What is the US Dollar Index (DXY)?

The US Dollar Index (commonly written as USDX or DXY) is an indicator that measures the value of the US dollar against a basket of six foreign currencies. These currencies include the euro, the Japanese yen, the Great Britain pound, the Canadian dollar, the Swedish krona, and the Swiss franc.

The reason this index is important to traders is because the USD is considered a global trading currency and the world’s primary reserve currency. The vast majority of trades across all financial markets is done with the US dollar. Knowing its current value against other currencies can help you plan for more profitable trades.

History of the US Dollar Index

The US Dollar Index was first introduced in 1973 after the Bretton Woods system was abandoned. This system established the US dollar as the international reserve currency, fixing the value of the other currencies to the dollar, which in turn was tied to the value of gold (one ounce = $35). However, the system caused the US gold reserve to deplete, and the USD couldn’t hold to its value. Because of this, the DXY was established as a way to record the value of the currency.

At first, the base value of the USD was set at 100.000. However, it has fluctuated throughout the decades, rising to its historical maximum (164.720) in 1985 and hitting the historical minimum (70.698) in 2008.

Throughout the years, the basket of currencies against which the USD is measured has been altered only once in 1999, when euro was added to the list. Currently, a lot of experts argue that it is time to revise the basket and include other currencies (such as the Chinese yuan and the Mexican peso) to reflect the countries the US is currently actively trading with.

How to use the US Dollar Index in trading?

There are multiple ways to use the DXY in trading. Here are some of them.

1. Trend indicator

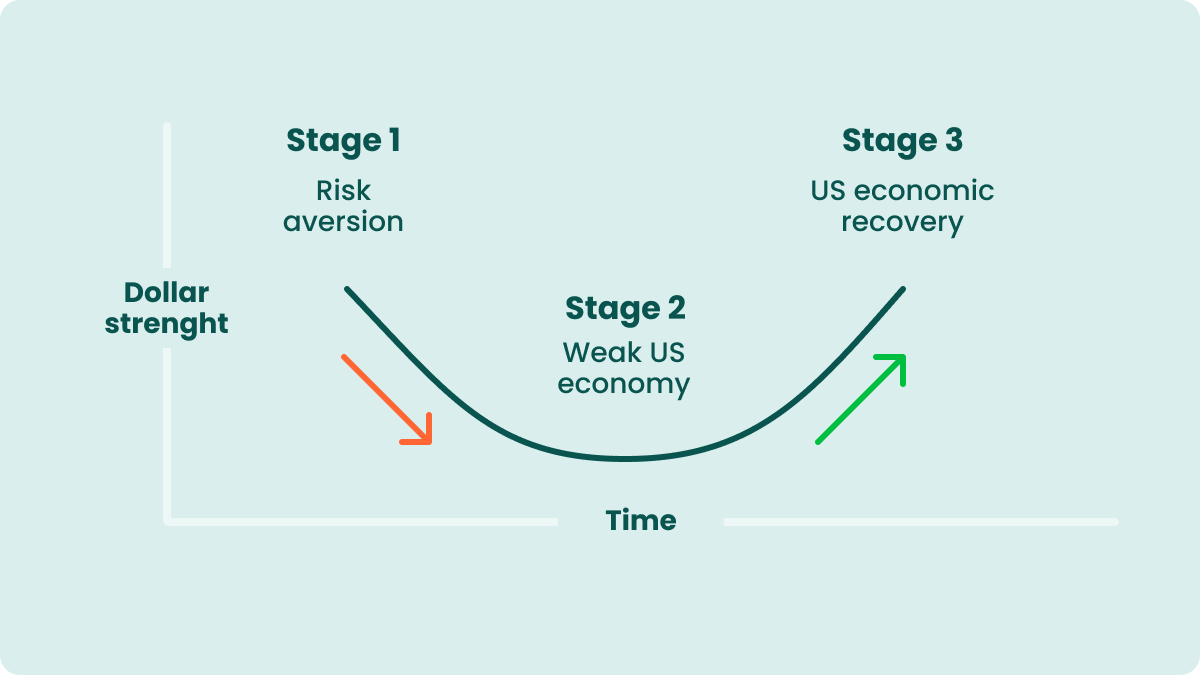

The DXY can provide a lot of useful information to Forex traders who trade the USD against other currencies. One of the ways you can use it in your Forex trading is by identifying the current USD tendency.

Knowing whether the USD is experiencing an uptrend or a downtrend in value can help you plan your Forex trades accordingly. If the DXY indicates an uptrend in value, it is best to buy the USD against other currencies. If the USD is going through a downtrend, it is time to sell the USD against another, stronger currency.

2. Trading correlated currency pairs

Another way to apply the DXY in trading is to use it as a source for additional trading signals. The US Dollar Index has quite a lot of influence on the currency markets as many traders use its support and resistance levels and price patterns to plan their Forex trades.

Correlated currency pairs are the pairs that move in the same direction as the DXY (USDJPY, USDCAD, USDGBP, etc.). In order to trade them, you need to find a confirmed technical analysis pattern on the DXY chart and look for a correlated currency pair that has the same picture on its price chart. Once you do, open a position for the correlated currency pair in the direction of the DXY trend.