.jpg)

What is truncation in trading?

According to Elliott Wave Theory, there are different types of waves, and under certain circumstances, the phenomenon known as “truncation” appears.

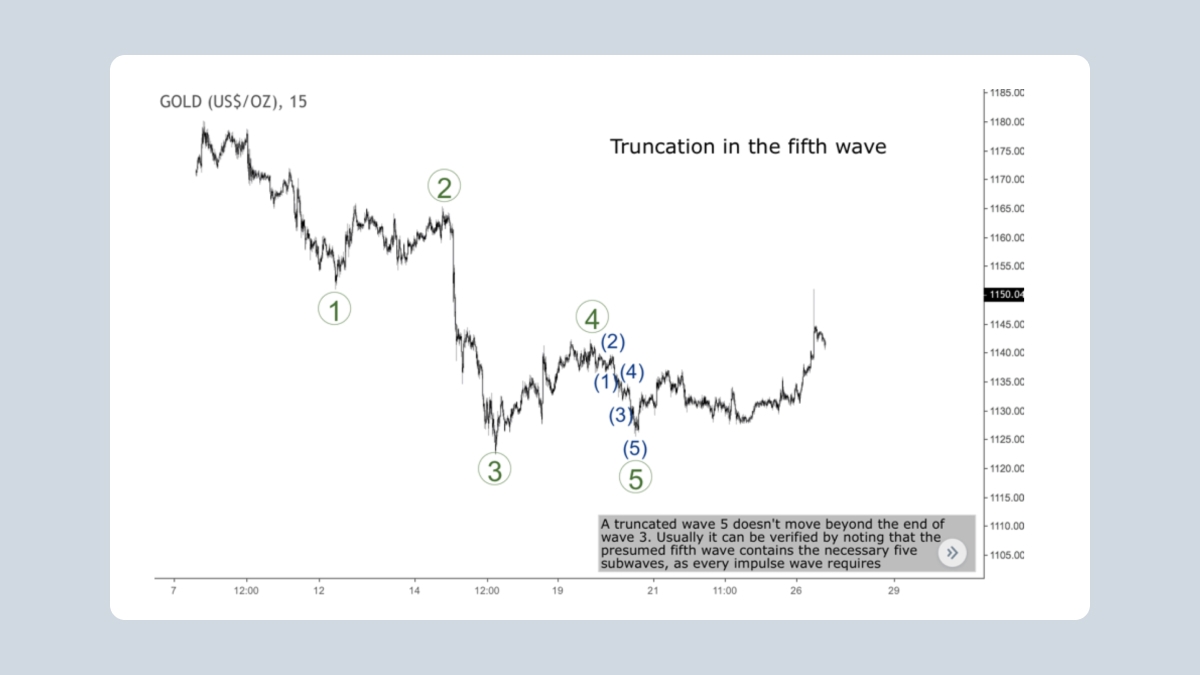

In most impulses, the fifth of the Elliott waves extends beyond the extremum of the third wave, but sometimes the fifth wave may be weak and end without reaching the end of the third wave. This is called “truncation”. It can occur on the fifth wave of an impulse (also known as the ending diagonal). It is extremely rare, if possible at all, for a fifth wave of a leading diagonal to be truncated. Usually, a truncation happens after a strong third wave. You can track the movements of different types of waves on the trading platforms.

