How to choose a stock

Choosing a stock to invest in? Wonder how to make wise decisions that will benefit you? Here are some key factors to take into account.

-

The company’s performance is without doubt the most crucial point. Check their revenue and profit (you can use public financial reports).

-

Industry trends are also important. Is the industry growing? If so, how fast? What might the hidden pitfalls be? For example, the fintech sector is growing rapidly, but there are some risks to consider (covered later in the article). Do the research and monitor the news of the industry you are interested in.

-

Some companies pay dividends to their shareholders, which means more profit for you.

-

A company with too much debt will probably struggle if business slows down, which will inevitably affect your investment. Choose the dominating companies on the market — their stocks are less risky to invest in.

-

Market conditions can (and usually do) affect stock value. Stocks tend to rise when the economy is strong, but during a recession, many stocks may fall in price. That is what happened to many companies during the COVID-19 pandemic.

Choose a stock and invest with FBS!

Inter (INBR32)

Inter is a fintech company, and one of the leading digital banks based in Brazil. It has been actively expanding its product offerings lately. Inter provides not only banking services, but also foreign exchange, insurance, loans, digital checking accounts, and investment products. The bank works with private and corporate clients through a user-friendly platform, authorized by the Central Bank of Brazil. Intel’s indicators show considerable growth and profitability.

Why invest in INBR32? Financial analysts expect the fintech space to expand significantly in the near future. Technology and the ability to offer a seamless digital banking experience are Inter’s strategic priorities, which makes the stock a perfect choice for investors interested in high-end fintech assets.

Consider the following factors about Inter.

-

The company continuously grows, expanding into new financial services sectors.

-

Inter has a strong customer acquisition strategy with which it attracted over 30 million customers by the end of 2023. The number of its clients continues to increase, which ensures the company’s growth and profitability.

