Trading Strategies for the Descending Channel Pattern

Every pattern demands its own approach. Here are some strategies that will help you profit when trading the Descending Channel Pattern: choose the ones that suit you, your goals and your trading style.

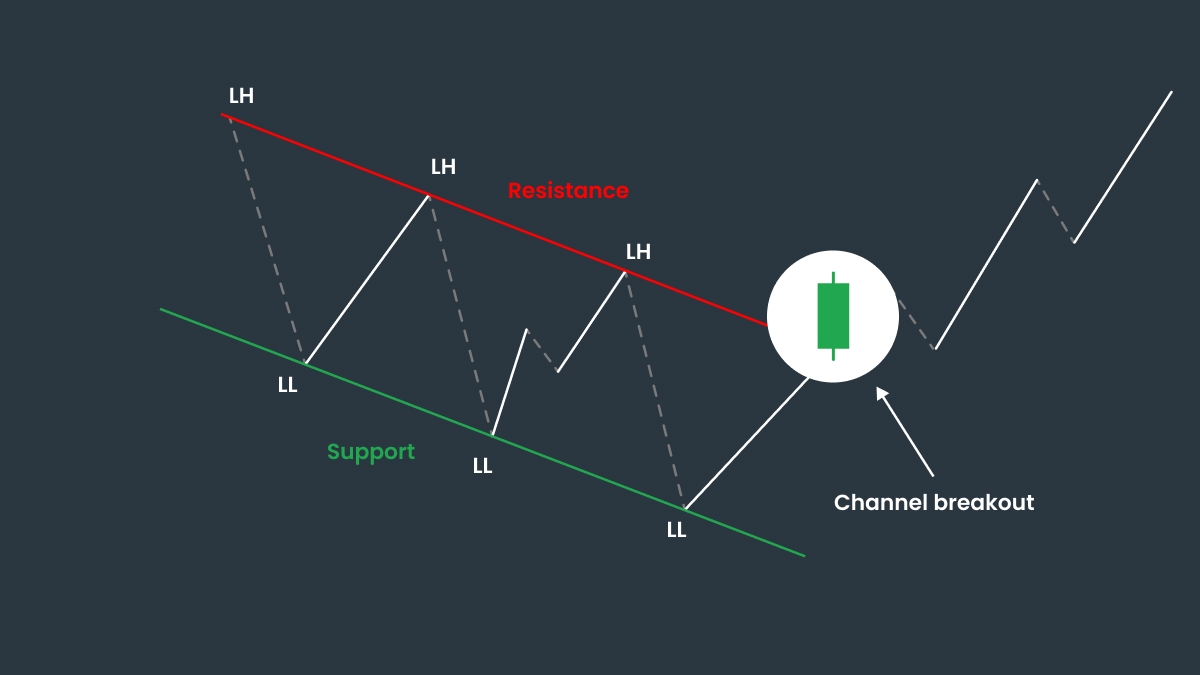

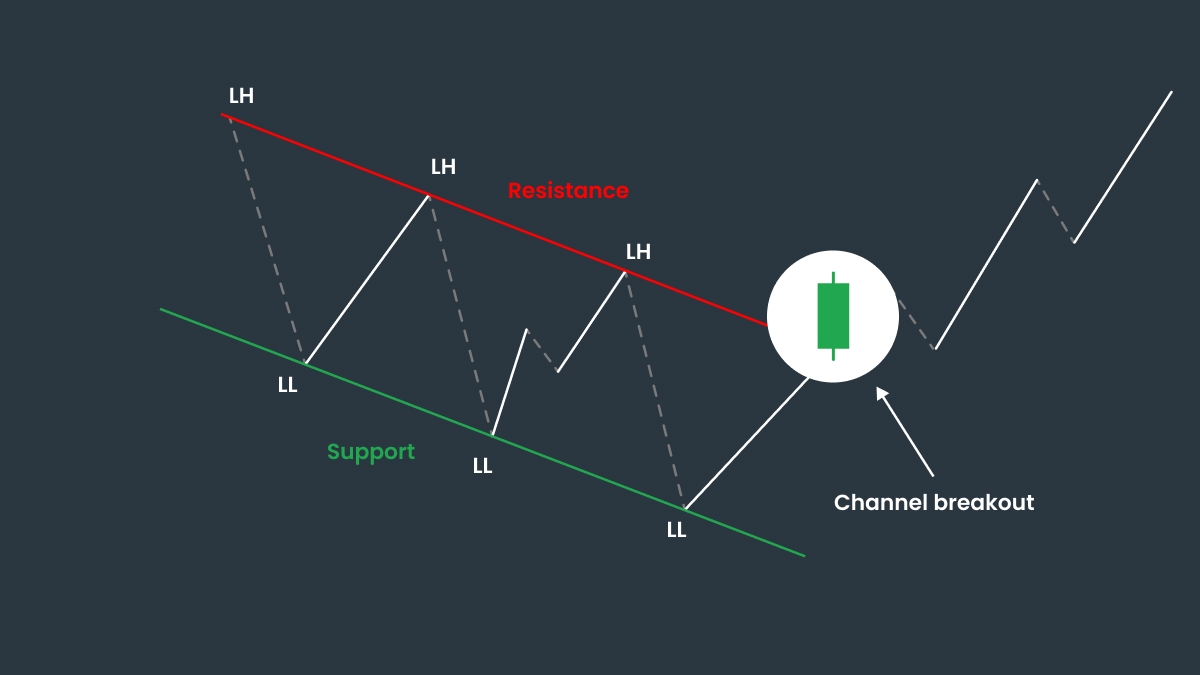

1. Breakout Strategy (Bullish Reversal)

When the price finally breaks out above the upper resistance line, especially with strong momentum or high volume, it often signals the end of a downtrend and the start of new upward momentum.

This is a potential bullish reversal and a great chance to enter a long position.

Here’s how to trade on it:

Entry: wait for a clear candle close above the upper resistance. Don’t rush in during a breakout candle, let it close to confirm the move.

Stop-loss: place it just below the last swing low or below the lower channel line to protect yourself against false breakouts.

Target: measure the height of the channel (distance between support and resistance) and project that distance upward from the breakout point.

