May 29, 2025

Strategy

Successfully Investing in Precious Metals

Since ancient times, precious metals like gold, platinum, and silver have been remaining the source of financial stability for the people, especially during times of uncertainty. Wars start and end, centuries change, but metals stay the best safe haven assets to invest in. Why are they so important to investors? Let’s find out.

Investing in gold (XAU)

When you plan to invest in gold, do not expect to buy or sell a physical piece of bullion. Instead, you will make operations with the spot price of gold. This price can be driven by various factors and reflect global changes across the markets. Let's find out why choosing gold is good for your investment strategy.

The yellow metal has taken an important part in the financial markets for a long time. In previous ages, it was used to support fiat currencies. During the gold standard period, paper money had to be backed up by an equal amount of gold in a country’s reserves.

From the 1980s tothe early 2000s, interest in this precious metal was very low due to rising stocks and strong,stable growth of economies. The price of gold was situated between approximately $300 and $500 throughout that period. Interest in gold grew after the financial crisis of 2008. The price even reached $1907 in August of 2011. A recovering US economy, as well as Fed rate hikes have weakened gold since 2013, but the precious metal continues to attract investors.

Why do investors choose gold?

It is a safe haven asset that remains stable in uncertain times, including declines in the investment market, extremely high national debt, weak currency, high inflation, war, and social instability.

The history of the gold standard makes gold behave more like a currency than a commodity.

Gold acts as a subject of speculation.

Gold is universal: it is durable, portable, and widely accepted.

Factors that influence gold’s price

Unlike the key currencies, gold is not supported by levels of employment, production, and infrastructure. It is comparable to other assets like oil or corn in that they all have physical characteristics. However, the price of gold usually acts independently of its industrial supply and demand.

Here are the most important drivers of gold's price:

Central bank reserves. Central banks hold the yellow metal for diversification purposes. Gold can also be used to fund emergency liquidity or currency interventions. In addition, central banks pay attention to the economic conditions of a country when deciding to buy or sell gold. For instance, if a central bank decides to diversify its monetary reserves, the price of gold rises.

Risk aversion. The sentiment in the equity market also plays an important role in the price of the yellow metal. If the risk-off dynamic increases, investors prefer to sell their stocks and turn to the safer and more stable gold.

Central banks’ interest rates. This is a historical factor that affects the price of gold. When real interest rates are set to a low level, investment alternatives can provide a low or negative return, pushing investors toward gold. If the interest rates are high, the investment attractiveness of a safe haven asset decreases.

USD dynamics. As gold is priced in US dollars, there is a huge inverse correlation: that is, they move in opposite directions. If investors are selling the greenback on the market, gold becomes more attractive and, as a result, more expensive. Alternatively, if the USD strengthens, gold prices tend to fall. However, you should know that this doesn’t happen in all cases. It’s mostly a feature of times of crisis and huge uncertainties in the economy.

The Consumer Price Index tends to correlate directly to changes in the price of gold. If inflation is high, investors look for more reliable assets, so they choose in gold. Otherwise, if economic conditions are good, the demand for gold declines and the asset becomes cheaper.

Gold-producing countries. Political uncertainties in the gold-producing countries, as well as the sanctions applied to them, can affect levels of gold production and, therefore, increase its price. However, as there is no widely known official document that represents the level of production to investors, this factor is the least informative for investment purposes.

Investing in silver (XAG)