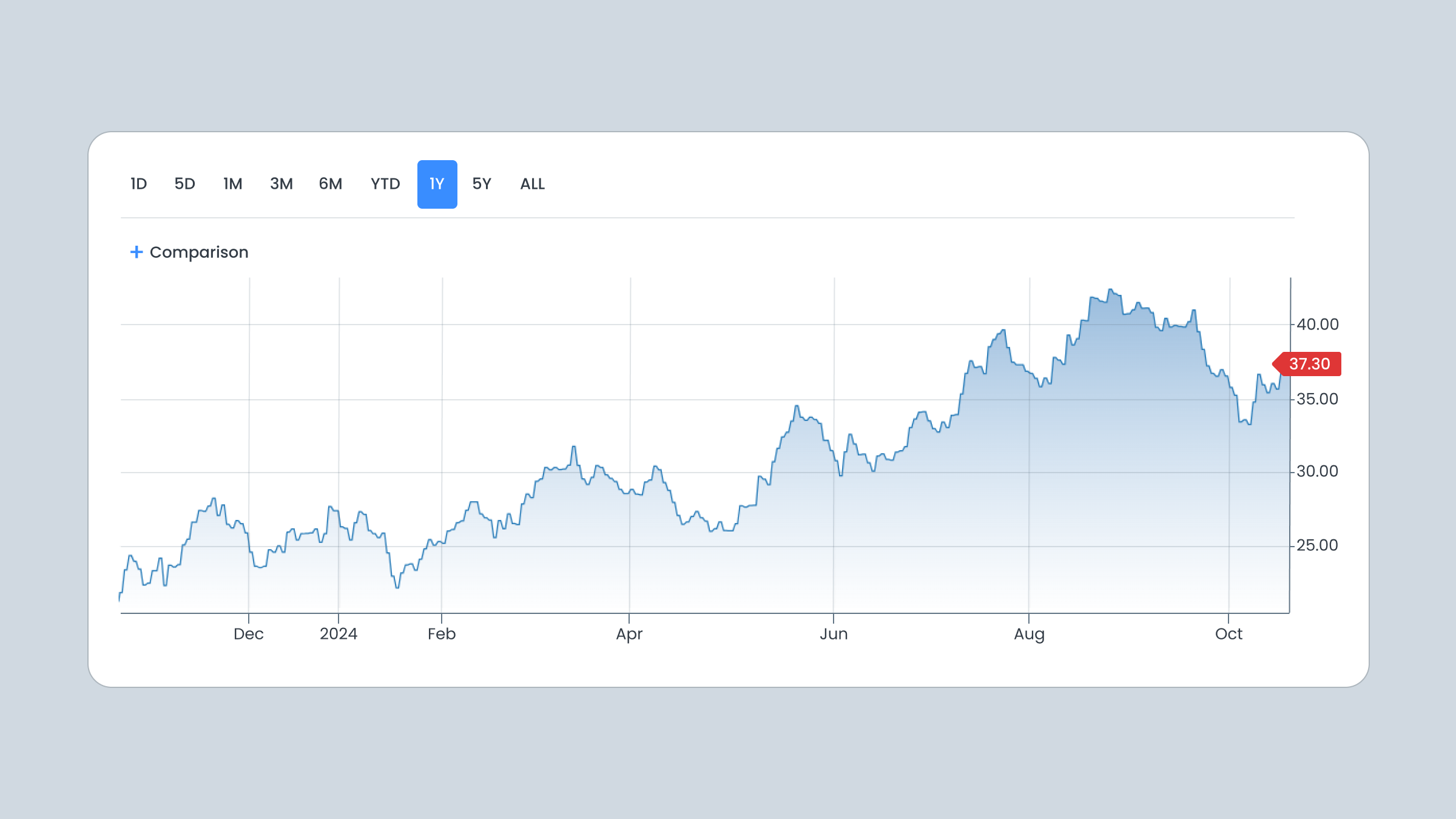

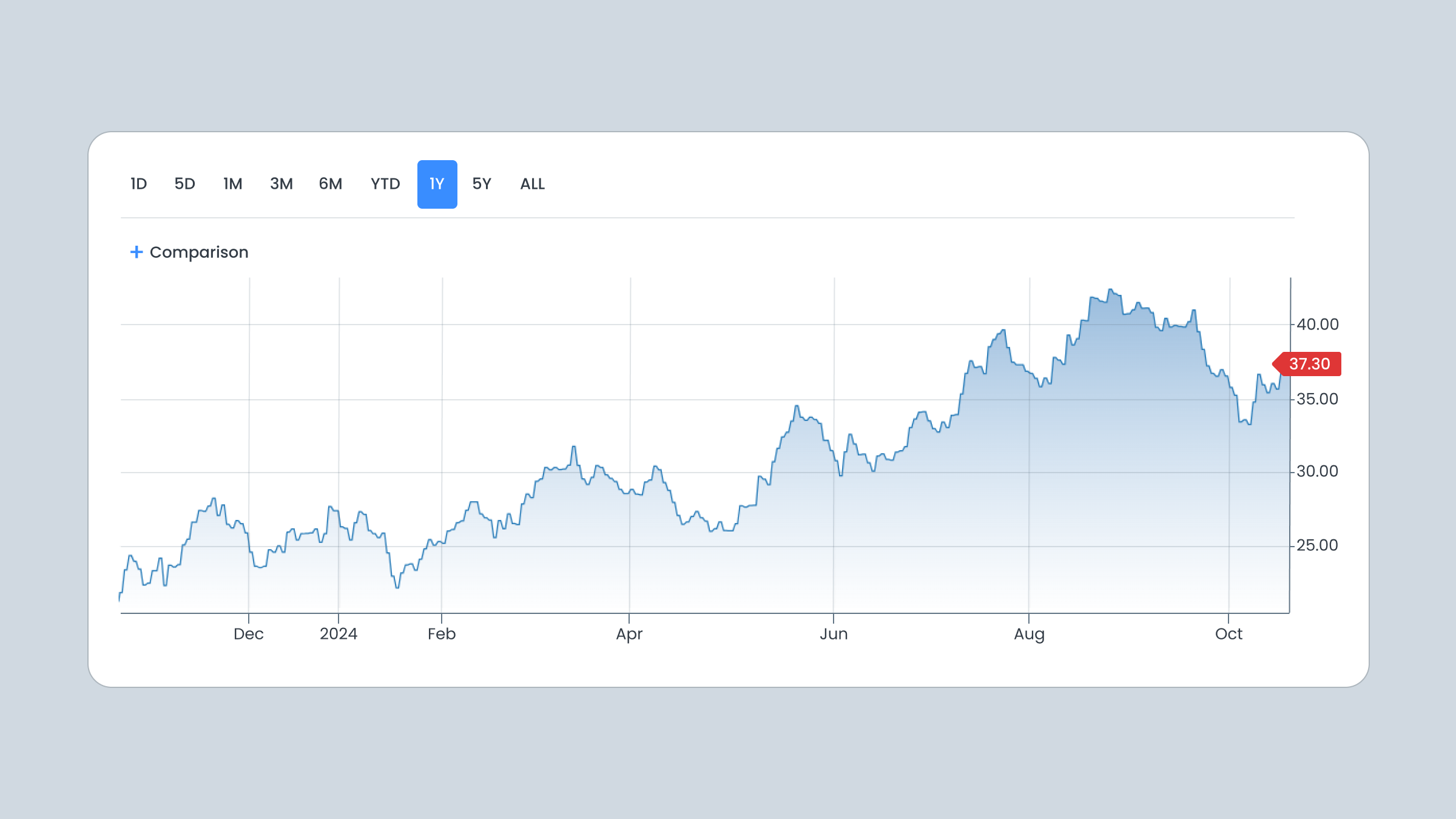

The graph below shows Inter’s stock dynamics throughout the year.

While offering opportunities, investing in a fintech company has its risks.

-

Macroeconomic problems like high inflation, staff layoff, and unemployment have significantly affected the fintech sector.

-

Fintech companies use top-notch technology but still have their fair share of cybersecurity threats, because of the pure digital nature of their operations. Email phishing, DDOS attacks, and other cybersecurity issues can harm the company and therefore your investment.

-

Fintech is an ever-growing industry, which is a good thing, but it leads to regulatory concerns. The problem is that the regulations are often changed and sometimes it is difficult for companies, especially start-ups, to keep up to date with them. Another problem is different regulatory rules in different countries — a factor to consider when we deal with cybersecurity and client privacy.

Prio (PRIO3)

Prio is one of the major companies in the oil exploration industry. Prio has shown growth, expansion, and stability, given the changing energy prices in recent years.

Why invest in Prio? It is a promising opportunity: the company has strong financial performance, good valuation metrics, and positive analyst sentiment.

-

Its revenue and net income have grown significantly. The company’s revenue growth rate shows a 114.10% quarterly year-over-year increase. This is a sign of strong business expansion.

