The Japanese Yen (JPY) strengthened significantly on Friday, helped by solid inflation data from Tokyo, which increased expectations for another Bank of Japan (BoJ) interest rate hike in December. Tokyo's Consumer Price Index (CPI) rose more than expected, signaling higher inflation, while Japan's industrial production and retail sales also showed improvement. This boosted the Yen and pushed the USDJPY pair closer to the 150 mark, its lowest in a month.

Geopolitical tensions, such as the ongoing Russia-Ukraine war and fears of a global trade slowdown, have also fueled demand for the safe-haven Yen. Meanwhile, the US Dollar (USD) weakened after Scott Bessent was nominated as the next US Treasury Secretary, as he is seen as likely to maintain tighter fiscal policies. Additionally, expectations of a Federal Reserve rate cut in December and falling US bond yields further pressured the USD.

As a result, the USDJPY pair has dropped significantly, losing around 700 pips from its high earlier in November, and it remains vulnerable to further declines.

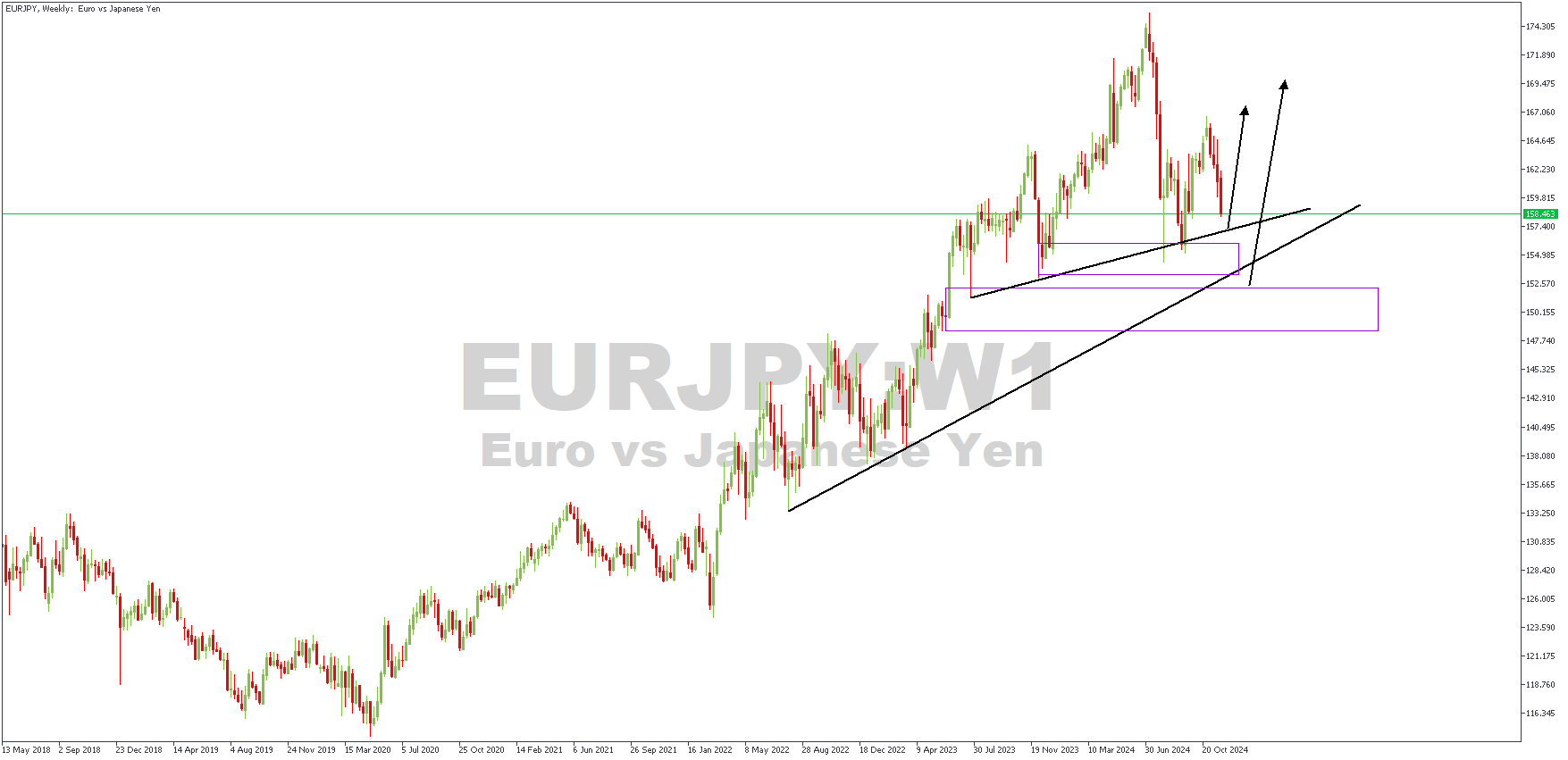

EURJPY – W1 Timeframe

There are two possible scenarios for a bullish continuation on the weekly timeframe chart of EURJPY. The first and most recent one is highlighted by the first demand zone on the chart and features a confluence of trendline support, demand zone, and the 88% level of the Fibonacci retracement tool. However, the second scenario presents a similar confluence at a slightly lower price point. The daily timeframe chart of EURJPY provides more significant details.