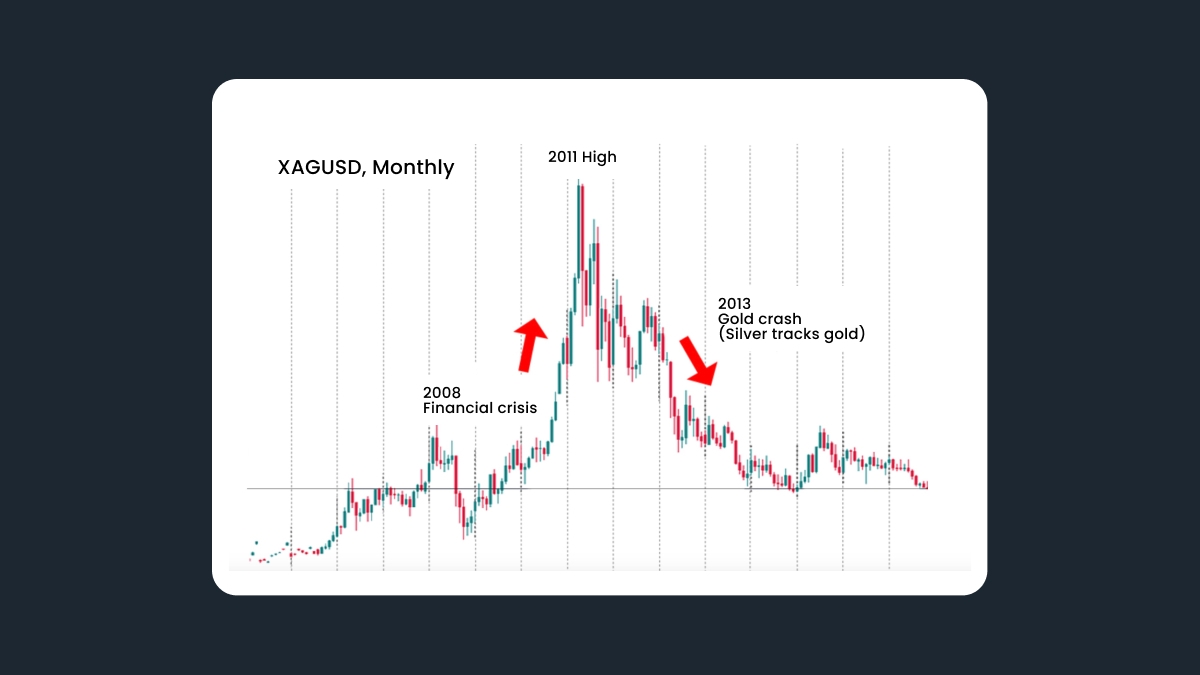

Silver is the second-most popular metal among investors. Like its yellow brother, it has been considered a currency for a long time. For example, the British pound is called a “pound” because it was equal to a pound of sterling silver. Most of the factors affecting the price of silver are similar to those impacting gold, and the price dynamics of the two assets are similar, but there is a slight difference in volatility: silver is less volatile than gold.

Investing in platinum (XPT)

Platinum is the rarest metal used for financial purposes. Its price is mostly dictated by industrial demand and the mining process. As production is concentrated in fewer countries than gold, the volatility of platinum is higher than that of any other metal market. Moreover, it tends to be more affected by world uncertainties than other metals are.

Investing in copper (XCP)

Copper is a soft red metal that is in limited supply. People use it in piping, electrical wiring, car radiators, and other essential things. Due to fast industrialization and electrification, the demand for copper has increased massively.

If you want to invest in copper, you can do so directly or indirectly. In the first case, you can buy bullion bars or copper coins and hold them as long as the price of copper is strengthening.

You can also invest in copper futures. An investor can either buy or sell a certain amount of copper on a specified expiration date.

In the case of indirect investment, you can buy stocks of copper-producing companies, such as BHP Group, Southern Copper, or Freeport-McMoRan. There are also copper ETFs that track the price of copper. They can hold copper bullion, copper futures, or stocks of copper miners. Other options for indirect investment in copper are copper mutual funds and options.

Like the price of any other commodity, the cost of copper is driven by supply and demand. It's also highly dependent on global economic activity. There is a notable correlation between Chinese GDP growth and the price of copper, since China accounts for the largest share by far of global demand for coil.

Another interesting correlation is between copper and oil prices. The copper price will rise following an uptrend in oil prices due to the uptrend’s energy consumption.

Below you can see the uptrend in copper futures since 2021.

Investing in palladium (XPD)

Palladium is a metal that is similar to platinum. It's a necessary element for producing electronic products and catalytic converters for automobiles. It's also used for developing carbon monoxide detectors.

If you want to invest in palladium directly, you can buy it at its spot price or via a futures contract. You can also trade palladium as Contracts for Difference (CFDs).

Among the primary factors driving the price of palladium are supply and demand. Since drivers have switched from diesel-run cars to petrol vehicles, which use palladium in their catalytic converters, the perturbations of the car industry affect the price of palladium as well.

On the chart below, you can see the weekly performance of palladium from November 2021.

To conclude, investors choose metals as safe assets during times of instability. These assets can bring a more stable profit and are less affected by changes in markets.