Picture a charging bull with its horns stuck forward and upward. When sellers are in control of a market and the price is growing steadily, you’re looking at a “bull market.”

Aug 07, 2025

Basics

Picture a charging bull with its horns stuck forward and upward. When sellers are in control of a market and the price is growing steadily, you’re looking at a “bull market.”

Definition of bull market: a period of generally rising prices and investor confidence.

Investors mostly see a bull market as a positive trend. Here are its main features:

Rising asset prices.

Investor confidence.

Economic growth.

Low unemployment.

High trading volume.

Positive sentiment.

Increased mergers and acquisitions.

Low interest rates.

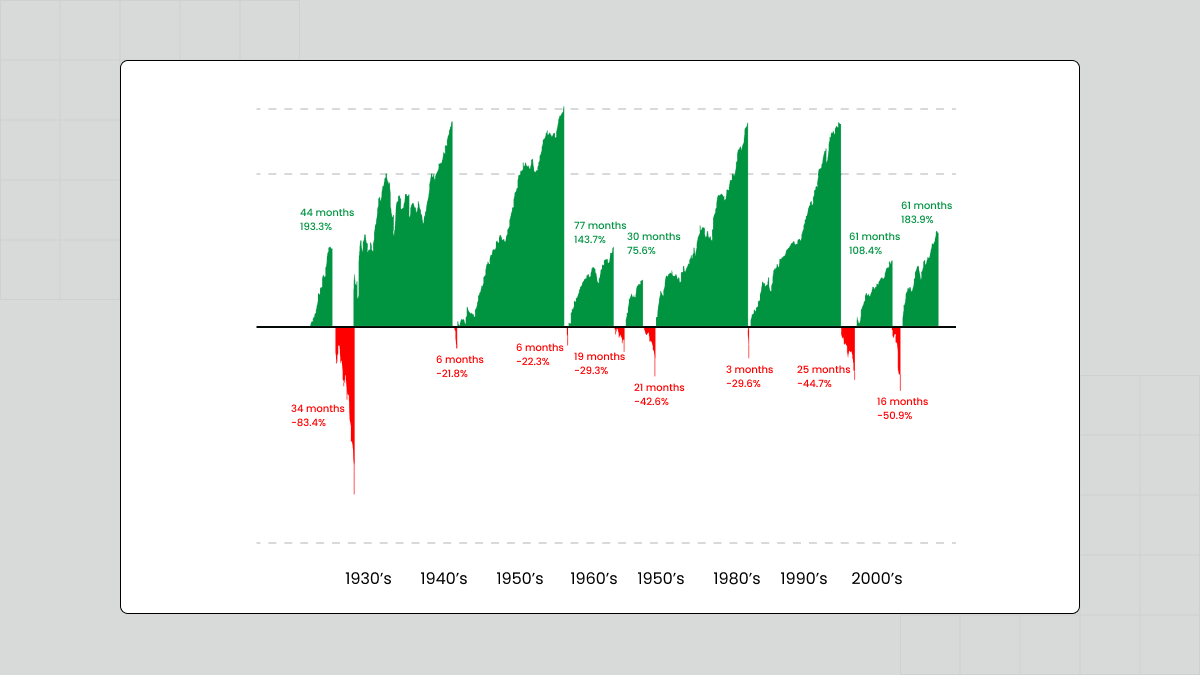

A bull market occurs against the backdrop of a positive political and economic environment. It is a period of growth and confidence fueled by good news. But bullish trends can’t last forever, and the market is no stranger to dramatic turnarounds. As history shows, however, the market tends to heal itself, resulting in new growth and chart slopes with new highs higher than the previous ones and new lows never falling back to the earlier levels.

Look at the two-year APPL chart: the steady inclination you see is a bullish trend.

Another example is Bitcoin, arguably the world’s top cryptocurrency known for its dramatic behavior changes. Here, BTCUSD is showing significant bullish trends with sudden downfalls – bearish trends, the opposite of a bull market.

This happens constantly in trading.

A bull market can last up to several months. But no matter how long a bullish trend gets, it always ends with a bearish one. And this is a good thing.

If we zoom out, we will get a broader scope of the market and see that the whole bullish/bearish trends cycle is part of a larger bullish trend.

One of the best ways to look at the market is to consider it a fractal, where smaller-scale events are exact copies of larger-scale events. And the larger trend — the prevailing trend — is a bull market. Within this ever-growing bullish market, you can stumble upon smaller periods of bullish trends followed by bearish ones, and then the cycle repeats itself.

Bull markets are considered, on the whole, favorable for investors and the economy. The rising asset prices in these periods lead to high investment returns. But! What goes up must come down, and if you lose sight of that, you risk losing on unexpected downturns.

Overvaluation. Riding the momentum of a bull market, a price may rise higher than the actual value of the asset. When the price goes back to corresponding to the asset’s true value, the market will correct, and may even crash.

Complacency. You get used to the market rising and rising, day in and day out, and you abandon diligence. You may overlook warning signs, and become lax at risk management.

Excessive leverage and margin trading. Investors very often rely on these things to maximize their haul while the getting’s good. But if the going gets tough, especially if you didn’t expect it to, you’ll be in for redoubled losses instead of redoubled gains.

Geopolitics, economic downturns, and market shocks are something that no market is immune to — even a bull market.

If you invest in a bull market, you’re positioning yourself for a pretty sweet ride on its upward momentum as long as you manage your risks properly.

Build a diversified portfolio including various asset classes, based on your goals, risk tolerance, and strategy.

Market hype is your enemy. You’re looking for an investment with truly competitive advantage within its industry. Look at fundamentals and earnings growth.

The most surefire way to protect yourself against the slings and arrows of the market is to diversify your portfolio.

The other universal method is setting stop-losses.

Don’t rely too much on leverage and margin trading.

If you’re not sticking to your strategy, and instead reacting emotionally to every fluctuation, you’re most likely going to snatch defeat from the jaws of victory over and over.

Market trends, geopolitical news, and economic indicators are all things you need to be on top of at all times.

Investing in a bull market can be stripped down to a few go-to tips, including:

Stick to a quality portfolio.

Follow your financial plan.

Continue to build your gains.

Take a gradual approach to investing and selling.

Be on the side of market momentum.

Use options to hedge your risk.

Traditionally, a bull market is considered a favorable time to invest. However, one must take note of risks that may occur, as bullish markets tend to give way to bearish trends, resulting in financial losses.

Investing in a bull market can be advantageous as rising stock prices and positive investor sentiment typically characterize it. However, investing in a bear market can also present opportunities, as stock prices are generally lower and may offer attractive entry points for long-term investors.

Consider your risk tolerance, investment goals, and time horizon when deciding whether to invest in a bull or bear market. Diversifying your portfolio, seeking professional advice, and staying informed about market trends can help you make informed decisions regardless of market conditions. Ultimately, the decision to invest in a bull or bear market should be based on carefully considering your financial situation and investment objectives.

Usually, bulls — bull market investors — focus on growth-oriented assets such as stocks, particularly those of companies with solid fundamentals and potential for future earnings growth. Other sectors that do well in a bull market include technology, consumer discretion, and health care. Some bulls consider investing in exchange-traded funds (ETFs) that track broad market indexes or specific sectors.