Let's start with the basics: Forex, or FX, is a foreign exchange market where currencies are traded.

Every currency is usually abbreviated and contains three letters. Generally, to help traders recognize them without learning every name by heart, the first two letters represent the country name, and the third is the currency name. For example, USD stands for the United States dollar, GBP is the Great Britain pound, etc.

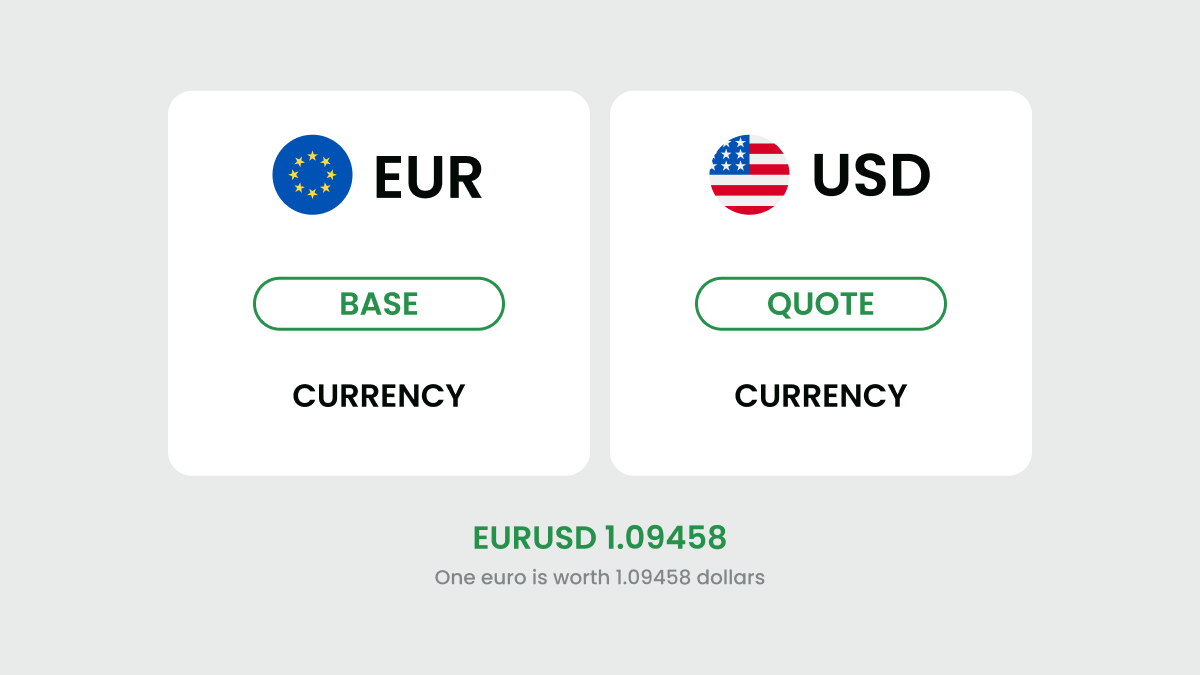

When you first start learning about Forex trading, you'll see that currencies are traded in pairs: EURUSD, AUDCHF, NZDJPY, etc. When placing an order on Forex, you buy the first (base) and sell the second (quote) currency. For example, if you pick the EURUSD pair to purchase, you buy the euro and sell the dollar.

What are base currency and quote currency?

The base and quote currencies are parts of the FX pair – that's it! Forex currency pairs have a very simple structure: the first one is the base currency, and the second one is the quote currency, also known as the counter currency. The price you see in the market is always the current Forex base currency value against the quote currency value. For example, if the EURUSD rate is around 1.22, one euro amounts to ~1.22 US dollars ($1 and 22¢).

In a pair, one currency will be stronger than the other. However, the currency strength is not constant and can change for various reasons; these are usually important financial events in the region. This is why comparing the currencies and valuing them against each other makes sense.

Types of pairs: majors, crosses, and exotic

Major currency pairs

Most popular Forex pairs, also known as majors or major currency pairs, take up most of the trades on the market:

As you can see, all Forex major currency pairs include USD and another very common currency. Together these amount to about 75% of all trades – hence the name. Majors are the most tradable currencies due to their high liquidity and normal volatility. As a result, spreads on trading forex major pairs are lower than on cross or exotic pairs, making them the best trading currency pairs.

Cross currency pairs

The popular currency pairs made up of major currencies other than the US dollar are usually called cross pairs. However, these pairs still include some of the most traded currencies, like EUR, GBP, AUD, CAD, NZD, CHF, and JPY:

When these currencies are traded, they get converted through the American dollar, which means a trader makes two transactions and could face losses. Even though USD is still extremely popular on the market, the popularization of Forex trading has made cross-pair trading more common and convenient.

Exotic currency pairs

Another category of FX currency pairs is exotic. Generally, one currency used here is a popular one, like USD, and the other is rare, usually a currency of a developing or emerging economy. FBS offers 44 exotic pairs to trade. Here are some of them:

Check out the full list of exotic currencies.

Importance of currency pair types

These categories usually reflect the liquidity and volatility of the currency pairs.

Liquidity and volatility are the two main factors the type of currency pairs affects.

Liquidity shows how interested other traders are in this particular pair. More popular pairs (e.g. major pairs) have higher liquidity. As a result, you can easily buy and sell EURUSD in large quantities without risk of slippage.

Volatility is the range of value of a price within a certain period (day, week, month, etc.), which shows the currency's stability. It depends on the number of orders with this particular currency on the market, economic well-being in the region, and certain macroeconomic events.

Currencies with lower liquidity have higher volatility and vice versa. Usually, the less popular the pair, the higher its volatility. High volatility can be a risk for traders, although it may bring a bigger profit: it all depends on your trading style and strategies.

To be a better trader, you should always be aware of these aspects.

Traders should analyze the behavior of major currency pairs and other types of currencies (cross, exotic). It will help them understand which currency will be the strongest and which will be the weakest in a certain period. Based on this information, a trader can correctly build a trading strategy.

Moreover, since major currencies are less volatile and have more liquidity, they are more suitable for scalpers and daily traders. In contrast, the cross and exotic currencies are ideal for swing traders due to increased volatility.