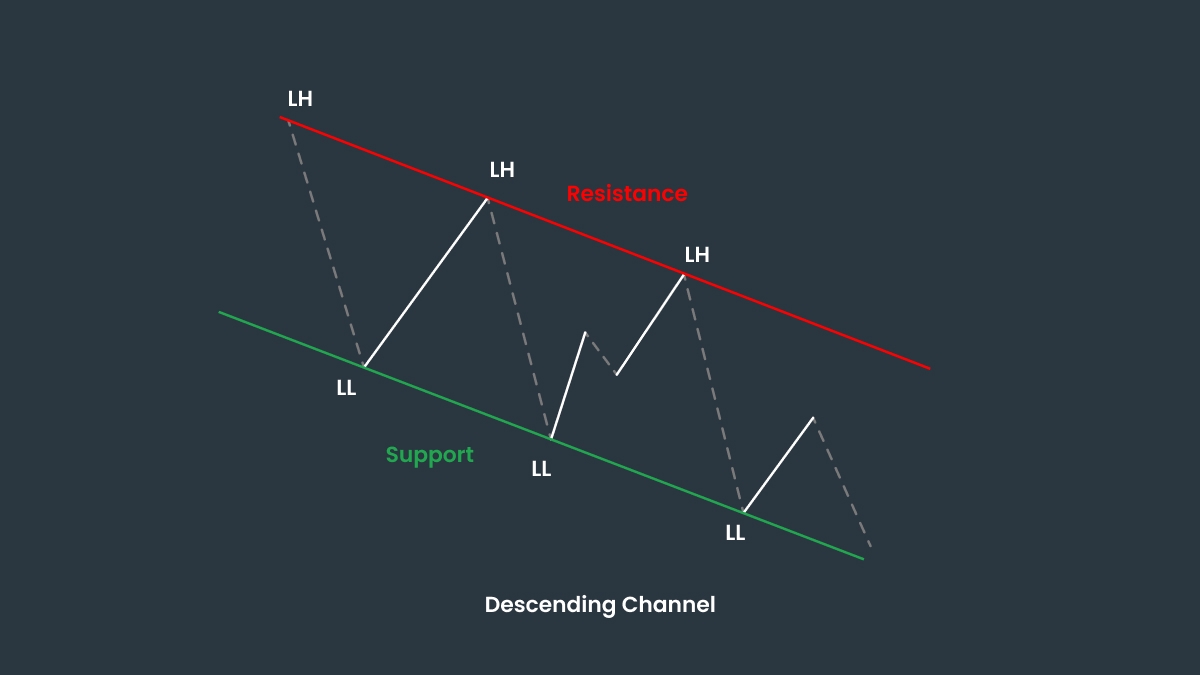

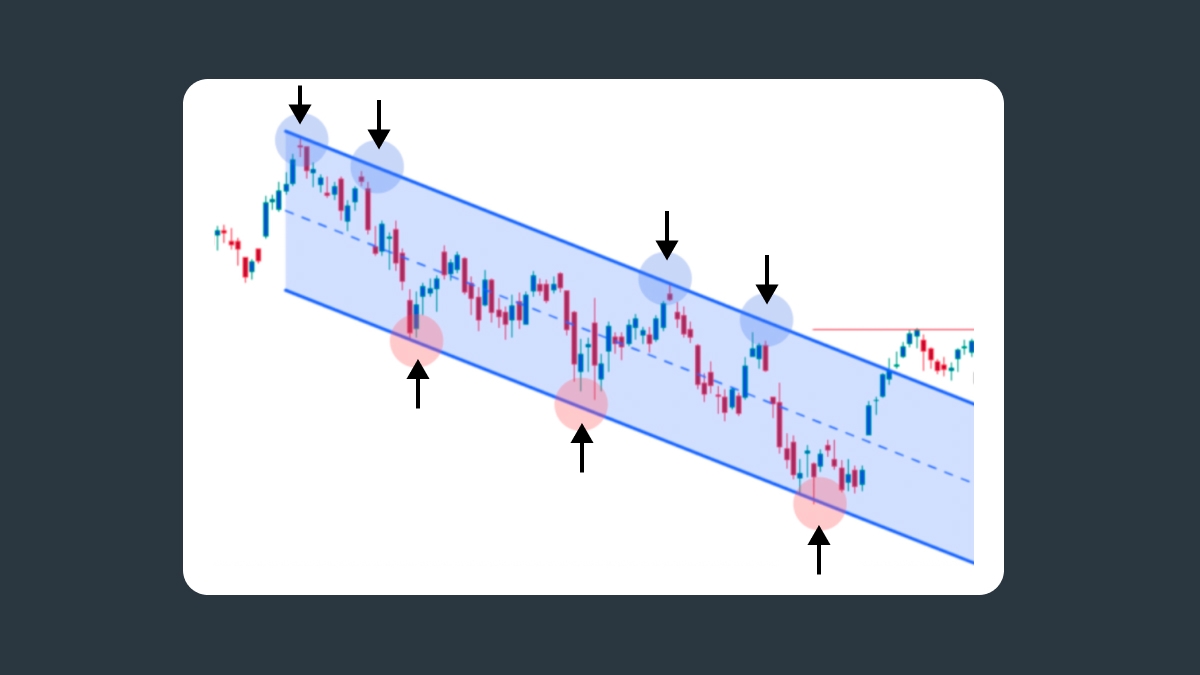

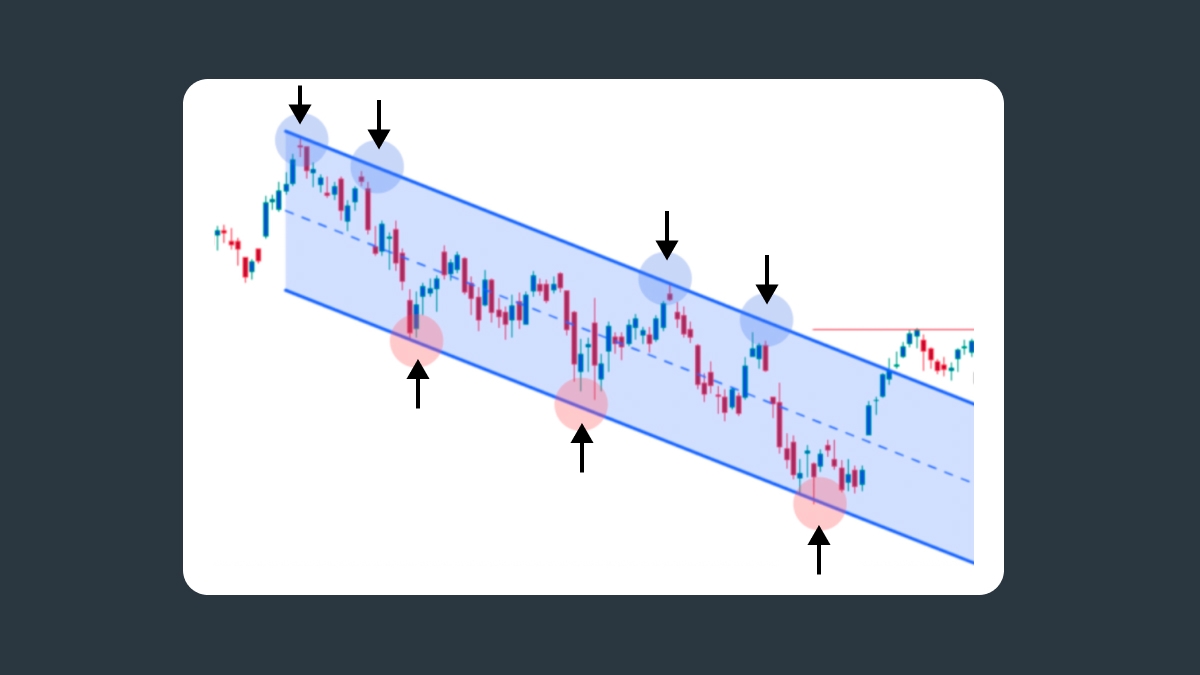

2. Range-Bound Strategy (Trading Within the Channel)

Not every trader is waiting for a breakout, some traders choose to trade within the trend, opting for a more predictable and less risky scenario. The price in the Descending Channel tends to bounce between the resistance and support lines, offering multiple chances to enter short near the top and go long near the bottom. In this case the Third Touch Strategy is a good option.

How to determine the entry point:

First touch: the price hits either the support or resistance line but may bounce back.

Second touch: the price tests the same level again but with less momentum.

Third touch: the price hits the level once more, and this time, the move has higher probability of either reversing or breaking through.

To set a take-profit order, use this formula: (highest level at point A – lowest level at point A) + entry point. This gives you a reasonable target based on previous price behavior.

As for the stop-loss, place it a few pips below the support line or the most recent low.

To learn more about this method, read this article: “The Third Touch Trading Strategy”.

Pros and cons of the Descending Channel Pattern

The Descending Channel is definitely a tool worth using, and here’s why:

It’s fairly easy to spot once trendlines are drawn.

It provides multiple trading setups from trading the trend within the channel or the breakout.

It works across all markets: Forex, stocks, crypto, etc.

However, every pattern has its own drawbacks. Note these disadvantages:

Not every breakout is the real deal. The Descending Channel is prone to false breakouts if confirmation is weak, so don’t rush into a trade without making sure it really is a bullish flag.

It requires precise trendline drawing, otherwise it can lead to bad trades.

Sideways markets may be tricky, so the pattern might underperform on low liquidity or volume.

Common Mistakes to Avoid

Even seasoned investors can make mistakes when trading the Descending Channel, but you can avoid them with this short guide from FBS.

Don’t trade without confirmation. Wait for a candle close, volume spike, or indicator signal to avoid entering on a false breakout.

Don’t ignore volume or indicator confirmation. These tools can offer clues about the strength of a potential breakout.

Don’t neglect risk management. Use stop-losses and set realistic profit targets. Trading on a trend breakout or inside a channel without respecting risk levels is a sure way to lose capital.