July 23, 2025

Risk management

Risk Management in Forex

Imagine waking up one day and finding out that you have lost a significant part of your money due to a major political event. Even the best trading strategy will not make you completely immune to things like that. Risks are an inalienable part of trading, and the ability to manage them will allow you to not lose all your funds at once if something unexpected happens.

In this article we will tell you about the most common strategies that help you make smarter decisions and protect your savings.

What is risk management in Forex?

Every trader takes losses.ф Risk management makes sure those losses do not break you. It includes position sizing, stop-losses, trade risk limits, and more.

The goal is not to maximize gains, but to stay in the game.

Various types of risks always accompany Forex trading. Investors need to be able to manage risks in order to remain effective and avoid large losses. It all starts with whether a trader is tolerant of losses. Some traders are willing to accept larger losses if they believe in their ultimate success and win in other trades. Others prefer to remain more conservative and receive smaller profits with smaller losses.

Risk management includes several strategies. One of the best options is to invest no more than 1-3% of all available funds in one asset or asset class. This percentage allows you to avoid large losses and keep your financial position stable.

Key concepts every trader must know

If you want to succeed in trading, you should know several key concepts.

Risk per trade should not be more than 1-3% of all the money available on your account. This strategy will help you to not lose all your funds. For example, if you have $5000 on your account, then the maximum permissible loss for each trade would be $150. That way, even if you lose, most of your deposit will remain safe.

Stop-loss orders are a way investors ensure that they do not lose more than a set amount of money. A good stop-loss strategy is crucial in Forex trading, as this market is particularly susceptible to rapid and sharp price movements.

The Risk-Reward Ratio (R/R) is the ratio between potential profit and potential loss in an investment. Potential reward should be at least twice the potential risk. The ideal R/R ratio for traders is 1:2, 1:3, and more. In simple terms, for every dollar of risk, a trader should earn $2, $3, and more. Two trades with a ratio of 1:3 and one trade with a ratio of 1:4 cover 10 unsuccessful trades.

Drawdown refers to the loss in value of an investment from its peak to its lowest point. It is commonly expressed as the percentage decline from the highest value to the subsequent bottom. This metric is useful for assessing the historical risk of an investment, comparing the performance of various funds, or tracking the progress of a portfolio.

How to set up risk management in Forex trading

1. Set an appropriate risk level per trade. This will usually be no more than 1-3% of your deposit on account. A bigger percentage leads to higher risk and possible loss of money.

2. Define a stop-loss level, which is based on charts, not random numbers. Use these methods to set your stop-loss:

a) Percentage-based stop-loss is determined by what percentage of your total capital you are willing to risk. Traders normally set at most 2% on a single trade.

b) Volatility-based stop-loss is based on the ATR indicator (Average True Range), which reflects the range of possible changes in asset prices over a selected time interval. This method adjusts your stop-loss according to the market’s current movements.

c) Support and resistance levels is a method that involves placing stop-loss orders just below a support level or just above a resistance level. This strategy considers technical analysis and market sentiment.

d) Moving average stop-loss is based on analysis of moving average for a certain period, such as 50 days.

3. Calculating position size can help you to define how much of a particular asset you should buy or sell per trade. Your calculations should be based on the entry price, stop-loss level, and risk per trade.

4. Always check the risk-reward ratio. In order to not lose all the money on your account, the R/R ratio should be 1:2 or 1:3. This is the only way to increase your chances of success. In any other conditions, the best thing to do is skip the trade.

5. Always follow these rules even in cases when it feels right or looks like the ‘perfect’ setup.

Say you have $1000 on your balance. Experts advise trading rookies to set a 1% risk per trade. In this case, that would be $10. Then, you need to calculate the value of 1 pip in terms of USD: we need to know how much a pip is worth based on the currency pair and lot size. For EURUSD, the pip value for a standard lot (100 000 units) is usually around $10 per pip (the quote currency is USD). For 0.02 lots, the pip value would be $10 x 0.02 = $0.20 per pip.

You are risking $10 and each pip is worth $0.20. So, $10 ÷ $0.20 = 50 pips. The stop-loss is 50 pips, which matches the amount you are willing to lose ($10) based on the pip value of your trade.

Common mistakes in Forex risk management

1. Ignoring stop-loss. Without a stop-loss, you can burn through your whole budget very quickly. Hoping that price will come back is not a good strategy. Setting a stop-loss will help you trade successfully in the long term.

