However, much depends on the number of active market participants and available liquidity, so a trader must still understand the best time to trade. Their trades may cause volatility and lead to more opportunities.

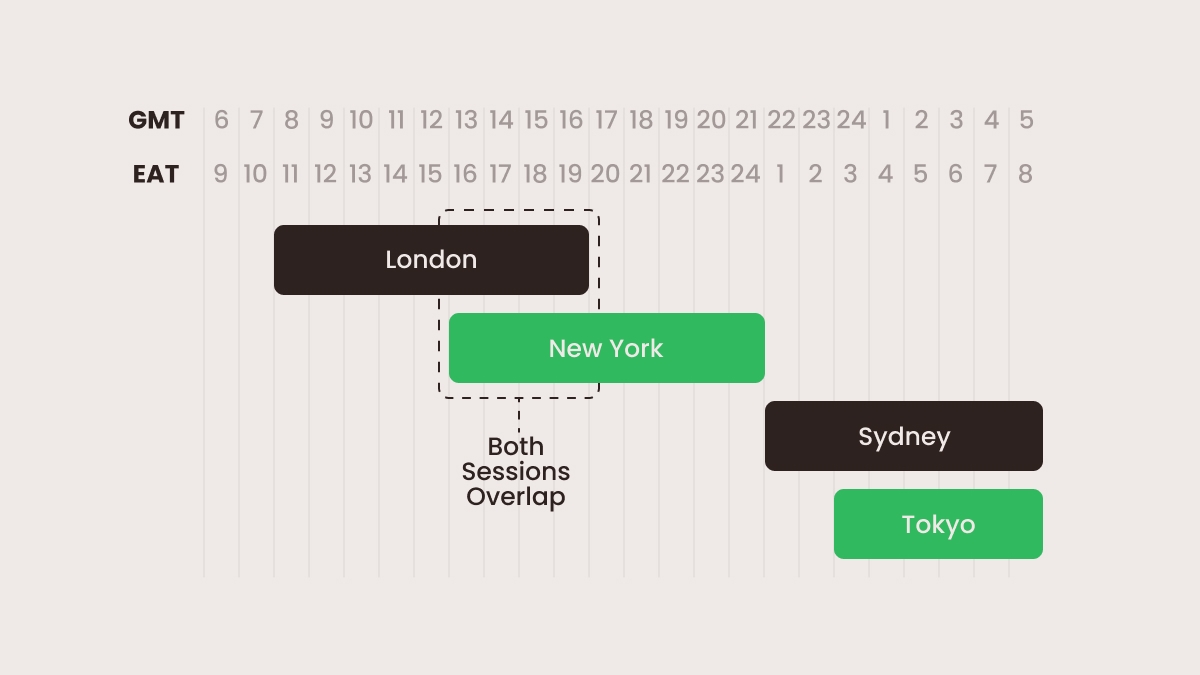

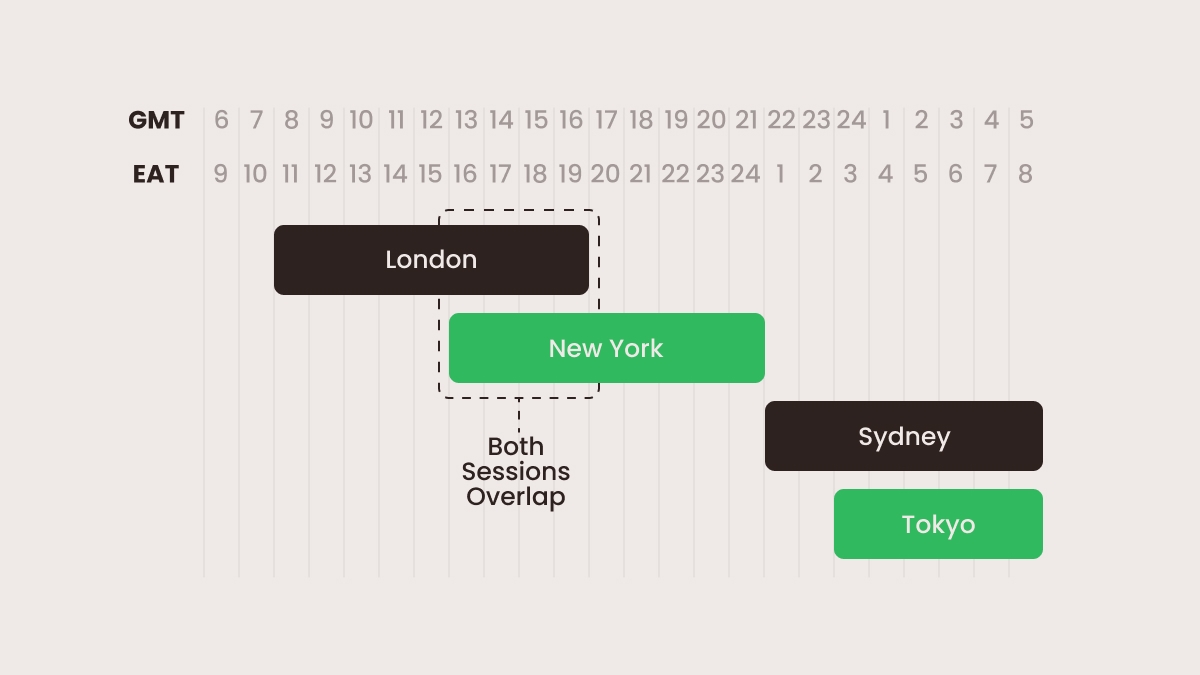

Experienced traders from Kenya suggest trading between 11:00 and 20:00: that’s when the London session is open and European traders are most active. This period includes major macroeconomic news releases that open trading opportunities, too.

Another particularly appealing period is from 16:00 to 20:00, when the London session overlaps with the New York session. This overlap means that the number of market participants (volume) is particularly high, and they offer a lot of liquidity.

If you are a morning person, you may also consider trading from 3 to 9 a.m. – the interval when the Sidney and Tokyo sessions overlap. While this overlap is not as busy as that of London and New York, it still opens more opportunities than other periods when only one session is open.

As you can see, there are plenty of opportunities to integrate some active trading into your day without compromising your lifestyle if you live in Kenya. Forex trading only stops for the weekends.

How much money do you need to start trading Forex in Kenya?

Like anywhere else, the minimum investment in Kenya is as low as $5 (about 650 Kenyan shillings). You must make this minimum deposit to open a trading account with a broker. The minimum deposit amount varies by broker, but you can usually expect a tiny amount that will let you enter the market. You need to understand that low minimum deposits will limit your profit opportunities and will not let you withstand potential failures.

You will see the difference in the minimum deposit amount between international and local brokers. While reputable international brokers will let you register an account with as little as $5, the CMA-regulated brokers will require a minimum deposit of $50 to $100. Naturally, higher deposits may offer premium features unavailable in basic account types. However, a new trader usually does not need advanced features, and a low minimum deposit makes the markets more accessible to inexperienced people.

If you want to profit from trading, though, you will want to make a higher investment. Usually, experienced traders suggest an amount around $100. You can use this amount with your broker’s leverage (the amount the broker lends to their client to enable them to open larger positions) and generate income over time. You can eventually turn this amount into a significant income with proper money and risk management.