Fundamental Drivers

Australian Economy

- Sluggish Growth Outlook:

- Australia's economy is projected to grow 1.2% in 2025, weighed down by high interest rates and sticky inflation. Weaker household savings and soft consumer spending are further dampening momentum.

- RBA Turns Dovish:

- The Reserve Bank of Australia is expected to cut rates by 25bps in November, with more easing likely in 2025 as policymakers respond to stagnant growth and persistent inflation pressures.

U.S. Economy

- Data-Driven Dollar Strength:

- The U.S. dollar has gained ground, buoyed by stronger-than-expected consumer confidence data, reinforcing its dominance against weaker currencies like the Aussie.

- Fiscal Fragility Looms:

- Despite recent resilience, the greenback could face longer-term pressure from mounting U.S. fiscal concerns, including rising national debt and deficit risks.

China's Shadow Over the Aussie

- Trade Dependence Hurts AUD:

- China's mixed economic data weighs on the Australian dollar as soft demand from its largest trading partner hits exports and sentiment.

Short-Term Outlook

AUDUSD remains under pressure, hemmed in by a dovish RBA, tepid domestic growth, and China's economic slowdown. While technical momentum offers a glimmer of optimism, the U.S. dollar's ongoing strength and macroeconomic headwinds suggest any rallies may face resistance. Traders should stay tuned to central bank commentary and China-related trade updates for direction in the days ahead.

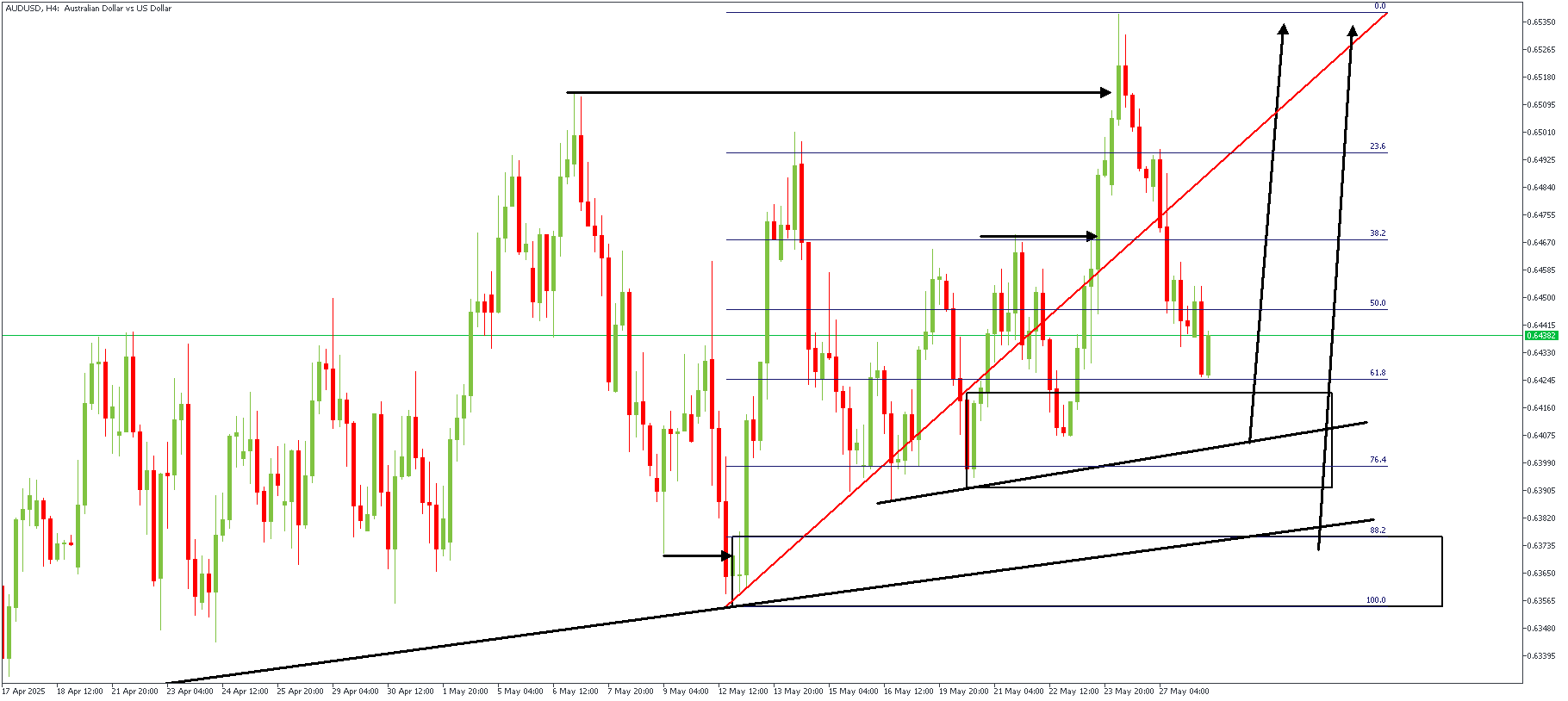

AUDUSD – H4 Timeframe

The bullish break of structure on the 4-hour timeframe of AUDUSD set the precedence for bullish sentiment. There is also an SBR pattern with its base near the 76% Fibonacci retracement level. Coupled with the trendline support and the drop-base-rally demand zone, we have adequate confluence in favor of a bullish outcome.

Analyst's Expectations:

Direction: Bullish

Target- 0.65378

Invalidation- 0.63469

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.