Sometimes it can be difficult for beginners to understand when to sell or buy assets. Experienced traders analyze trading signals and technical indicators for this purpose, such as candlestick patterns that show that the market will rise or fall soon. One such candlestick pattern is the Hanging Man — a pattern that appears in a bullish market as a harbinger of a transition to a bearish trend.

The Hanging Man candlestick’s meaning and significance

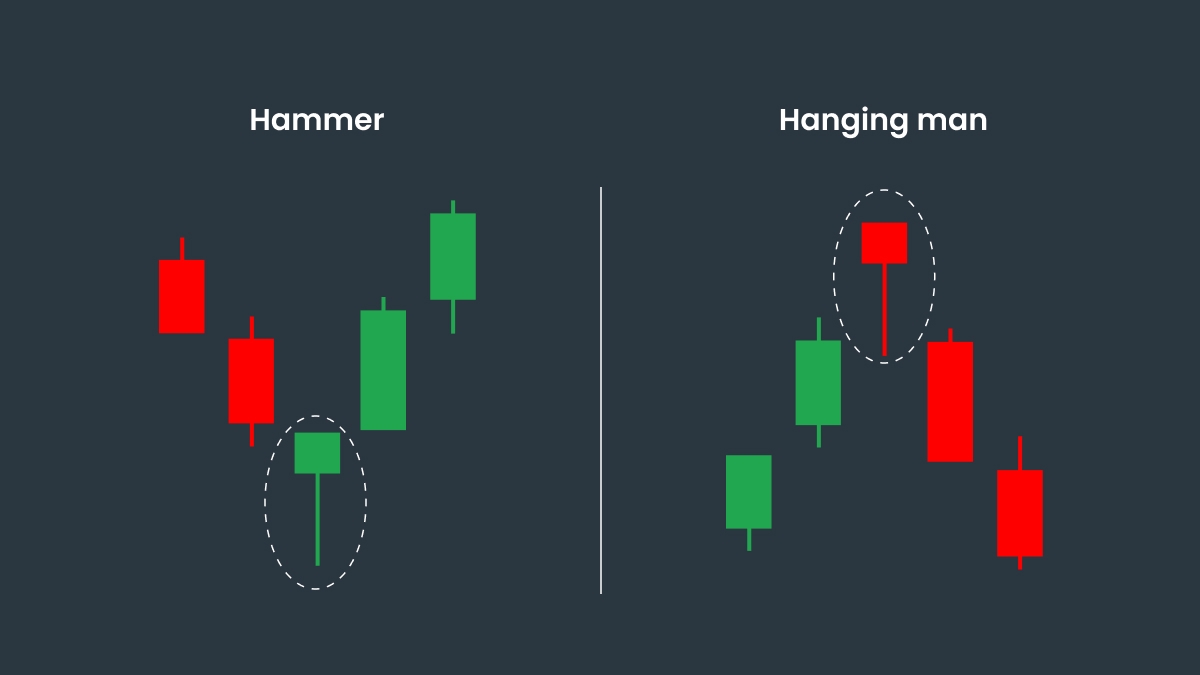

The Hanging Man is a pattern that appears at the peak of an uptrend. It serves as a warning sign that the market is about to reverse and fall.

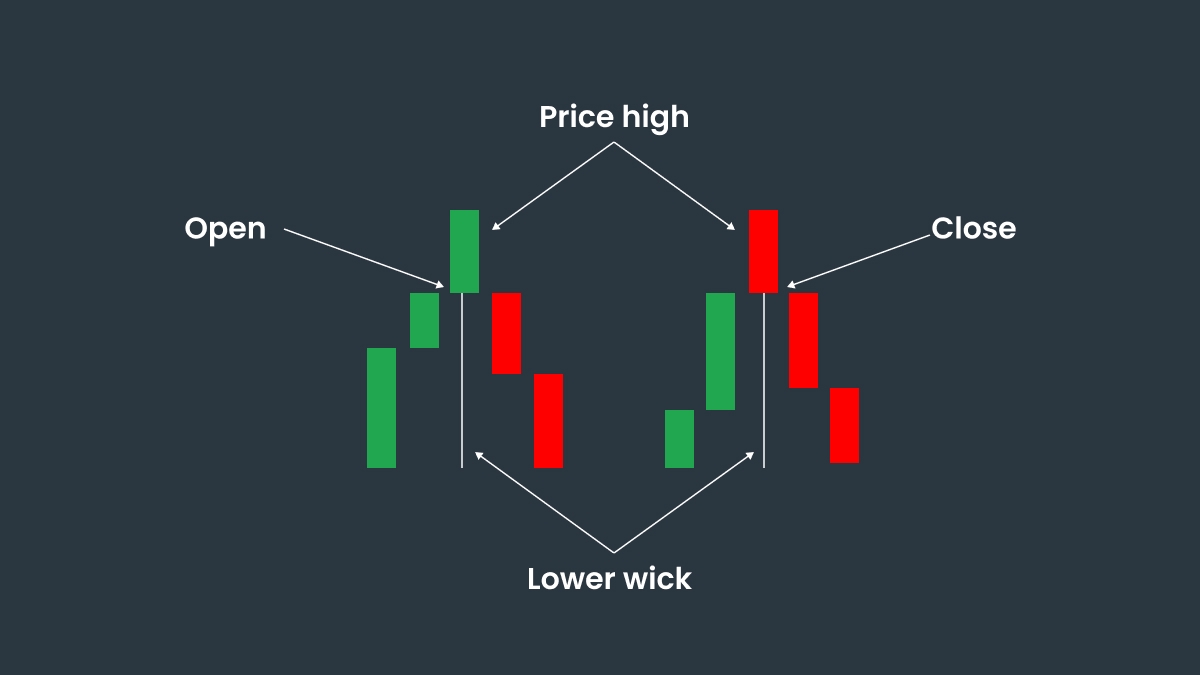

The Hanging Man candle is characterized by a small body and a long shadow (a wick). The long shadow means that during the session the price fell significantly, and the small body indicates that it recovered to the same level as before the opening of the session.

This pattern gets its name from the visual resemblance to a figure with long legs. The Hanging Man candle is not so alarming at first glance because the price has not fallen sharply. But the long shadow is a key indicator that sellers were dominating during the session and that the current trend was weak. A bearish candle after the Hanging Man will confirm that hypothesis. The pattern is especially significant after a long rally or near resistance levels.