them at the earliest stage of their formation. Here is how. Imagine, there is an uptrend; then, you notice the price running into resistance level and breaking it; it doesn’t stop there and continues to move higher. Then, a few candlesticks later, the rally phases out, and prices start falling. Those market participants who had open long positions (the bulls) as they notice a breakout of the resistance now feeling nervous as their stop losses are getting hit. So, they got trapped. Common bull trap chart pattern A bull candlestick breaks and closes above the resistance level, but the next 2 bars are bearish. The second candlestick in the pattern resembles a bearish pin bar type of candlestick.

Another version of bull trap chart pattern A bull trap candlestick breaks the resistance and goes higher, but then closes below the resistance level forming a bearish candlestick.

Finding bull trap chart patterns as well as key resistance zones can be really difficult, especially for novice traders. Sometimes you can be deceived by the market. When you think that you found a bull trap, it will eventually turn out to be a true breakout to the upside. So, to find a strong resistance level you should switch to the weekly or the daily timeframes (any higher timeframes) and look at the charts. Is there a peak that actually stands out from the trading channel? If there is a peak, this is your resistance level (don't be too lazy to do this to confirm your resistance levels).

Trading Strategy

Now when you learned how to find the bull traps, we would like to suggest you several trading strategies.

"Key ingredients"

Currency pairs – any.

Timeframes – hourly charts are preferable, but you may use daily, H4 as well.

Background – learn to recognize bearish reversal candlesticks on multiple timeframes.

Technical tools – not required.

"Rules of the game" 1. When you see the price advancing to the resistance level, you should wait and see what happens when it reaches it; 2. After the price reached the resistance zone, and the formation of the bull trap chart pattern has started you may place a sell stop pending order at least 2 pips below the low of the candle that broke the resistance zone; 3. Then, place a stop loss at least 2 pips above the high of this candlestick; 4. Take profit should be placed at the previous swing low price level.