The market doesn’t move in a straight line. As you trade, you will experience gains and losses, and moments when the market rises and falls. The value of your account, too, will rise and fall according to market prices and your trading strategies. When you’re trading in Forex, it’s therefore not just about how much money you can make: it’s also about how much money you can lose. That’s where drawdown comes in.

What is a drawdown?

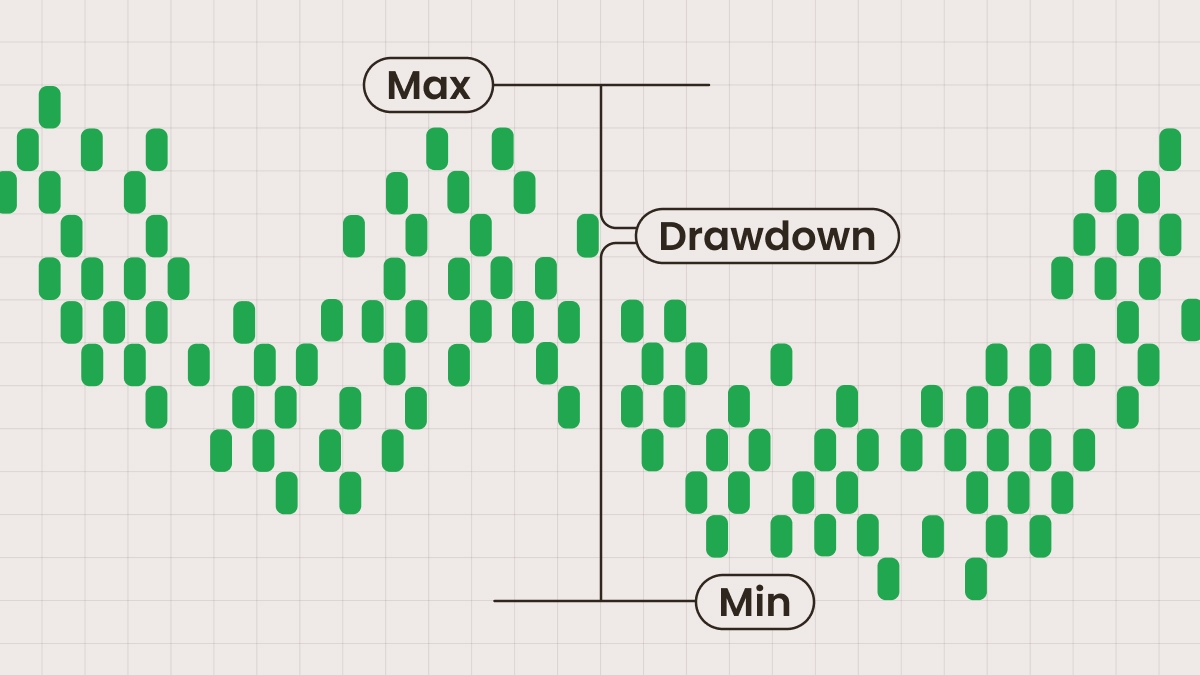

A drawdown is the percentage difference between the highest value of an investment, and the following lowest point before the value recovers. Drawdowns are used in Forex trading to assess the performance and risk of different trading strategies

In a drawdown, the time it takes a price to recover from the drop, if it ever does, is just as important as how far it dropped. It isn’t a loss unless the trader sells the investment at a loss.

Drawdowns are normal. Traders hold on to their investment and wait for it to recover and become profitable.

Key concepts of a drawdown

To understand what a drawdown is, it’s important to know a few key concepts.

The peak is the highest value of an asset or a trader’s investment over a specific period. If you’re looking at a chart, this would look like the peak of a mountain.

The trough is the lowest value of an asset or investment following the peak, before bouncing back and reaching a new high.

The percentage of a drawdown is the percentage by which the asset or investment has dropped from its peak to its trough.

The recovery is the period of time following the trough, during which the asset or investment recovers and returns to its previous peak.

The expansion is the new rise that follows the recovery, when the asset or investment continues to move past the old peak towards a new one.