-

The stock has a high return on equity (ROE) and return on assets (ROA). ROE shows how much profit the company is making from investors’ money, while ROA tells how much money it makes from all the assets, not just investments. PRIO3’s ROE and ROA are very good: 39.57% and 16.50% respectively. These indicators are significantly higher than the average in the industry.

-

There is a positive sentiment among analysts, who expect the stock to grow up to 63.79 BRL on average in the next year.

BTG Pactual (BPAC11)

BTG Pactual is a leading investment bank and asset manager dominating Latin America. It offers investment banking, asset, and wealth management services. What makes it a promising investment?

-

The bank has shown consistent earnings during various economic periods. Its strong market position and profitability attract investors.

-

People looking for environmentally friendly investment opportunities might be interested in BPAC11. The bank takes part in carbon removal projects and has signed a reforestation contract with Meta recently, which shows an initiative to maintain sustainability and a green economy.

Potential risks to look out for:

-

regulatory rules in Brazil are changing, so it is important to double-check if everything falls into line with the latest regulations;

-

capital markets are volatile, which poses an additional risk to investors.

Mills (MILS3)

Mills provides specialized engineering services for the construction sector in Brazil. The construction industry in the country is developing rapidly, so MILS3 can be a good choice for an investor who wants to put their money into infrastructure projects.

Is MILS3 a good buy?

-

Mills has a high dividend yield of about 2.61%, meaning you can earn money aside from the profit made in the stock. The dividend has grown steadily over the past decade.

-

The company shows stable revenue growth with a 3-year revenue CAGR of 8.8%. The net income has also been on the rise: a 3-year net income CAGR is 1.8%.

-

MILS3 takes part in government infrastructure projects and not only has a lot of branches in Brazil, but is also actively expanding into neighboring countries of Latin America.

On the downside, economic decline affects infrastructure and, in turn, the investors’ profits. To make a decision, closely monitor the economic situation in the chosen industry.

Priner (PRNR3)

In the last quarter, Priner has met the estimated figure of 206 million BRL in revenue, which shows stability and strong financial performance.

-

Priner’s revenue for the last quarter was 206.00 million BRL, with an estimated figure of 206.00 million BRL, indicating stability.

-

The recent surge of 33% in the share price indicates a positive market response and investors’ confidence.

-

Priner has a dividend yield of 0.58%, with a payout ratio of 19.62% in 2023, which is relatively low, but the company’s dividend policy targets a consolidated dividend payout ratio of 40% as a medium-term target, which shows the company’s tendency to maintain financial health, as well as its commitment to returning value to shareholders.

-

Primer has growth potential: the company operates in diverse sectors such as petrochemical, pulp and paper, steel, offshore, naval, mining, and infrastructure.

What are the risks?

Priner’s net income was −5.00 million BRL in the last quarter, which is a significant decrease from the previous quarter’s net income of 1.57 million BRL. However, overall financial health and strong market presence are good signs.