2. Making emotional decisions is also an inappropriate strategy. Trading must be accompanied by logic and strategy, not emotion-driven fast decisions. Many investors suffer losses because they do not follow the rules and the established strategy: they exit trades too early or too late, or move stop-losses manually, or risking more after a loss, hoping to get their money back. These actions usually end badly for traders. Stay disciplined and remember that rules exist for a reason..

3. Overtrading and oversized trades occur when traders make too many trades out of boredom, impatience or other reasons. This leads to an increased stress level, and consequently, to losses. To avoid this mistake you should concentrate only on high-quality setups that fit your strategy.

4. Averaging down is a strategy when traders purchase additional shares of a stock that is falling in price. This approach often leads to a worsening of the situation.

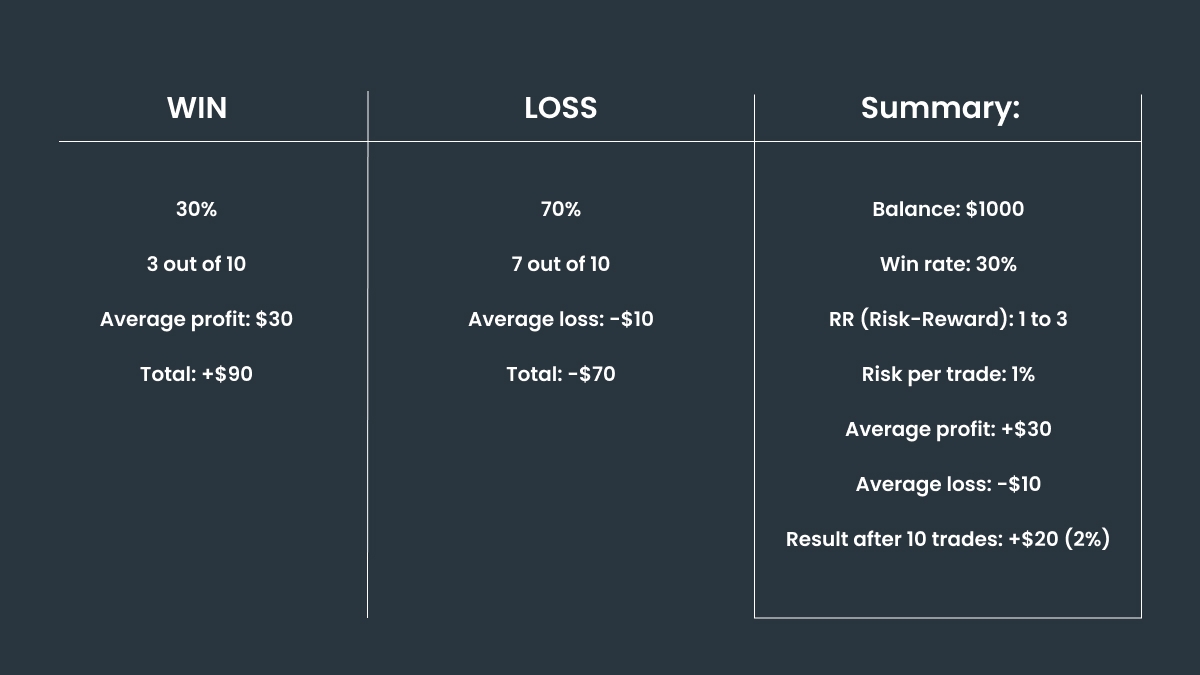

An example of a structured risk approach

Here is an example of two traders with different strategies. Trader A is more conservative, and in the long term their position is more stable, while Trader B is more risky and their gain could be greater, but in case of a fall they lose more. This strategy is not appropriate for staying afloat for a long time.

Tools that help with risk management

Position size calculators help you determine the ideal lot size for your trades based on your account balance, risk tolerance, and chosen stop-loss level. Examples of such calculators are Myfxbook.com, Babypips.com, and Forextester.com.

Special platforms for traders such as TradingView and MT4. TradingView is a social network for traders where you can ask your questions or follow quotes, news, financial statements, and much more. MT4 allows you to conduct operations and study technical analysis.

Create your journal to track your trades. Use Notion or Excel for it.

Final thoughts: master risk before strategy

To conclude, competency in risk management is an important part of trading, because it keeps traders in the game. Professionals are in business not because they are always right, but because they do not let one trade end their career.