In October and November, Bitcoin experienced a significant decline. This wasn’t due to technical patterns or irrational panic, but the result of a chain of connected events.

1️⃣ MSCI: The Silent Alarm

MSCI determines which companies are included in global indexes that are followed by many investment funds.

On October 10, MSCI announced it was considering excluding companies with more than 50% of their assets in cryptocurrencies.

This affected companies like MicroStrategy (MSTR), which holds a large portion of their treasury in BTC.

Why does this matter for BTC price?

If MSCI excludes these companies, funds that track MSCI indexes would need to sell their shares.

Those sales would indirectly impact BTC, because companies with large BTC balances might have to adjust their positions.

2️⃣ U.S. Liquidity: The Amplifier

At the same time, the lack of liquidity in U.S. markets has had two main causes:

1. Treasury (Primary Market, under Scott Bessent as Secretary): Since July, the U.S. Treasury, led by Scott Bessent, has carried out a massive short-term debt issuance. Around $500 billion in bonds were sold, raising the Treasury's account balance to nearly $800 billion. This withdrawal of dollars from the system occurs because buyers of that debt deposit their money in the Treasury's account, absorbing liquidity that stops circulating in markets such as Bitcoin

2. Fed (Secondary Market, QT):

Simultaneously, the Federal Reserve maintained its “Quantitative Tightening” (QT) policy: it let bonds and MBS from its balance mature without reinvesting that money, and occasionally sold assets directly. When the Fed removes bonds from the secondary market, the dollars it receives are temporarily eliminated from the financial system, amplifying the liquidity drought.

The result?

With money absorbed by the Treasury's issuance and liquidity drained by the Fed, the market was left "dry." There were not enough dollars to absorb selling pressure, and Bitcoin fell faster and deeper.

3️⃣ JPMorgan: Public Confirmation

On November 20, JPMorgan published a report noting that excluding MicroStrategy (MSTR) from MSCI indexes could trigger billions in forced sales.

This increased bearish pressure pushing BTC below $90,000.

The report acted as a reminder that “this risk is real” and accelerated investor capitulation.

It’s also worth noting that the report may have had a manipulative intent.

Lesson: In today’s crypto ecosystem, news about key companies and macro conditions can directly affect prices, even if the event isn’t specific to Bitcoin, as BTC is now part of institutional investment assets.

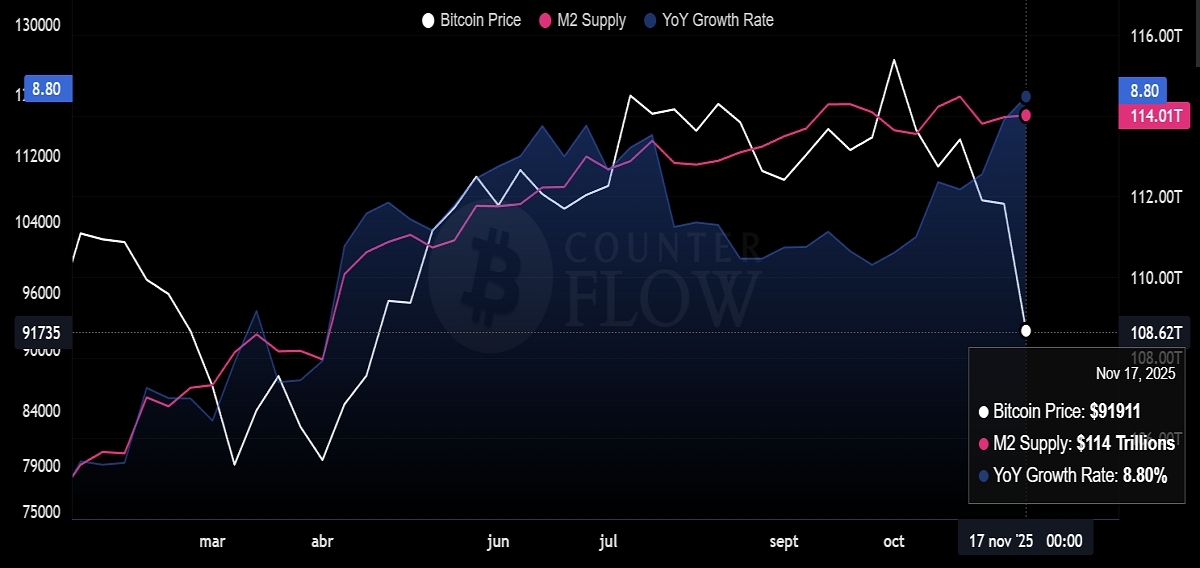

BTC Correlation with U.S. Liquidity (M2)

BTC has historically shown a lagged correlation with the U.S. M2 money supply of about 12 weeks. However, this relationship was interrupted when Bessent started reducing system liquidity. Once the operation is complete, this correlation may recover.

Source: https://bitcoincounterflow.com/

BTCUSD, H4

After breaking previous monthly volume support zones, BTC reached levels seen in April. The bearish bias remains, as no key resistance has been broken yet.

The price may start consolidating, forming an accumulation floor around $80,000 and aiming to break the H4 key resistance at $93,064–$93,074. Breaking this level would be the first sign of recovery.

For now, as long as BTC stays below $93,000, consolidation testing $80,000 is possible, with a potential drop to the volume node around $77,200.