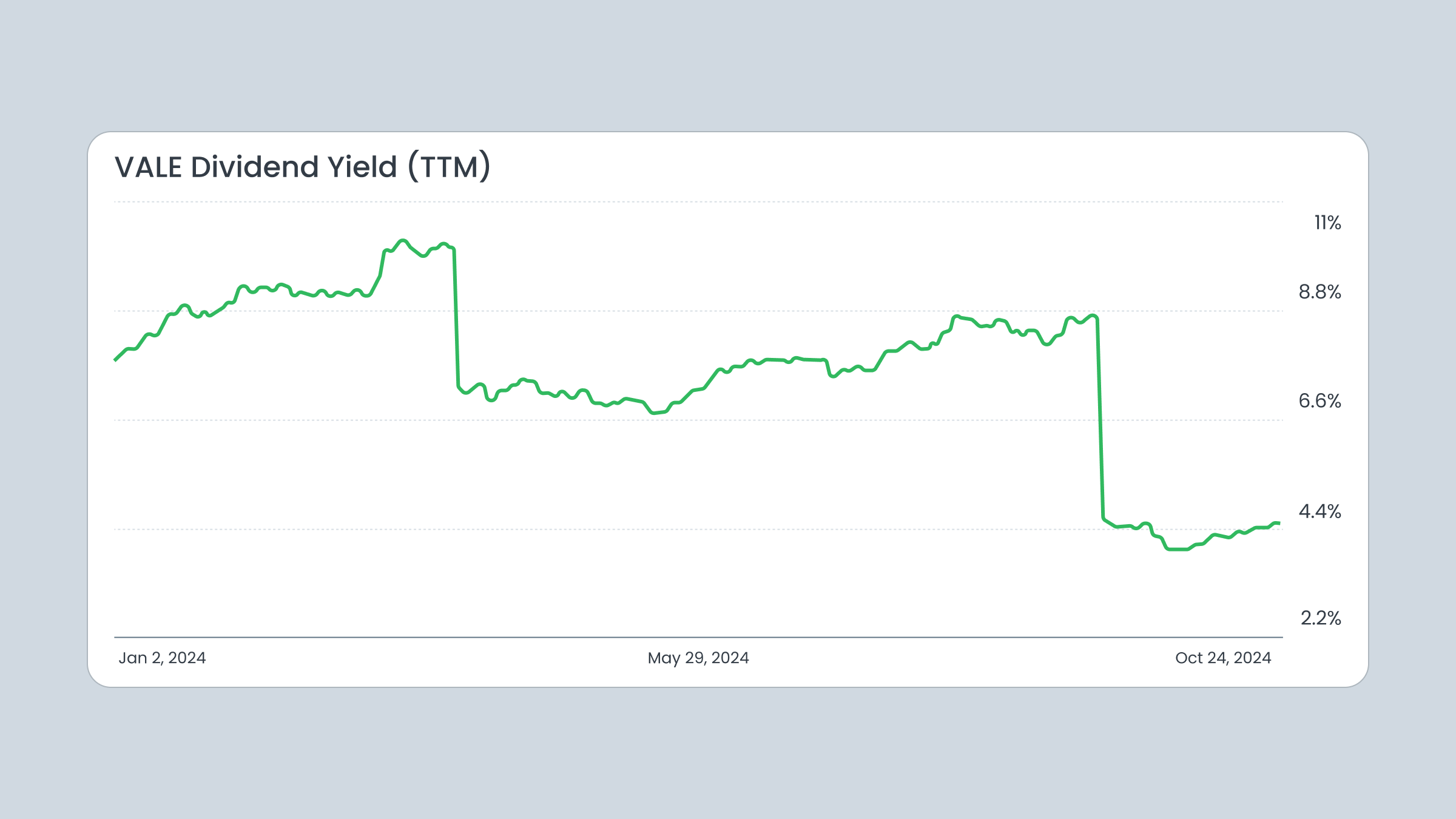

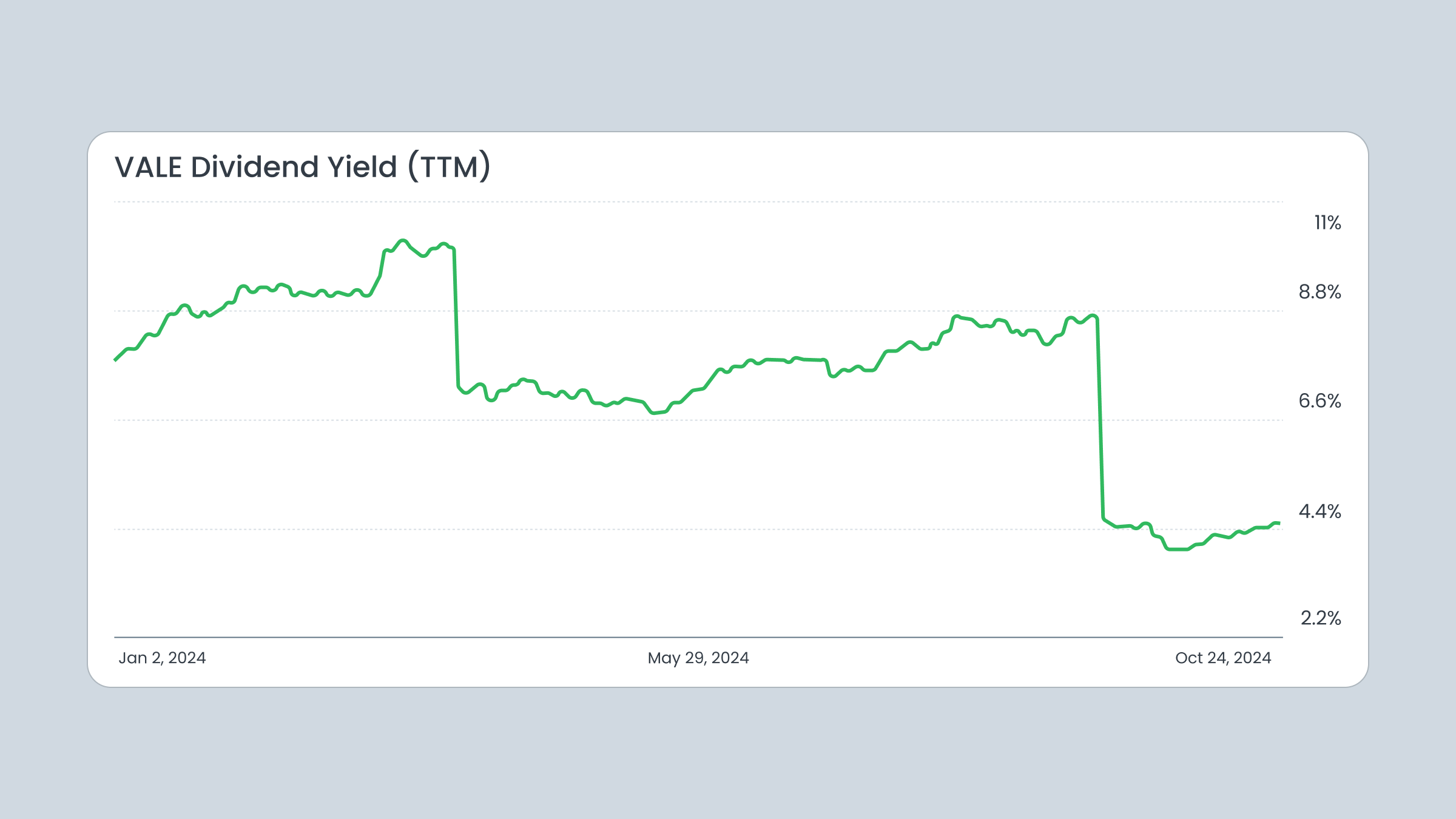

Vale (VALE3)

Vale is one of the biggest mining enterprises in the world. It is widely known for iron ore mining and nickel. Vale stock remains a reliable investment perspective, given an increasing demand for metal in steel and car battery production.