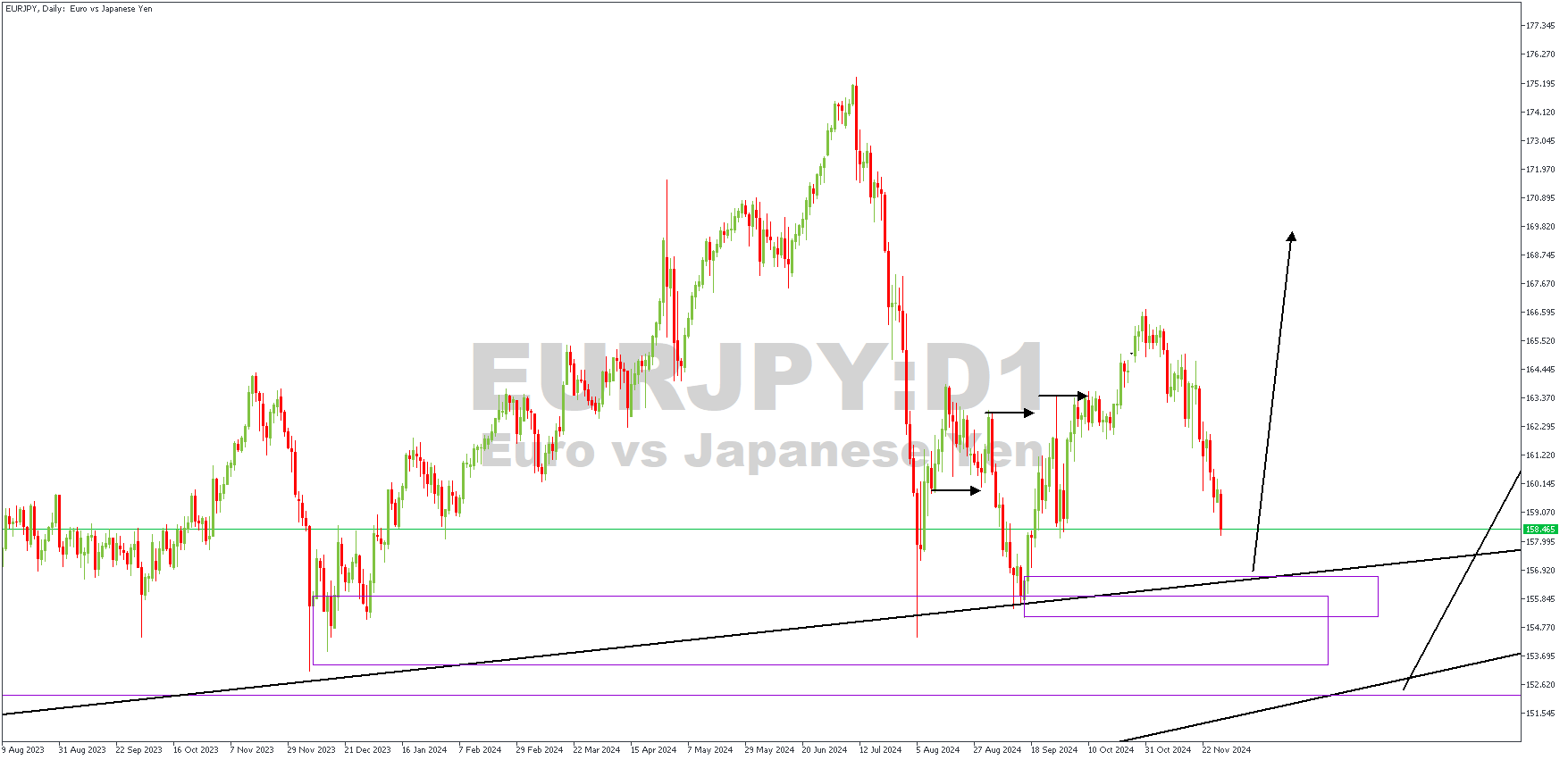

D1 Timeframe

We see price as a double break of the structure pattern during the daily timeframe. As a result, the retest of the demand zone is a good entry area since it features a drop-base-rally demand zone and the 88% Fibonacci level. If the price fails to react from this area, the next region below would be the perfect entry point.

Analyst's Expectations:

Direction: Bullish

Target: 168.910

Invalidation: 153.119

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.