Fundamental Analysis

The US dollar is losing ground as markets price in deeper Fed rate-cut odds and the prospect of a more dovish chair replacing Powell, pushing the DXY to 3½-year lows and propelling AUD/USD to YTD highs near 0.6564 after seven straight gains. The Aussie’s rally is further underpinned by a global risk-on tone and perceived progress on trade deals, favouring commodity FX such as AUD.

In Australia, AUD strength rests on a global easing cycle where investors expect looser Fed policy, while May’s drop in China’s industrial profits reinforces bets that the RBA will stay less aggressive into year-end—keeping AUD/USD tilted bullish in the near term.

Complementary Ideas

• Keep an eye on today’s US PCE print; a soft read could firm Fed-cut wagers and add AUD tailwinds.

• Any confirmed breakthrough in US-China trade talks would extend AUD’s risk-asset bid.

Technical Analysis (AUDUSD | H3)

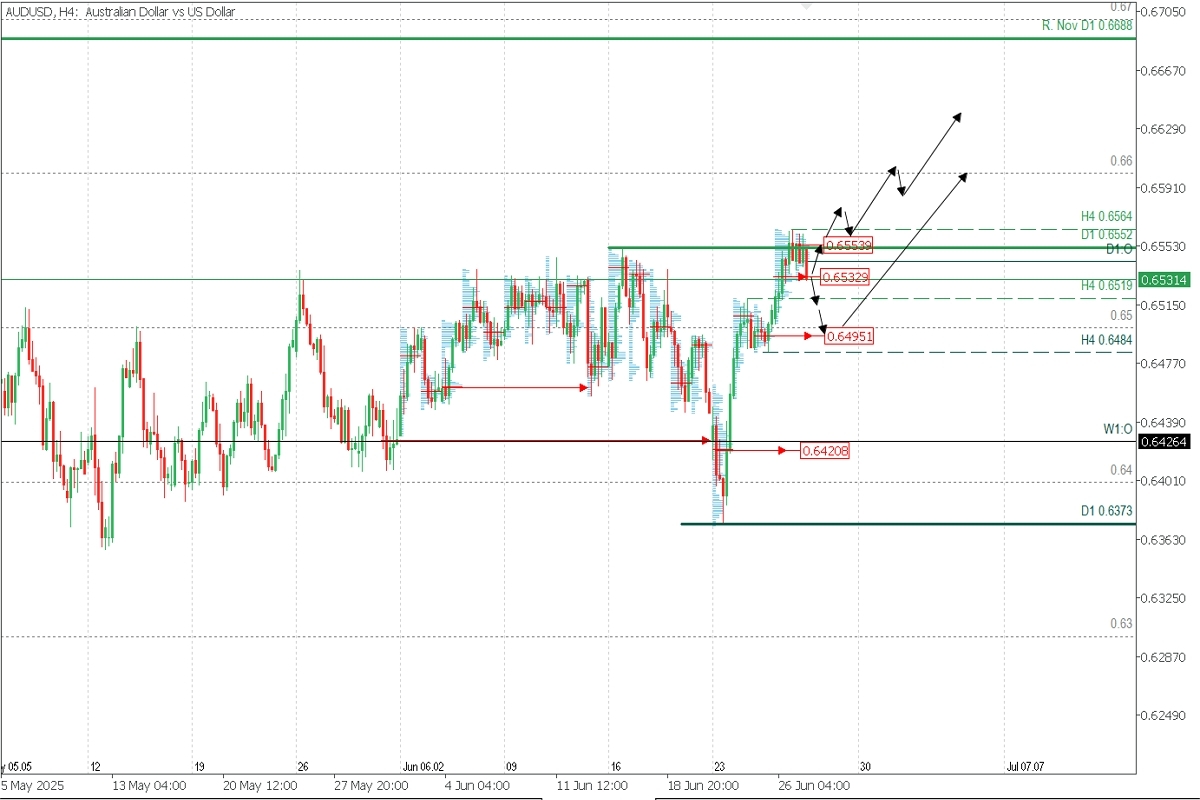

Supply zones: 0.6553

Demand zones: 0.6532 | 0.6495

Trend stays bullish above the last H4 support at 0.6484. A POC formed at 0.6553; a break below yesterday’s buy-POC at 0.6532 could open intraday shorts to 0.6519 and the 0.65 demand cluster (psychological level + bearish daily range + Wed’s uncovered POC at 0.6495), where a fresh rally toward 0.66–0.6650 is favoured.

Conversely, an early bounce from 0.6532 and a clean break of 0.6553 would signal buyer dominance, clearing the path above 0.6564 toward 0.66–0.6650.

Technical Summary

• Bullish: Longs above 0.6564 → 0.66 / 0.6650.

• Bearish: Shorts below 0.6530 → 0.6519 / 0.65 to reload longs.

ERP (Exhaustion/Reversal Pattern): Wait for M5 confirmation before entries.

Uncovered POC: highest-volume level acting as resistance (sell) or support (buy) depending on prior move.