The stock has been volatile recently (October 2024), but there is a positive trend.

-

Vale’s recent financial data shows a net income of $2.77 billion and a diluted EPS of $0.65. The growth rates for net income and EPS are impressive at 198.38% and 66.67% respectively.

-

Vale’s dividend yield is 4.51%, which can be attractive for income-seeking investors.

-

Analysts have rated Vale a "moderate buy". An average one-year price target is $15.5, which indicates a potential rise from the current price.

-

The company’s strategic projects and expansion into energy transition metals make it an investment with strong potential in the long term.

The risks to consider:

-

the stock is trading below moving averages, which is a bearish sign. However, it has the potential to rise if market conditions improve.

-

the stock experienced a 25% price fall because of changing iron ore prices and governance issues.

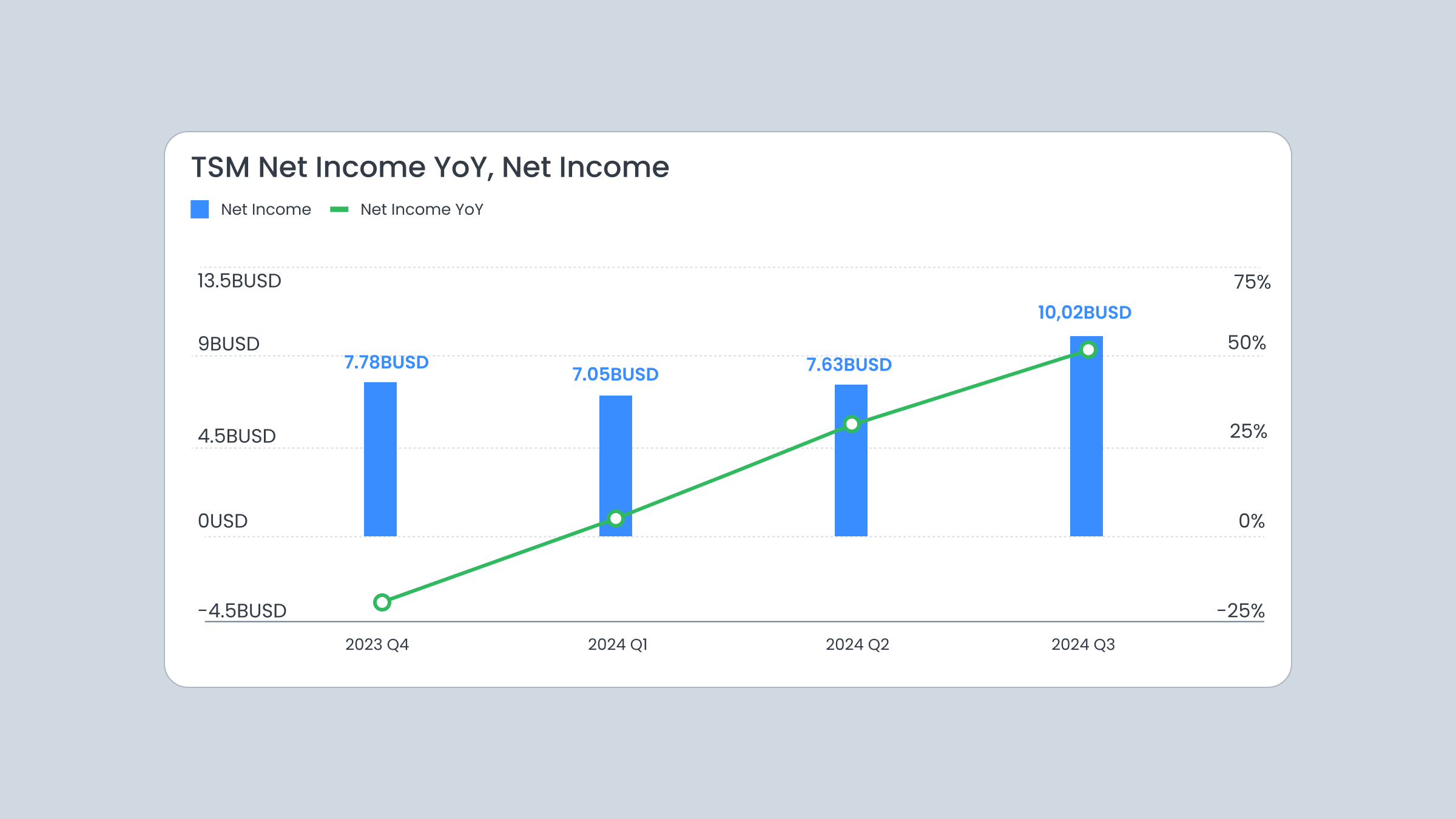

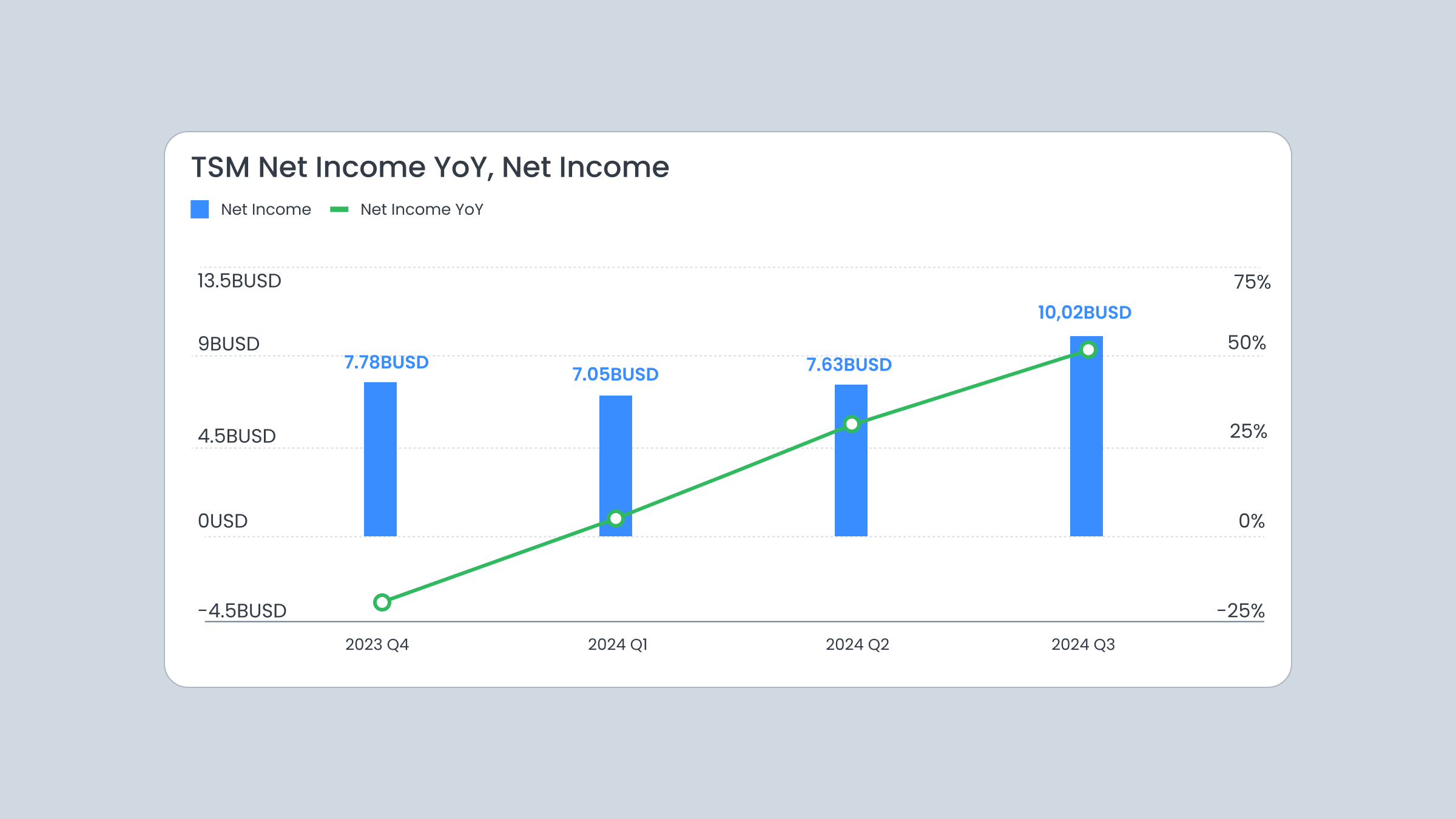

TSMC (TSCM34)

Taiwan Semiconductor Manufacturing (TSMC) is the world’s largest semiconductor supplier. TSMC34 is a good investment idea, mostly because of its strong financial performance, strategic growth initiatives, and dominant position in the chip industry.

-

TSMC offers a dividend yield of 1.1%, which also makes the stock appealing to investors.

-

As for market sentiment, the experts and analysts expect it to grow even more and see TSMC very positively in general.

-

TSMC is considered the leader in the industry.

-

The company’s gross margin improved to 57.8%, reflecting efficiency and profitability.

TSMC’s strong financials, strategic growth, and dominant market position make it a good investment idea.

Sabesp (SBSP3)