Real truncation examples

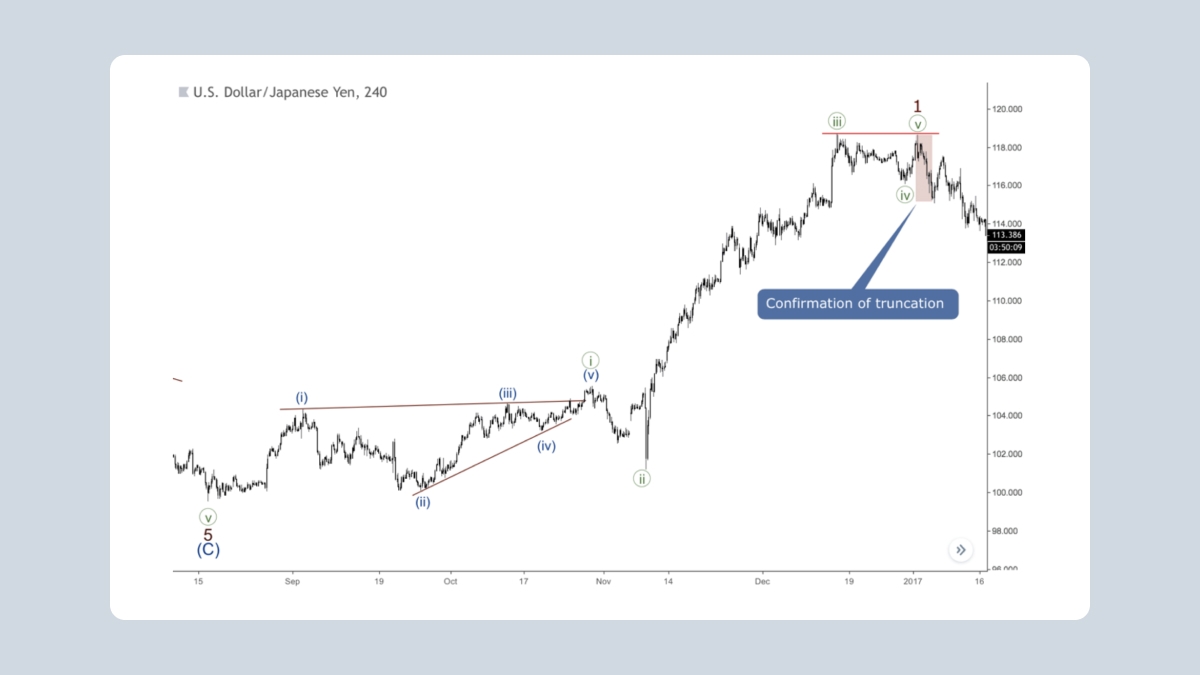

The chart below shows an upward impulse in wave ((i)) with a huge extension in wave (iii). Wave (iv) finishes as a flat pattern (we will examine it in the next articles). There is also a five-wave price movement from the ending point of wave (iv), which is followed by a decline. Thus, the fifth wave of wave ((i)) has turned out to be truncated.

Types of truncated waves

Truncated Elliott waves can be of two types:

Impulse wave

An impulse wave is a separate directional market movement that determines the direction of a trend and the most common type of driving wave. In an impulse, the fourth wave does not overlap the territory of the first wave.

Diagonal wave

Diagonal waves represent a movement pattern that has not become an impulse due to the presence of one or two correctional traits. For diagonal triangles, as with impulse waves, the main feature is that none of the opposing sub-waves can roll back more than the size of the last active sub-wave.

There is a distinction between leading diagonal and ending diagonal waves. Ending diagonal is a special type of wave developing in place of the fifth wave, while the past movement of the third wave went “too fast and too far”, as Elliott described.

How to recognize truncation

It is quite challenging to recognize truncation in real time, so here are some tips:

1. In most cases, a truncation forms in impulses with huge third waves. When you see one of those, watch out for a possible failure in the fifth wave.

2. If you see a five-wave price movement from the end point of the fourth wave, but the market does not move beyond the end of the third wave, the five-wave price movement could be wave one of the fifth wave, or the fifth wave itself. The key is what happens after this five-wave price movement after the fourth wave. If we have a local three-wave correction, then the fifth wave is likely to continue. However, if a five-wave price movement forms instead, we should anticipate a truncation in the fifth wave.

3. As we can see on the chart below, sometimes we might see a truncation even if the third wave is not huge. Here, wave ((3)) is little more than wave ((1)), but wave ((5)) could not break the low of the third wave. A case like this usually happens when a larger trend is running out of steam.

Note: It is very risky to try identifying a truncation in real time, so do not assume that’s what you’re seeing when a five-wave price movement forms in the opposite direction.

4. The next example shows a small truncation. The high of wave ((v)) is narrowly lower than the end point of wave ((iii)). A five-wave decline arrives afterwards, confirming the truncation. Note that wave ((iii)) was long, which pointed to a possibility of a truncation.

5. The fifth wave of an ending diagonal pattern could be truncated as well. As you probably already know, in most cases ending diagonals consist of zigzags, so the truncated fifth wave of this pattern could form like a zigzag rather than a five-wave price movement. Truncation in expanding ending diagonals is common because it follows the same logic as impulse waves. The third wave of an expanded diagonal is usually longer than the first wave, so the market is exhausted and the fifth wave simply does not have enough strength to reach the end point of the third wave.

6. Here is another tip for recognizing a truncation in expanding diagonals. Because the fifth wave is supposed to be a zigzag, wave C of this pattern could be an ending diagonal. Thus, if the end point of a diagonal in wave C of the fifth wave does not reach the extremum of the third wave, there is a reasonable chance of a truncation. The chart below shows an example of this situation. There is a pullback from the diagonal's upper side, which led to a massive bearish rally.

The bottom line

According to the Elliott method, the fifth wave of impulses or ending diagonals can be truncated. The form of the fifth truncated Elliott wave is not affected. In impulse waves, the truncation is formed as an impulse or diagonal, and in diagonal waves as a zigzag. A truncation in the fifth wave of a leading diagonal is extremely rare. Five-wave price movement in the opposite direction confirms the truncation.