Sabesp, the largest Brazilian sanitation company, seems a robust option for investment due to its strong market position and analyst ratings.

Key positive factors:

-

The Goldman Sachs Group rated this stock as a “strong buy”, which demonstrates confidence in the stock’s future performance.

-

The company’s recent privatization can lead to more investment opportunities.

-

Sabesp has a strong market position in Brazil’s sanitation sector. There has been a compound earnings per share growth of 17% over the last three years.

-

Sabesp has a dividend distribution policy with a minimum mandatory dividend of 25% of adjusted net income.

Factors of risk to consider:

-

The P/E ratio is 14.8. It is relatively high compared to the industry average in Brazil.

-

There is no data on the dividend yield yet, which can drive away the investors interested in passive income.

Itaú Unibanco (ITUB4)

Itaú Unibanco is based in Brazil and provides financial services to private and corporate clients in retail and wholesale banking, as well as activities with the market and corporate sectors. This affordable stock can be a good starting point for a beginner investor and an appealing option for a seasoned investor because of its strong financial performance and market position.

Why Itaú Unibanco?

-

The net income of the company is $37 015 million, a significant increase of 18.58% year-over-year. The bank has been expanding its operations and improving its financial indicators lately.

-

The bank has a “strong buy” rating from analysts and the experts give an optimistic forecast about the stock’s future performance. The EPS is $1.03, and the average price target is $35.70.

-

The company has a profitable dividend program. The annual dividend yield is 2.77%.

-

The company has diversified business segments, such as loans, deposits, and investment activities, which suggests stability and potential for further growth.

-

The bank’s technical indicators are showing positive trends (the 5-day, 10-day, and 20-day moving averages).

-

Itaú Unibanco has improved its return on equity and return on assets.

However, there are some factors to consider:

-

The bank’s P/E (price-earnings) ratio is 9.84, which is relatively low, and could be a sign of an undervalued stock.

-

The dividend payout ratio is not provided.

-

Interest rate changes during economic cycles can affect the bank’s profitability.

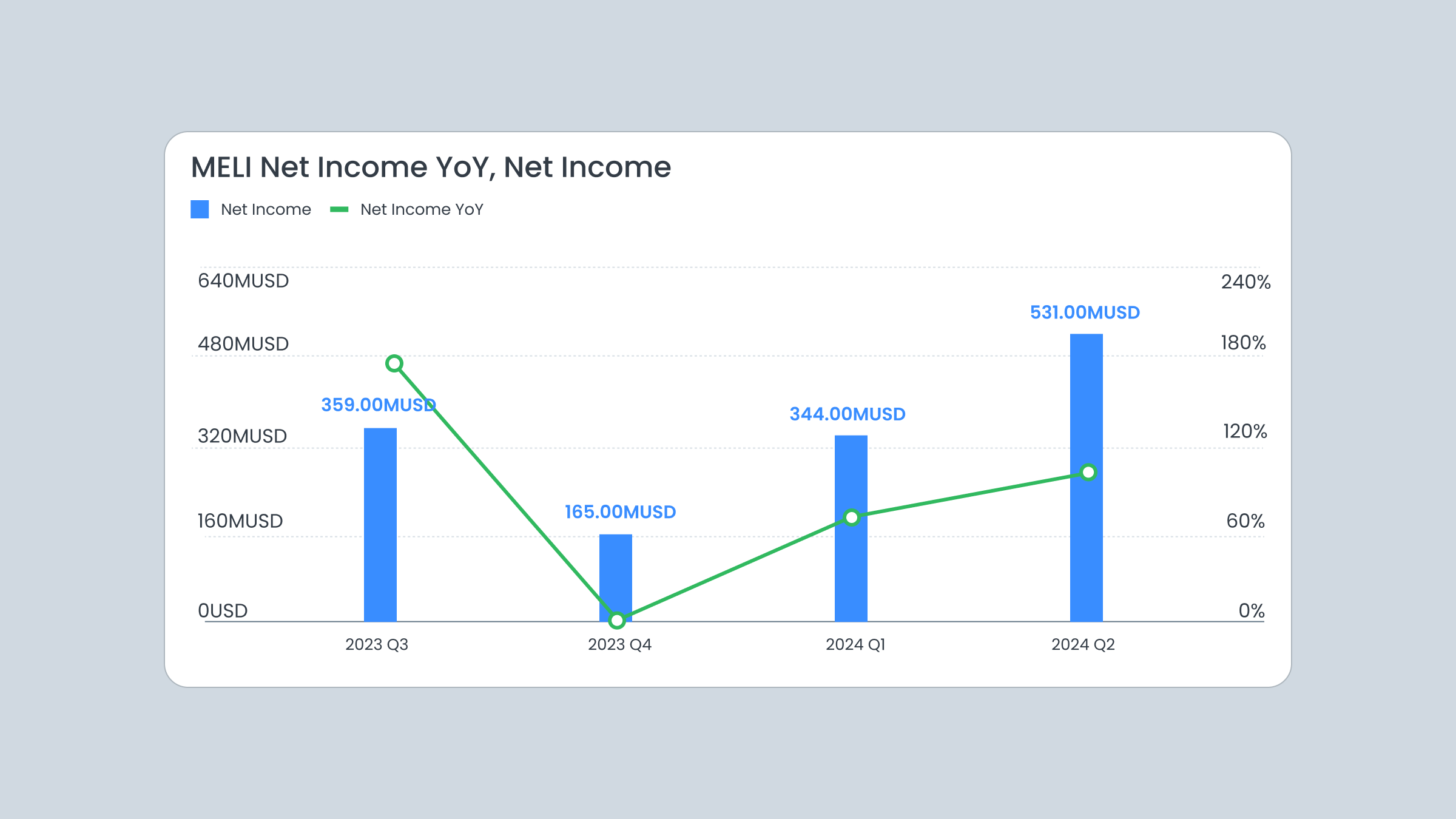

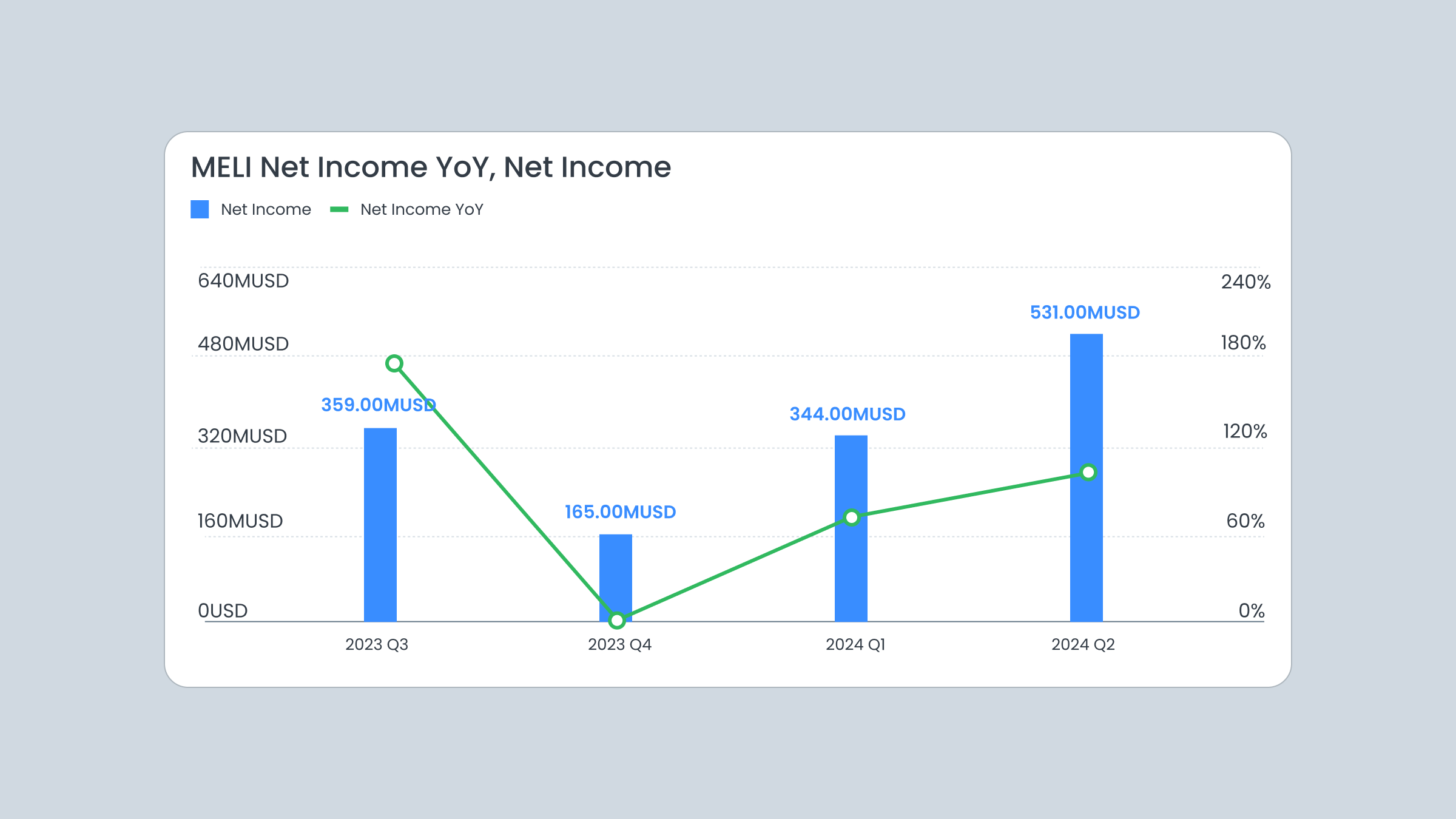

Mercado Livre (MELI34)

Mercado Livre is an Argentinian company operating e-commerce marketplaces and auctions. The company’s financial indicators and performance have shown robust growth.

-

In the second quarter of 2024, the company’s revenue has increased by 41.51%, the diluted EPS (earnings per share) by 54.57%, and the net income by 102.67%.

-

Mercado Livre is a leading e-commerce platform in Latin America. It maintains a leading market position in Brazil, Mexico, and Argentina.

-

There is a positive outlook on the stock’s prospects: analysts give it a “strong buy” rating.

-

It is a financially healthy company with a gross margin of 41.51%, despite the fact that it invests a lot in growth.

A factor to consider:

The P/E ratio is 75.4, which is high, but it can be justified by the company’s strong growth in earnings.

FAQ

What is the difference between saving and investing?

Saving is when you set money aside, while investing is using money to try to earn more money. Investing has the potential for compound growth, which can lead to significant profit over time.

Are stocks and shares the same thing?

People usually use these terms interchangeably. However, there is a slight difference: the word “shares” usually refers to one company. “Stocks”, on the other hand, means different stocks in different companies. “Stocks” is a wider term. It covers ownership in general, while “shares” refers to the specific quantity of ownership in one company.

What are the sectors of the stock market?

There are 11 stock market sectors, including information technology, energy, real estate, medical care, telecommunication, non-essential goods and services, utilities, materials, and others. The variety of sectors allows investors to diversify their portfolios and protect their assets.

When is the stock market open?

The operating hours of the market are from 9:15 am to 3:30 pm on weekdays. If you miss the regular trading hours, after market orders (AMO) can be used.

Why invest in shares?

-

Investing in shares gives an opportunity for high returns if the investor chooses the right stock. It is important to choose between short-term and long-term investments: the former stocks can be volatile, but the latter can give more profit than bonds or savings accounts.

-

Some companies pay dividends to their shareholders that can be reinvested or serve as passive income.

-

Shares can be a means of inflation hedging, protecting your money when the purchasing power of money is decreasing.

-

The stock market is very liquid, so you can buy or sell shares quickly.

-

In some countries, investing in stock gives you tax advantages, such as lower tax rates or dividends.

Is it safe to invest in shares?

No investment can guarantee a profit, so it is always a risk. However, there are ways to protect your portfolio. Choose reliable and regulated brokers and platforms, diversify your assets, and follow the news and major events of the industry closely.

If you are not confident in stock trading yet, practice with a demo account at FBS.